Heidi Pozzo shares what’s actually happening to your property tax dollars in the Ridgefield School District

Heidi Pozzo

for Clark County Today

It is April. Tax month. By now you’ve received your property tax bill and are getting ready to pay for the first half of the year taxes.

If you flip over your bill, you’ll see on the back rates for each taxing jurisdiction. At the top are the rates for voted levies. You’ll see one there for Ridgefield School District.

Rate per thousand is the preferred metric to speak about how a bond will impact your taxes. It is preferred because it seems low, usually only a few dollars and cents. You’ll see it in the presentation materials from entities running bonds and levies. And it is a way to show how low the rate is that you are paying, especially compared to others.

But that rate can hide big increases in actual tax dollars you pay and that school districts collect.

The rates make you think you aren’t paying much more, when you actually are. It’s only a few dollars or cents difference. No big deal.

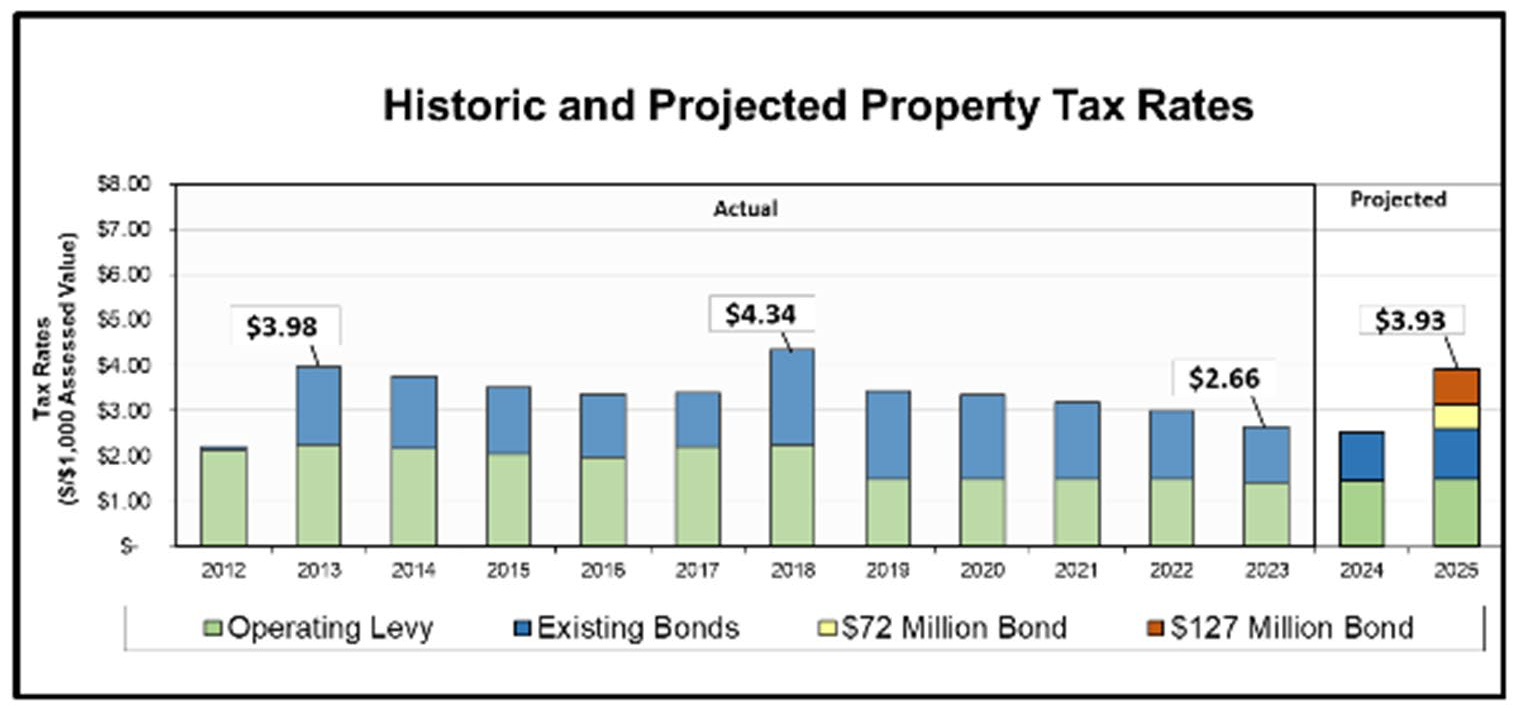

The graphic below is from Ridgefield School District’s January 3, 2024 townhall. The point was that a rate increase would get back to the norm as rates had fallen in recent years. And that a new bond would be slightly less than the rates the last two times a bond was passed.

What’s actually happening to your property tax dollars is a different story.

