The Washington State Legislature did not provide funding for the group to continue

Chris Corry

Washington Policy Center

The Washington State Tax Structure Work Group officially ended on June 30th of this year. Although the group was slated to produce a final report by December 2024, the legislature did not provide funding for the group to continue. The final report was made public this month.

TSWG was established in 2017 to “identify options to make Washington’s tax code more equitable, fair, adequate, stable, and transparent.” The mission was expanded in 2019 to include analyzing and facilitating statewide public discussion about Washington’s tax structure. This included updating previous research on state tax structure changes, making legislative recommendations, and providing the previously mentioned final report.

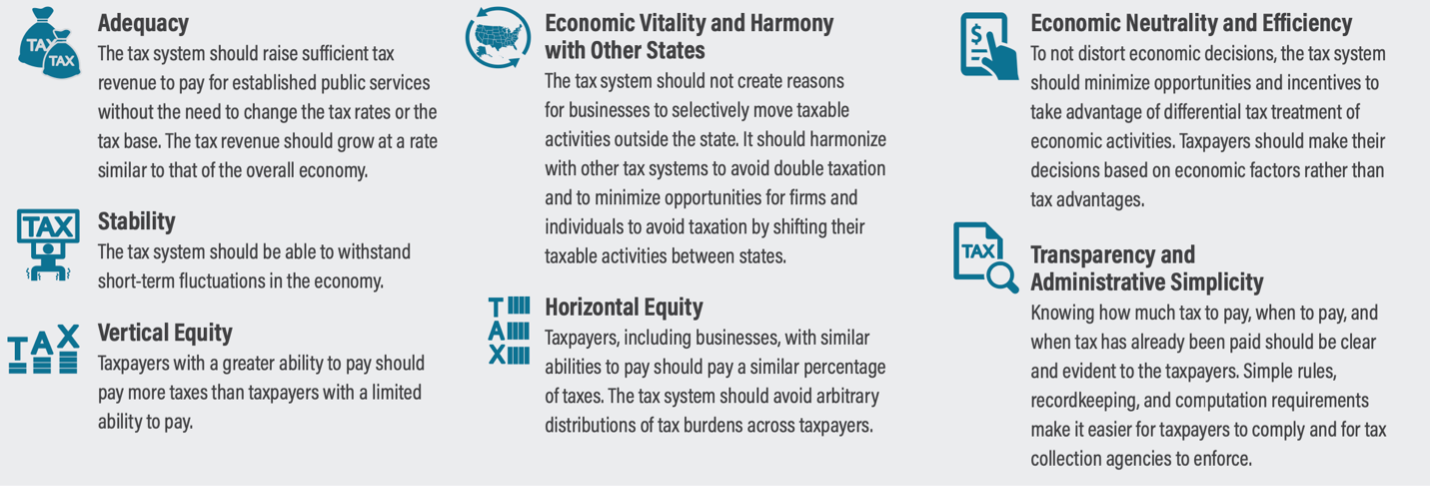

In 2019 legislative proviso directed the TSWG to examine tax principles in their modeling. They included several progressive tax principles, including vertical equity. This would mean creating tax rates based on the ability to pay rather than on a flat basis as codified in Washington State’s Constitution.

