Nancy Churchill says you never truly own your home

Nancy Churchill

Dangerous Rhetoric

For all our talk about freedom and homeownership, there’s one truth nobody wants to admit: You never truly own your home. Even after you’ve paid off the mortgage, you still owe the government rent — every year — just to keep what you already bought. Stop paying, and the state will gladly take it away.

That’s not a technicality. It’s a direct attack on your property rights. In a free country, ownership should mean security and control. But property taxes flip that upside down. Your home—your land, your legacy — is always on loan from the government, as long as you keep paying them for the privilege of keeping it.

And they never stop asking for more.

The tax that always goes up

Property taxes are relentless. They rise whether your income does or not. They rise even if your roads are crumbling and your schools are failing. They rise because government always finds a reason to spend more.

For working families and retirees, the impact is personal. As housing prices rise, so do assessments — and suddenly people are “rich” on paper but broke in real life. Retirees living on fixed incomes are being forced to sell just to escape tax bills they can’t afford.

No local control

Some claim property taxes are fair. But let’s be honest—they hit the middle class hardest. The wealthy can absorb it. Most folks can’t.

Here in Washington, the system is even more frustrating. Property assessments are dictated by state law, and your local assessor is stuck following those rules. Neither taxpayers nor assessors have much of a voice.

Meanwhile, Democrats treat your home like their personal piggy bank.

Olympia wants more

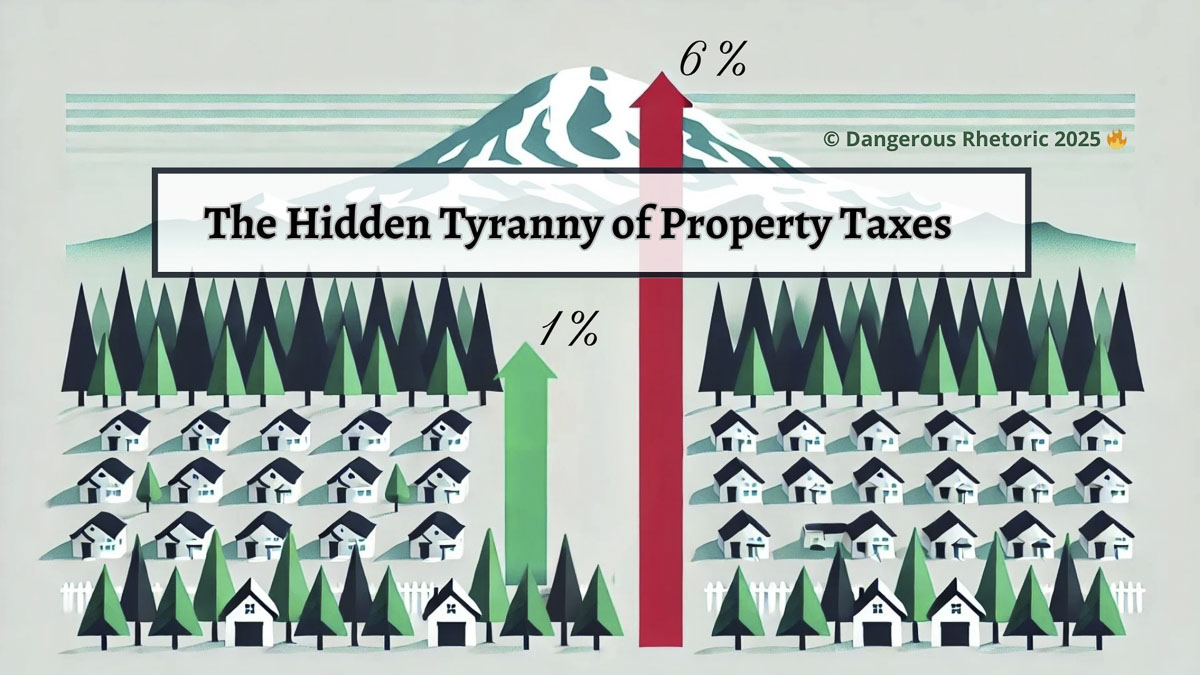

State law currently caps annual property tax increases at 1%, thanks to voter-approved Initiative 747 back in 2001. But even that 1% cap gets painful when home values skyrocket. Now, Democrats in Olympia are trying to bust that cap wide open.

Their new plan? Raise the limit to match inflation and population growth. That means taxes could rise 3% or more each year — whether your income goes up or not.

House Bill 1334 does exactly that. It ditches the 1% cap and sets a new maximum of 3% annually. One Democrat even called concerns about affordability “laughable.” That’s what they think of taxpayers.

No cap, no end in sight

The Senate version — SB 5798 — is even worse. It doesn’t include any cap at all. Instead, it ties tax increases to inflation and population growth. In 2023, that would’ve meant a 6.74% increase without voter approval. Imagine trying to budget for that kind of hike on a fixed income.

If you’re already struggling to keep up, this could be what pushes you out of your home.

So what can we do?

Take action now

If you’re feeling upset about these proposals, GOOD! Use those feelings to inspire you to action. Everyday people like us can fight back against these property tax increases! It’s time for a letter-writing tax revolt!