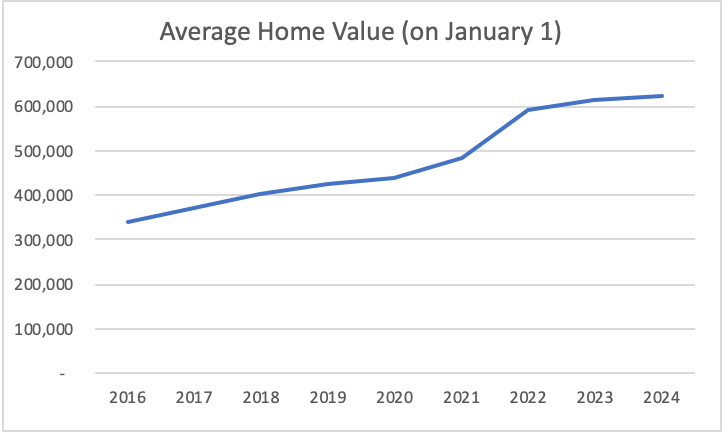

Home values have been increasing as shown is this chart for the 98642 (Ridgefield) zip code:

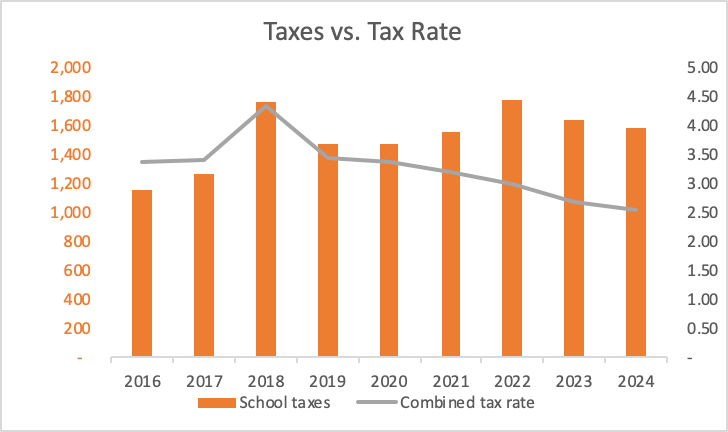

Taxes are calculated by taking the assessed value multiplied by the tax rate and divided by 1,000.

Applying the historic tax rates to the average home values in the chart above, you can see tax dollars paid increased while rates decline, until the last two years when the dollars were spread over more properties:

The Assessor’s Office takes the dollars voted for in bonds or levies and divides those dollars across all of the assessed values of properties. As communities grow, tax rates should be going down.

It’s math.

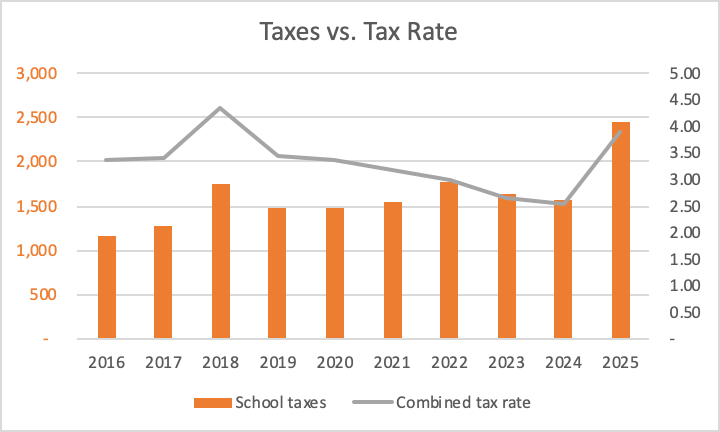

Here’s what happens when the rate goes back up to reflect the rate and dollars that are being proposed in the new bond. Actual dollars paid will be more than double what they were in 2016.

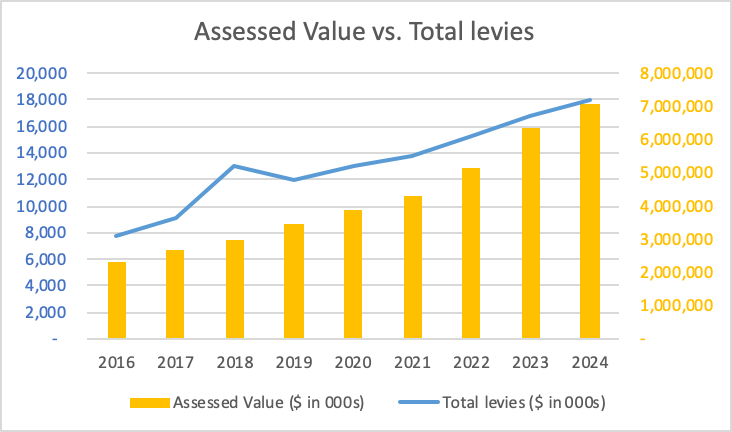

Over this time period, the assessed values of all the properties in the district increased from $2.3 billion to $7.1 billion because property values appreciated and properties were developed. Operational and bond related levies collected by the district went from $7.8 million to $17.9 million.

You are being told that the rate declining to the second lowest in Clark County is a bad thing, with the implication that Ridgefield schools aren’t being funded adequately. However, over the time period shown above, the District received an extra $10 million. That’s a 130 percent increase in taxes collected for a 47 percent increase in students.

Little changes in rates can turn into big dollars. Most of the time, there isn’t a shortage of money. It’s a matter of how well the money is spent.

Heidi Pozzo has been a Ridgefield resident for 16 years. She is a concerned citizen who would like students to get a good education and thinks we can do it in a more cost-effective way.

When I was in college, I worked for the facility services of the university doing general labor tasks. There were many days that myself and other student workers would show up and were told to jump in one of the trucks and drive around for our shift. One time I asked my supervisor why he just wanted us to drive around instead of just sending us home if there wasn’t anything to do. His response was he has to make sure he spends all of his budget, and in fact, go over his budget, so the university can justify asking for more money in their budget next year. This is probably typical of every department in every level of government