TSWG Tax Principles

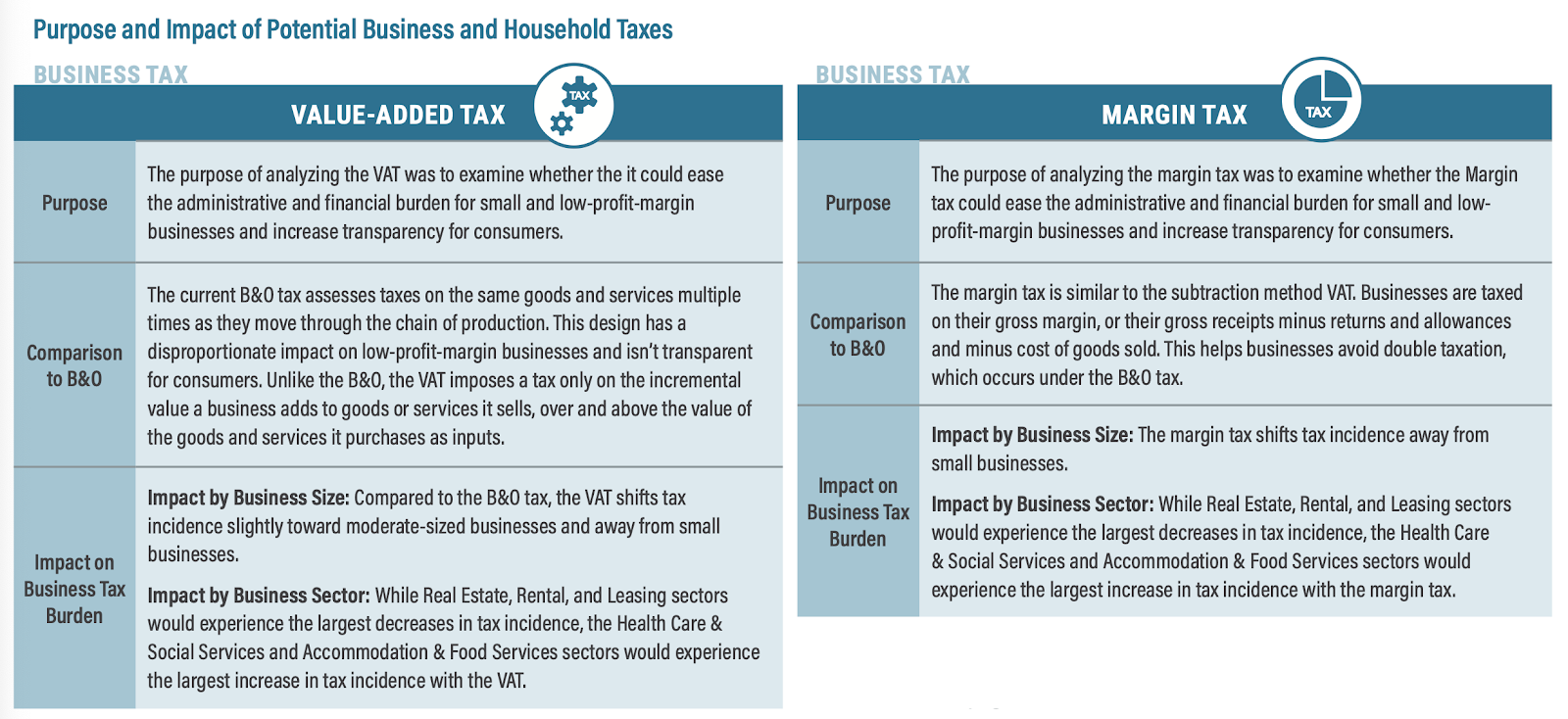

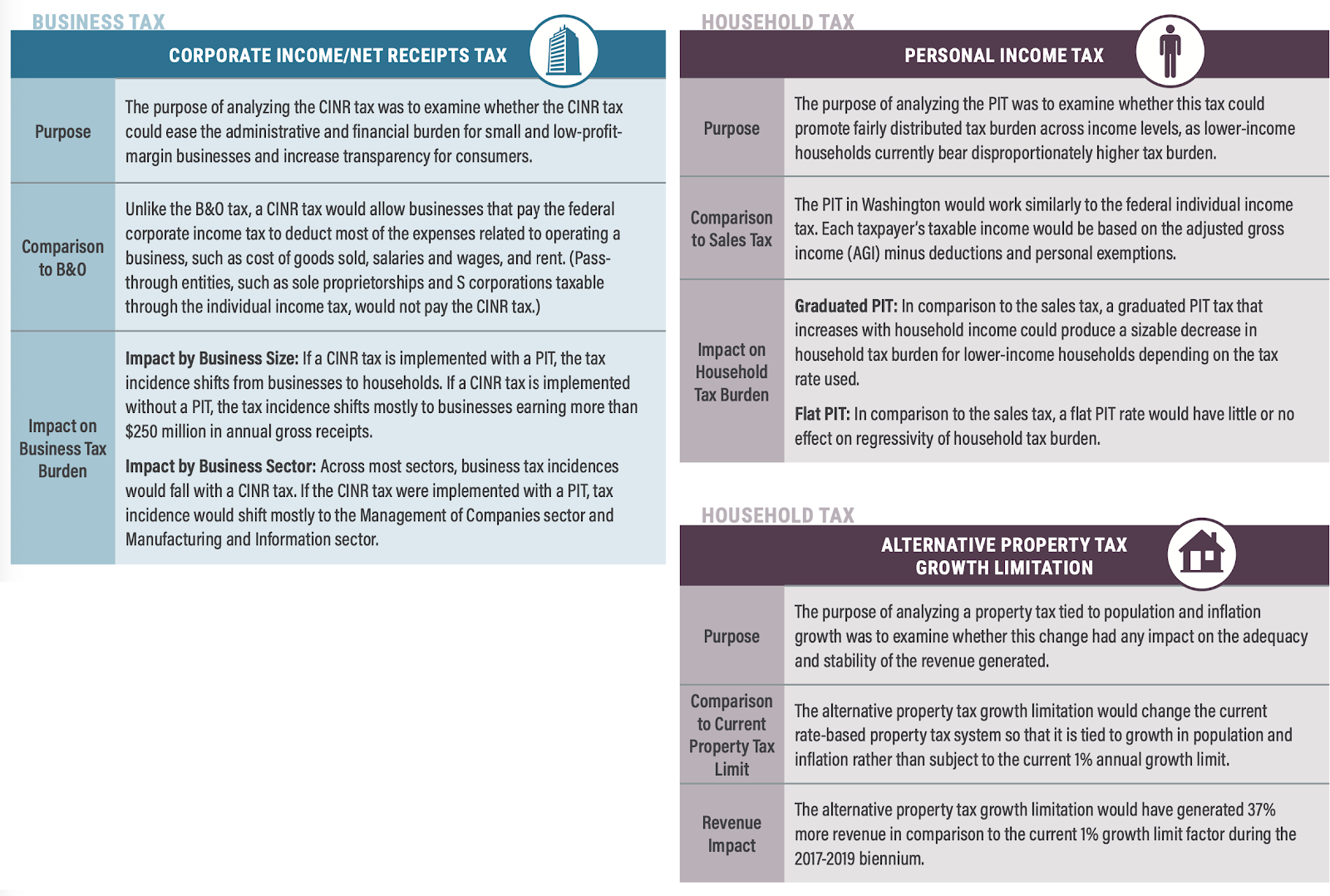

Under those tax principles, the group also examined tax modeling for alternative tax options for both business and personal taxes. The group reviewed a value-added tax, margin tax, and corporate income/net receipts tax for businesses. They also examined personal income tax and alternative property tax for households.

