In her weekly column, Nancy Churchill shares her thoughts on Gov. Jay Inslee’s proposed budget

Nancy Churchill

Dangerous Rhetoric

One of the most basic ways conservatives are different from progressives is centered around the idea of taxation and government spending. Conservatives believe some limited taxation is fine — usually for national defense and interstate commerce. Progressives believe they know best how to spend (or redistribute) the money of the citizens, and ruthlessly increase taxation at every opportunity.

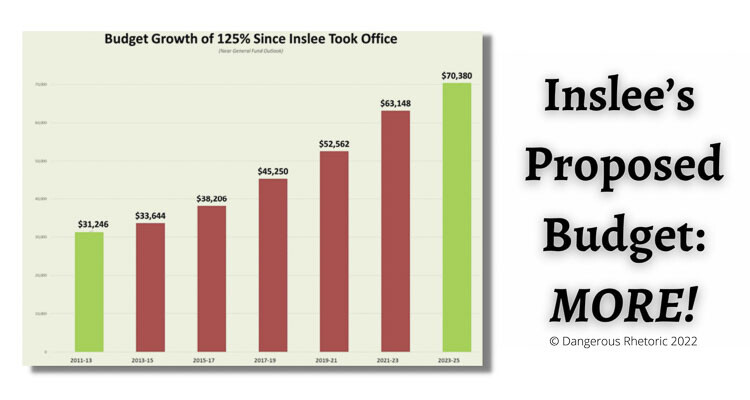

Washington Democratic Governor Jay Inslee is no exception to the rule. He recently released his 2023-2025 proposed budget, which will continue his quest to rapidly grow the size and cost of state government. This budget is 12% larger than the last state budget and 125% larger than the budget when he came into office in 2013.

While the governor’s media release on the budget trumpets his legislative priorities, the blog at Shift WA points out that the real agenda is most likely about continued power and control. If the budget can “increase state revenues so more government employees are hired, then the government union bosses can take more dues fees from government workers’ paychecks, and in return the union bosses can kickback even more money into funding Democrat politicians’ campaigns and supporting far-Left organizations.”

They who grow government, control government

I agree with this astute analysis. By growing the size of government, the Democrats can control government. Government unions often promote legislation that harms union members, but which increases union power. Because of forced union dues, union leaders have much more financial influence on politicians than the average hard-working citizen. More unions begets more collectivist policies, which in turn increases the power of collectivist and Marxist politicians. It’s a vicious circle.

What would the Republicans do if they were in power? “Republican Senate budget leader Lynda Wilson (Vancouver) stated her concern that the governor’s priorities apparently do not include helping school children who suffered significant education loss, which are the results of students being kept out of schools (longer than nearly every state in the country) due to governor’s emergency orders and teacher unions’ selfish demands during the pandemic. The governor’s budget has less than 44% of the state’s budget going to schools, which is far below the 50% Republican’s spent when they controlled the Senate a few years ago.” The governor’s budget also demonstrates a lack of concerns for the financial struggles of everyday Washingtonians trying to cope with the Democrats’ inflationary policies and the increase in fuel prices. Rather than providing tax relief at the pump, the governor’s new cap-and-tax policies are expected to increase fuel prices by over 40 cents a gallon! No tax relief for you!

Will more spending create more affordable housing?

Unfortunately, the governor’s budget increases the state’s debt in order to throw money at the problem of housing. This does nothing to address the many regulatory and policy hurdles that builders face. The Building Industry Association of Washington’s executive vice president, Greg Lane, is concerned that the governor is on the wrong track. “Just spending taxpayer money without addressing the systemic policy failures that have driven up the cost of

housing the past two decades is senseless,” Lane argues. “To really make housing more affordable, we need fundamental changes to our state and local planning, land use, permitting and regulatory processes.”

Lane continues, “… policy reforms are what’s really necessary to reduce the costs of housing.” The builders association calls for permit timeline reform, State Environmental Policy Act (SEPA) exemptions, State Building Code Council reform and Impact Fee deferral program reform. If the governor is serious about solving the housing crisis, simplifying the building process and easing unnecessary regulations is a critical step in developing affordable housing.

No tax relief

Finally, the governor made it clear in an interview he’s unlikely to allow broad-based tax relief for middle-class Washingtonians. Why? He believes the benefit the middle class would receive is outweighed by his concern that the wealthy may also benefit. Rather than implementing reforms that would help the majority of the middle and lower classes, the “little people” will have to suffer so that Inslee can punish the “billionaires”. In a statement, Republican Senator Wilson said, “The six billion dollars in reserve are more than enough to support meaningful tax relief for the average Washington family — even something temporary to offset the effects of record price inflation. Unfortunately, the governor is showing once again that in his world, government’s desires come ahead of families’ needs.”

The governor’s upside-down Marxist way of thinking harms everyone except for the grifters who get special sweetheart deals from the progressive policy makers. It’s time to demand the state budget work for everyone, not just for the politicians and special interest groups.

Nancy Churchill is the state committeewoman for the Ferry County Republican Party. She may be reached at DangerousRhetoric@pm.me. The opinions expressed in Dangerous Rhetoric are her own.

Also read:

- Opinion: In-n-Out Burger is so much more than fast food for so many of usPaul Valencia shares why In-n-Out Burger means more than just fast food for countless fans as Ridgefield nears its grand opening and Vancouver’s location begins construction.

- Opinion: Washington’s June 2025 budget revisions – revenue up spending up moreMark Harmsworth of the Washington Policy Center critiques the state’s latest budget revisions, warning that new taxes—not organic growth—are driving revenue. He calls for fiscal restraint and long-term reform.

- Opinion: Pedestrian control signalsDoug Dahl explains Washington state law regarding crosswalks and pedestrian signals, offering safety insights and common misunderstandings about traffic control at intersection

- Letter: ‘How can five part-time legislators without research support or reliable access to information serve as an effective check on six full-time elected executives’Bob Zak expresses agreement with recent opinions on the Clark County Charter’s imbalance and endorses John Ley’s transit preference while questioning light rail costs and Council effectiveness.

- POLL: Should the Clark County Clerk remain an elected position?Following public opposition, Clark County Council dropped a proposal to make the clerk an appointed role. Readers can now weigh in through this week’s poll on whether the clerk should remain elected.