Todd Myers believes a combination of factors mean we are likely to see the impact of the tax on CO2 emissions increase in 2024

Todd Myers

Washington Policy Center

Washington’s new tax on CO2 emissions ended up adding about 43 cents per gallon of gas for 2023. The final price was reduced by several market interventions by Department of Ecology staff, but prices are likely to increase next year.

Ecology staff released the results from the fourth-quarter auction of CO2 emission allowances. The settlement price was $51.89, a significant drop from the previous auction price of $63.03.

The average tax on CO2 in 2023 ended up at $54.74 per metric ton, which equates to about 43 cents per gallon of gasoline and 53 cents per gallon for diesel.

The most notable thing about the allowance price is that it is one penny below the threshold of $51.90 that triggers a special auction of CO2 allowances from the credit reserve. If the settlement price had been one cent higher, Ecology officials would have held a special auction to put more emission credits on market in an effort to drive prices down.

The result of the auction is not a coincidence. Bidders recognized that Ecology’s special auction strategy was to offer a significant number of credits at the flat rate of $51.90. In the first special auction, Ecology offered just over one million allowances split between $51.90 and $66.68. In the second special auction, Ecology offered another five million credits at $51.90.

If the settlement price for the fourth quarter reached $51.90, Ecology said it would have put about two million more allowances on the market. Bidders seem to have reasonably assumed that those credits would again be offered at a flat rate of $51.90.

As a result, bidders offered $51.89, knowing that if they failed to win the allowances they needed it would be because the price hit $51.90, triggering another special auction, and there would be another opportunity to buy credits for one penny more per allowance.

A penny doesn’t seem like a lot, but for entities looking to purchase one million credits, that savings amounts to $10,000.

Ecology’s strategy of flooding the market with flat-rate CO2 allowances essentially turned the auction into a flat carbon tax. Having set the pattern in 2023, bidders may do the same in 2024. The cost, however, will be higher since the trigger price for the special auction will increase 8.2 percent to $56.16.

Additionally, the number of allowances offered for auction will decrease by 7 ½ percent in 2024, which is likely to push prices up. Unless consumer demand falls significantly, bidders who need allowances may not have a choice but to bid above the price trigger if they need the credits to comply.

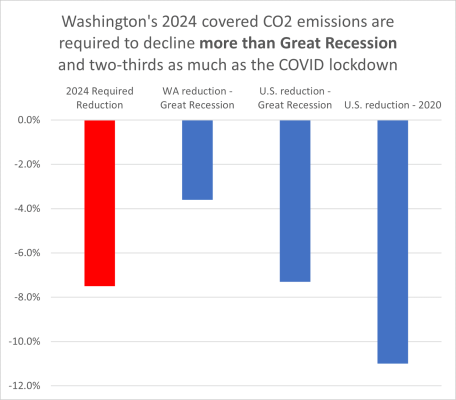

To put that 7 ½ percent reduction in context, energy-related CO2 emissions in the United States fell 7.3 percent between 2008-09 during the Great Recession. In Washington state, emissions fell only 3.6 percent during the Great Recession. We will have to double that in one year, hopefully without a recession.

During the COVID lockdowns of 2020, U.S. energy-related CO2 emissions fell 11 percent.

The combination of those factors mean we are likely to see the impact of the tax on CO2 emissions increase in 2024.

Todd Myers is the director of the Center for the Environment at the Washington Policy Center.

Also read:

- Letter: ‘There will be consequences’Hazel Dell resident Bob Zak criticizes Democratic lawmakers for advancing ESSB 5181, arguing it undermines parental rights and defies biblical principles.

- Op-Ed: La Center Schools — Committed to families and their childrenIn a public letter, the La Center School Board and Superintendent Peter Rosenkranz affirm their commitment to supporting families and honoring both state law and community values amid state-level scrutiny.

- Letter: Mayor blames others on homelessness problem in Vancouver while she has enabled a lawless encampment zoneVancouver resident Peter Bracchi urges city leaders to enforce laws and end permissive policies that have allowed unsafe encampments to overrun public spaces near the Share House.

- Letter: ‘Look it up for yourself’Camas resident Anna Miller encourages skeptics of Elon Musk’s claims about government waste to do their own research using official resources.

- Opinion: Defending the indefensibleNancy Churchill argues that Washington’s lawsuit against a sheriff cooperating with ICE reveals a deeper political agenda that puts public safety at risk.

Interesting. According to AAA, the national average for December is up 3 cents over last year. The Washington average is up 27 cents. Where’s this 43 cents coming from?