Clark County Today’s John Ley shares his thoughts on the difference between Gov. Jay Inslee’s words and his actions

In politics, a lot of words are often used to describe legislation that may or may not match the real impacts of bills that become law. Over the weekend, Washington Democrats passed a new capital gains income tax and two new carbon taxes.

Sen. Lynda Wilson (Republican, 17th District) said: “If you like a budget that is harder on people with lower incomes and people in marginalized communities, and sneaks a billion dollars out of the rainy-day fund into a slush fund, then the Democrat budget is a winner.

“We learned over the weekend, as the two energy/fuel bills were brought up for final votes, that together they could raise the cost of gas by $2.41 per gallon,” said Wilson. “To be fair, SB 5126 and HB 1091 would not be fully operational unless a bill that increases the gas tax at least 5 cents per gallon is passed.”

The gas and carbon taxes are clearly regressive taxes, harming the poorest in our state the most. These new taxes make the state’s tax system even more regressive.

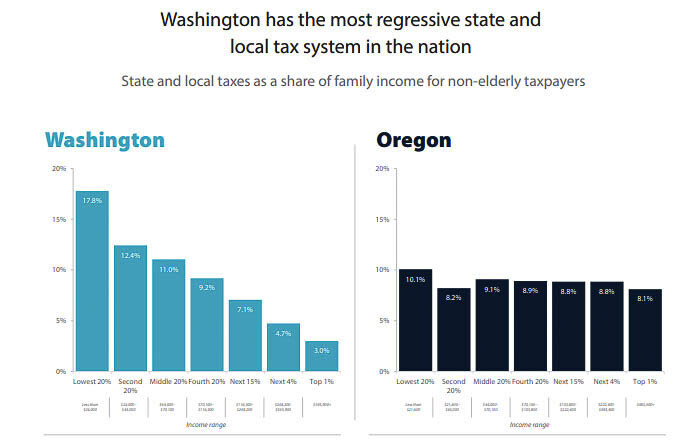

In December when introducing his budget proposal, Gov. Jay Inslee said the following: “Washingtonians with lower incomes pay more of a percentage of their income and taxes than the wealthiest Washingtonians. This is unfair, and it will not help our economic recovery if the old system continues. compared to most other states, our tax code is wildly regressive.

“The top 1 percent pays about 3 percent of their income (in taxes),’’ Inslee said. “The bottom 20 percent is paying 17.8 percent of their income in taxes. The bottom fifth of our citizens are paying six times more as a percentage of their income than the top 1 percent of the ultra wealthy in our state are paying. This is grossly unfair, grossly unacceptable and bad for our economy.”

Yet, Inslee in his recorded statement at the end of the legislature’s session spoke glowingly about the capital gains income tax being passed and all the “good” the state would do by increasing state spending 12 percent.

“The sessions’ accomplishments are as important to the long-term well being of our state as any session I’ve seen in a quarter century,” Inslee said.

“We took big steps to fix our state’s out of date, an unfair regressive system of taxation unfair to working people, where those with lower incomes pay a much higher percentage of their incomes and those who make more,” he said. “The legislature has passed a capital gains tax and excise tax on extraordinary profits that has the wealthiest Washingtonians paying their fair share. This has been a priority of mine for years.”

Sen. Mark Mullet (Democrat, 5th District) was the only member to break ranks, voting no on the budget. Speaking on the Senate floor prior to the April 25 vote, Mullet said lawmakers were trying to “move Heaven and Earth” to prevent voters from deciding on it.

While the governor touts raising taxes on the “wealthiest,” what did he do to provide relief to the lower income working people who “pay a much higher percentage of their incomes, and those who can’t make more?”

Did he lower the sales tax? Did he lower car tab fees? Did he lower the B&O tax on all the businesses shut down by his pandemic policies? Did he lower property taxes?

Inslee wouldn’t have to go very far to find an example for how to help the poor and make the state’s regressive tax burden much less regressive. Just four years ago, as he ran for Governor, the state debated I-732.

The initiative would have traded an increase in revenue from a carbon tax to actually deliver tax relief to citizens, but especially lower income working Washingtonians. It was designed to be revenue neutral.

The I-732 carbon tax started at $15 per ton of carbon and rose to a cap of $100 for carbon.

What would the revenue be used for? It would have lowered the state sales tax by 15 percent from 6.5 to 5.5 percent. It would have increased the Working Families Tax Credit for low-income families, and reduced the business and occupation (B&O) tax rate from 0.484 to 0.001 percent.

This would have lowered that high tax burden for the state’s bottom 20 percent, which Inslee touted as being “grossly unfair, grossly unacceptable and bad for our economy.” It would have helped all those small businesses harmed by his pandemic lockdown who still have to pay the state’s B&O tax that is not on profits, but on every dollar that a business takes in, regardless of their profitability.