Go to leg.wa.gov. Look up bills 1334 and 5798. For each bill, use the “send a comment” button to tell your three legislators you oppose these property tax hikes. Then sign up for email alerts so you know when to show up for the public hearings. Pay attention and submit your testimony — in favor or against — when the public hearings happen!

I’ve heard that handwritten letters make a big impact. Consider sending a letter or postcard to your lawmakers and the bill sponsors. Their mailing addresses are listed on the same website. For the cost of a few letters from each property owner, we might be able to save everyone thousands every year!

That’s three different actions you can take this week on both bills to have a big impact! (Comments, Alerts, and physical letters). Action item four: Share this information with all your friends and neighbors and get them to take these actions, too!

It’s not about need — it’s about control

Democrats say they need this money for schools and local services. But Washington is already raking in record revenues. The real problem isn’t too little money—it’s too much government.

Washington’s middle class is being squeezed out. As home values rise, folks who’ve lived in their homes for decades are being taxed right out of them. A paper gain in value shouldn’t mean a real-life eviction notice.

If homeownership is the American dream, property taxes are the termites in the foundation. It’s time for serious reform. And it starts by fighting these new tax hikes—because when we show up, we win.

Nancy Churchill is a writer and educator in rural eastern Washington State, and the chair of the Ferry County Republican Party. She may be reached at DangerousRhetoric@pm.me. The opinions expressed in Dangerous Rhetoric are her own. Dangerous Rhetoric is available on thinkspot, Rumble and Substack.

Also read:

- Letter: ‘We’re going to give them some money and a plane ticket, and then we’re going to work with them’Camas resident Anna Miller supports a new structured self-deportation policy, calling it a balanced approach to immigration and economic needs.

- Opinion: What the 2025 legislature tells us about why Washington’s government keeps failingTodd Myers of the Washington Policy Center argues that Washington’s government fails because it resists humility, experimentation, and accountability in its policymaking.

- Letter: Vancouver needs broader leadership than just a teacher’s lensVancouver resident Peter Bracchi urges Mayor Anne McEnerny-Ogle not to seek another term, calling for more diverse and inclusive leadership rooted in broader experiences.

- Opinion: Legislative session ‘was full of ups and downs and many learning experiences’Rep. John Ley reflects on the 2025 legislative session, highlighting local funding victories and warning of major tax increases passed by the majority.

- Opinion: Washington state Legislature 2025: That’s a wrapElizabeth New (Hovde) of the Washington Policy Center breaks down the highlights and lowlights of Washington’s 2025 legislative session, warning of rising taxes and new mandates.

Hopefully more and more people wake up to this fact. Property taxes are just one other way the parasite class keeps citizens in debt slavery. Obviously, there is no such thing as private property if all one is doing is renting from the parasite class.

Interesting asidem: the people of North Dakota (the ONLY State in the Union, btw, that is NOT bankrupt), had a referendum, a few weeks back, to rid themselves of property taxes. Guess what? It was defeated…..

If the government can just print fiat money (money with nothing backing it, money made out of thin air), why are we paying income taxes? And, with ALL the trillions of dollars the democrats have been laundering for the past 50+ years, why do we need to pay property taxes? The schools certainly aren’t doing anything worthwhile, the roads are falling apart, the sheriff is underfunded, and non-profits always seem to have plenty of money to donate to democrats that keep raising taxes….

On my property tax statement, there are six line items just for the schools. Four are for the local District, the other two are “State share” parts 1 and 2. This makes up the biggest single tax we pay on our home before all of the rest.

Don’t forget about all of the local taxes the City imposes, and raises, on citizens every year…garbage collection, recycling, water and sewer rates, cell phones, internet and a local sales tax.

Our water bill has gone up every single year, while our actual water usage has remained fairly level. I heat the house with our wood stove during severe weather, and use a modern, efficient heat pump as well, and still get these notices from CCPU about how much more electricity we use than is “optimal”. According to whom??

We are both in our seventies and really would like to stay here and age in place, but if ot keeps on getting this more expensive to maintain a home, that may well not be possible any longer. We shall see.

Bob,

It’s what the democrats want: for all of us to sell and move out so there is no opposition to their money grubbing and insane “politics”. All they want is a controlled “environment” with them in charge living in luxury, with a subservient under-class totally dependent on the shekels the overlords toss out to the peasants as was done in the middle ages.

Of course, with all the money laundering beginning to be cut off, their plans may have to be “re-evaluated”…..

BONDI WON’T EVEN ARREST MAYORKAS FOR PROVEN TREASON! GARLAND TESTIFIED B4 THE HOUSE THE OPEN BORDERS ALLOWED ENEMY COMBATANTS/TERRORISTS INTO THE COUNTRY! THAT IS THE DEFINITION OF TREASON! IF WE CAN’T EVEN ARREST FOR TREASON HOW, EXCEPT THRU REVOLUTION, DO WE RESTORE OUR PROPERTY RIGHTS

There are no arrests because ALL of them are on Epstein’s list….