Advocates are facing a daunting history of 10 straight rejections at the ballot box for income taxes

David Boze

Washington Policy Center

Ten times since 1934, Washington voters have said no to any kind of income taxes, including those targeting the wealthiest among us. Will it soon be 11?

The effort to repeal the newly-instituted income tax on capital gains advanced today with the certification of more than enough signatures to make it to the ballot. The first stop though, is the state legislature where the legislative majority is expected to do nothing. That action (or inaction) will send it to the voters in the fall.

Advocates are facing a daunting history of 10 straight rejections at the ballot box for income taxes.

But this time, they have an advantage.

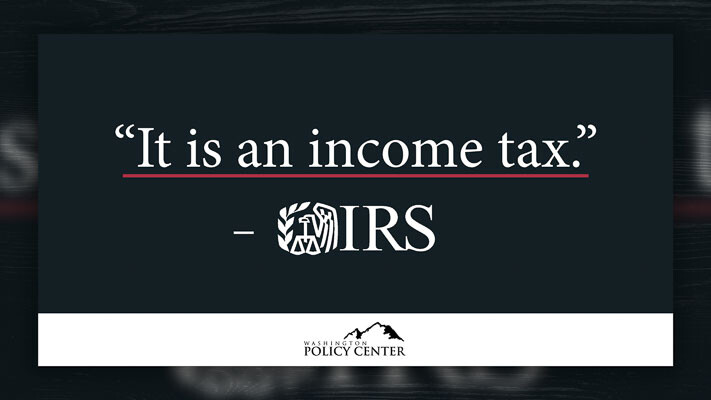

Despite the IRS confirming a capital gains tax is an income tax and despite every other state in the union and several other countries confirming they treat capital gains taxes as income taxes because … well, it’s the taxing of a form of income, the Washington State Supreme Court legitimized this political version of “Freaky Friday” and allowed Washington’s income tax on capital gains to become an “excise tax on capital gains.” This is an advantage unprecedented in the history of Washington’s income tax votes. Instead of being faced with truth in labeling, advocates will claim no “income tax” is on the line. I can imagine media sources “fact checking” opponents who call it an “income tax” and more.

Washington voters earned the right to decide — they also deserve an honest debate,

David Boze is the communications director at the Washington Policy Center.

Also read:

- POLL: Why did voters reject all three tax proposals in the April 22 special election?Clark County voters rejected all three tax measures on the April 22 special election ballot, prompting questions about trust, affordability, and communication.

- Opinion: The war on parental rightsNancy Churchill argues that Olympia lawmakers are undermining voter-approved parental rights by rewriting key legislation and silencing dissent.

- Opinion: An Earth Day Lesson – Last year’s biggest environmental victories came from free marketsTodd Myers argues that Earth Day should highlight free-market solutions and grassroots innovation as more effective tools for environmental stewardship than top-down mandates.

- Opinion: Time to limit emergency clauses and give voters a choiceTodd Myers urges the governor to remove emergency clauses from bills that appear intended to block voter input rather than address real emergencies.

- Letter: C-TRAN Board improper meeting conductCamas resident Rick Vermeers criticizes the C-TRAN Board for misusing parliamentary procedure during a controversial vote on light rail.