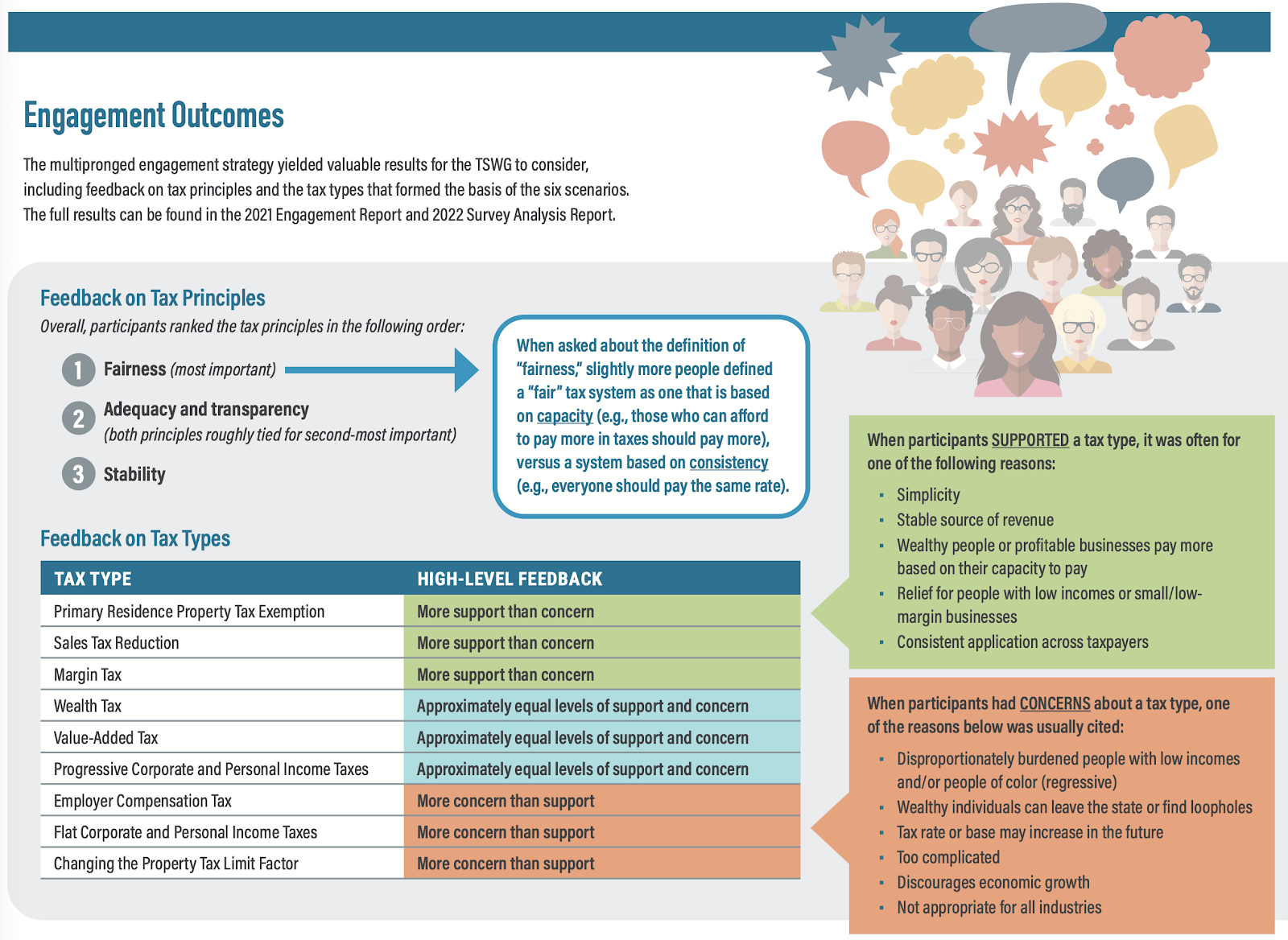

As mentioned, the TSWG was tasked with public engagement on these various potential changes. The group held virtual forums throughout the state. Feedback on changes to taxes provided an interesting insight into public sentiment on taxes. Two tax reduction options more supported than raised concerns, and the proposal for a flat income tax also solicited more opposition than support. Per the report:

The report’s conclusion reviews the tax concepts and proposed legislative ideas from the 2023 session, including the Margin Tax Bill SB 5482 and Property Tax Revenue Growth Limit SB 5618 and HB 1670. These bills did not pass in the 2023 session.

You can review all the Tax Structure Work Group archives here.

Chris Corry is the director of the Center for Government Reform at the Washington Policy Center. He is also a member of the Washington State House of Representatives.

Also read:

- POLL: Should the Clark County Clerk remain an elected position?Following public opposition, Clark County Council dropped a proposal to make the clerk an appointed role. Readers can now weigh in through this week’s poll on whether the clerk should remain elected.

- Opinion: Neighbors for a Better Crossing calls for a current seismic study for $7.5 Billion Interstate Bridge projectNeighbors for a Better Crossing is urging a new seismic study before construction proceeds on the $7.5 billion IBR project, raising transparency concerns and proposing an immersed tube tunnel alternative.

- Opinion: Washington’s Supreme Court hides the ball on state employee compensation offersJason Mercier criticizes the Washington Supreme Court’s decision to uphold secrecy in public employee compensation talks, calling for transparency reforms and public accountability.

- Letter: The Charterist III — Concerning the powers of the Legislative BranchJohn Jay continues his Charterist series, arguing that Clark County’s legislative branch is structurally weak and lacks the resources to balance the executive, calling for reform in the next charter review.

- Opinion: ‘Today’s Democratic Party is not our father’s Democratic Party’Editor Ken Vance reflects on how today’s Democratic Party diverges from the values he associates with his father’s generation, citing issues like taxation, gender policies, and shifting ideology in Washington state politics.