The one bit of tax relief that did pass in a bipartisan manner was HB 1297. Modeled after the federal Earned Income Tax Credit (EITC), this policy would provide working families with an annual base credit of $500 to $950, depending on family size.

The carbon taxes when combined with a possible future gas tax, could add well over $1 to the cost of a gallon of gas. “It will go up 50 cents to $1,” said Sen. Mark Schoessler, (Republican, 9th District). “These (numbers) are based on Puget Sound air quality authorities numbers, not Republicans. They’re based on California.”

“Let’s go back to December,” said Schoessler, in reference to the Governor’s capital gains income tax proposal. “Jay Inslee’s proposal was $50,000, not $250,000 with fewer exemptions. It proved that the real goal is an income tax.”

The Governor’s actual budget proposal on capital gains was as follows. “The state would apply a 9% tax to capital gains earnings above $25,000 for individuals and $50,000 for joint filers.”

The 2021-2023 budget House and Senate Democrats passed Sunday along mainly party lines marks a 12-percent increase in state spending over the 2019-2021 budget. It’s millions more than the $58.9 billion budget Senate Democrats proposed in March and Gov. Jay Inslee’s $57.6 billion plan from December.

The new budget also drains the state’s $1.8 billion rainy day fund, leaving $36 million in the account, according to one news report by The Center Square. Lawmakers approved of the transfer Sunday. They’re able to shift that money because of a 2002 amendment to state law. Washington Republicans floated the idea of diving into the state’s rainy day funds in February to fund COVID-19 business grants.

Rep. Vicki Kraft (Republican, 17th District) spoke about the carbon taxes. “It’s estimated to raise the price of gas by 66 cents to $2.10 per gallon by 2030.

“By forcing businesses to buy carbon credits and move away from dependable energy and fuel sources like natural gas and petroleum it will drive up their cost of doing business,” Kraft said. “In turn, this will drive up costs for consumers about $1,400 per year in higher utility bills, grocery costs will go up as grocery stores have to pay more to have their food delivered to and from the store, higher gas prices at the pump, and so on.”

Sen. Schoessler reported his numbers came from the Puget Sound air quality authority and from what California experienced. .

Democrats held on in a 25-24 Senate vote to pass a landmark 7 percent tax on capital gains in excess of $250,000, reported Washington Wire. “While the Senate initially didn’t concur with the House version, Democrats managed to retain enough votes to keep in language they call a ‘necessary clause’ and opponents call a ‘stealth emergency clause.’ Sens. Mark Mullet and Steve Hobbs voted no just as they did the first go around, while Sen. Annette Cleveland came on-board this time and Sen. Kevin Van De Wege jumped ship.”

The budget also allocated $10.6 billion in federal COVID-relief funds according to one news report.

“The 2021-23 operating budget raises taxes for the sake of raising taxes,” said Rep. Drew Stokesbary (Republican, 31st District). “We could fund everything in this budget with existing tax revenue, yet the majority party is choosing to impose a capital gains tax to score political points. We know taxing innovators and investors will ultimately drive jobs and opportunities to other states – jobs that Washington families need.”

Opponents of I-732 included the Washington State Democratic Party in Washington state and the Washington State Labor Council, among others according to Ballotpedia.

In the end, it would appear the governor’s concern for the bottom 20 percent of hard-working Washingtonians were crocodile tears, an empty concern designed to give the government more taxpayer money overall, while delivering Inslee the carbon tax he had sought for years to bolster his “green” credentials.

The governor’s ebullient “success” he touted as part of the “most productive” legislative session in a quarter century, picked the pockets of the working poor the most. The cost of their transportation to get to and from work will rise significantly. The cost to heat their homes will rise significantly.

“We took big steps to fix our state’s out of date, an unfair regressive system of taxation unfair to working people, where those with lower incomes pay a much higher percentage of their incomes and those who make more,” Inslee said Sunday.

Citizens here in Southwest Washington will often hear Oregon politicians claim their state’s tax system is too “volatile” and they tout the stability of Washington’s sales tax system. Does Gov. Inslee and his Democrat allies want a “volatile” source of taxpayer money? Or do they simply want more taxpayer money, any way they can get it?

Apparently the “fix” was in, with the Inslee solution harming the poor the most. They will get no consolation from the fact that “the wealthy” are paying more, when they can’t afford to fill their car’s gas tank or pay their heating bill. It will be no consolation to the poor who will be faced with increasing costs at the grocery story. As shipping costs rise, retailers will simply pass those costs on to consumers.

Inslee didn’t show the graph, bragging about lowering the tax burden for the bottom 20 percent on Sunday. That’s because the budget he will soon be signing will harm those people more than anyone else.

Apparently, the Inslee solution to the “unfair” tax system in Washington wasn’t lowering the tax burden of the poor. It was simply an excuse to raise taxes on the wealthy and to give the government more of your money.