Rob Anderson provides a closer looks at Ridgefield School District’s levy proposals

Rob Anderson

for Clark County Today

Ridgefield School District is asking voters to approve two levy proposals: Proposition 12, an operational levy, and Proposition 13, labeled as a “Technology and Capital” levy. While these measures are marketed as essential for maintaining and enhancing educational quality, a deeper analysis reveals significant concerns about fiscal responsibility, transparency, and respect for voter intent.

Understanding school levies and their impact

School levies are often presented using two metrics: the total revenue amount and the cost per $1,000 of assessed property value. While the cost-per-$1,000 figure helps property owners estimate their individual tax impact, it’s important to understand that this number is only an estimate — and it can distract voters from the more significant, fixed revenue amounts being requested.

The reality is that once a levy is approved, the district collects the full revenue amount, regardless of changes in property values or new taxable properties. This distinction matters because focusing solely on the cost per $1,000 can make the overall tax burden seem smaller — similar to a car salesperson emphasizing low monthly payments while glossing over an inflated total price.

With this context, let’s examine the current proposals.

Proposition 12: Operational Levy

Proposition 12 is described as a “renewal” or “replacement” levy, but this term is misleading. What is being proposed is a significant increase in operational funding — rising to $44 million, a 41% jump from $31 million in 2022. This follows a 56% increase from the 2019 levy of $21 million.

Proponents of Proposition 12, Ridgefield School District officials, employees, and Citizens For Ridgefield Schools (who have been potentially collaborating in violation of State law) argue that more money is needed to bridge gaps left by state funding and fund critical programs and services. However, Ridgefield taxpayers already contribute through state school property taxes and enormous impact fees. Asking for additional local levies at such a steep 41% increase places an undue burden on homeowners. The claim that these programs cannot survive without a dramatic tax hike suggests that the district has not prioritized its existing resources effectively.

Proposition 13: Technology and Capital Levy

Proposition 13, presented as a “Technology and Capital” levy, appears to mislead voters about its true purpose. Of the $21 million requested, only 7% is designated for technology — primarily for maintaining existing teacher and student devices. The majority of the funds are allocated for capital projects, including turf replacement and track resurfacing at the high school (per the November 12, 2024 RSD presentation).

Additionally, these projects — including minor adjustments like a token 5% reduction in square footage for the proposed elementary school — were previously rejected by voters when packaged in a bond measure. By rebranding these projects as part of a levy, which requires only a simple majority for approval, the district sidesteps the supermajority threshold required for bonds. This tactic not only undermines voter intent but also raises ethical concerns about transparency and respect for the democratic process.

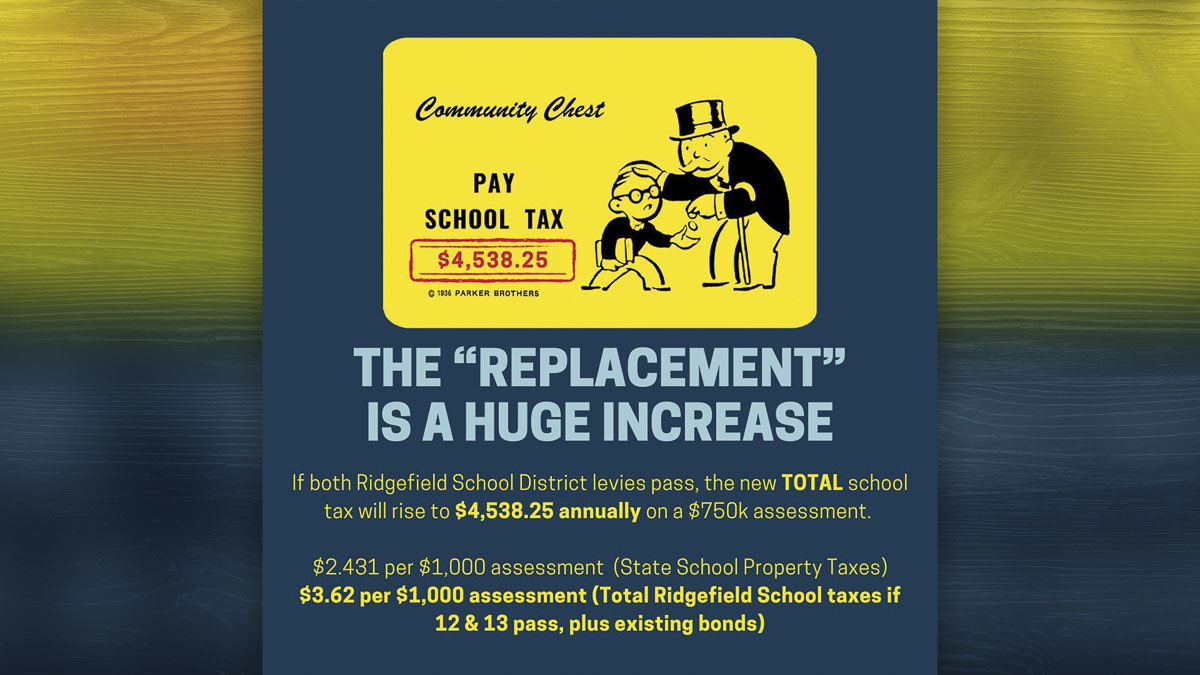

If both Proposition 12 and Proposition 13 pass, Ridgefield’s total school levy tax revenue will skyrocket to $65 million, more than double the $31 million approved just three years ago. For homeowners, the impact is substantial. The tax rate hike would result in a 72.7% increase, costing an additional $817 annually for the owner of a $750,000 home. Combined with existing state school property taxes of $2.431 per $1,000 of assessed value, the total school tax burden would climb to $4,538.25 per year.

Voters should reject both measures and urge the district to return with proposals that better align with community priorities. Specifically:

Proposition 12: should reflect a smaller, more reasonable increase of no more than 10%.

Proposition 13: should be reworked to eliminate non-essential projects like turf replacement and track resurfacing, with further cost reductions for the new elementary school to ensure the entire cost fits within the levy.

Ridgefield residents deserve better stewardship of their tax dollars. For more information, visit ReformClarkCounty.com.

Also read:

- Debra KalzLetter: ‘It was a love fest for the City of Vancouver without a true global perspective on the real issues addressed’Debra KalzDebra Kalz critiques Vancouver’s State of the City, citing debt, infrastructure, and homelessness.

- Opinion: Should striking workers be paid by their employers not to work?Elizabeth New critiques SB 5041, warning it could expand strikes and burden Washington employers

- Letter: ‘Our Vietnam and Vietnam-era veterans hold a place of honor in our community’J. Ron Powers honors Vietnam and Vietnam-era veterans in a heartfelt tribute.

- Opinion: Should you fear the end of the Department of Education?David Boze of the Washington Policy Center weighs in on whether eliminating the U.S. Department of Education could benefit Washington education.

- Opinion: Legislative leaders fail (again) to limit the abuse of emergency power in Washington stateWashington Policy Center’s Paul Guppy says emergency power reform has stalled