Newly elected state representative John Ley provides his capitol perspective

John Ley

Capitol Perspective

Newly elected legislators in the Washington State House of Representatives gathered in Olympia last week beginning their orientation for the upcoming 105-day session that starts Jan. 13. The biggest challenge these 18 legislators will face is dealing with a possible $12 billion funding shortfall, compared to earlier projections. “Sobering news” was how the Nov. 20 forecast was reported.

As your elected representatives, these legislators will seek your input and priorities for the tough decisions that lie ahead. Democrats control both chambers of the legislature and a new governor is expected to propose a revised budget after his inauguration. The state has three budgets – the General Fund, a Capital Budget, and the Transportation Budget.

People don’t want to pay more in taxes, so legislators will need to tighten the state’s spending belt. Not only is affordable housing an issue, but simply the cost of day to day living is a big factor for far too many families.

Incoming Governor Bob Ferguson said he’s not ready to back tax increases yet, according to one news report. Let’s hope he keeps his word on this!

The Center Square reported: Unlike during the Great Recession, the budget deficit isn’t due to a decline in revenue, as many of the state’s tax collections are at record levels while other new taxes have been imposed.

Senator Lynda Wilson wrote: “the chief economist warned our council that the state’s economic growth would be slow this year, and that has been the case. But still, between projected revenue and available reserves there is more than enough to balance a 2025-27 operating budget that maintains the services and programs being provided now.”

She added that “the problem – and the reason our Democratic colleagues are already talking about tax increases – is the billions of dollars’ worth of new spending requests we are likely to see in the governor’s budget proposal. Those include $4 billion tied to new collective bargaining agreements with state workers.”

Big Picture

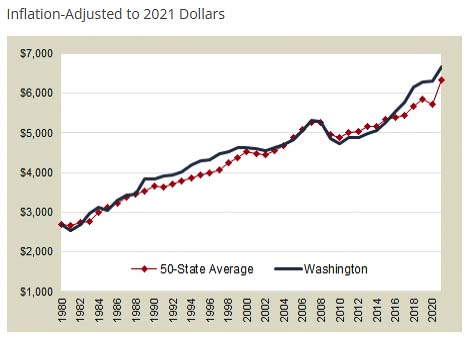

Annual state spending (General Fund) has grown from about $11 billion in 2000 to $37 billion in 2025. Per capita, inflation adjusted spending has grown about 50 percent, from about $4,000 per person to $6,000 per person.

Revenue growth averaged 8.3 percent per year from FY2016 through 2023. Looking ahead, FY2024 to 2029 revenue growth is projected to average just 2.7 percent. The important point is that your government will continue to take in increasing amounts of your money to the end of the decade, according to current projections.

Washington state has 133,250 employees (FTE). The largest percentage, 45 percent, are Higher Education (college) employees. Local K-12 school employees are primarily paid for by the state, but they are not state employees.

For comparison, Washington has 8 million people. Oregon has 4.2 million people and 45,000 state employees.

Supposedly, approximately 75-80 percent of the budget is “mandatory” spending. These include Constitutional elements, federal requirements (Medicaid), and other state created obligations.

Nearly half of all state employees work in higher education. Education, Health Care, and other Human Services programs are the major drivers of state spending. While some spending is discretionary, most is mandatory to varying degrees according to briefings the incoming legislators received.

Current Budget Revenues

The FY 2023-25 Biennium projected $66.4 billion in General Fund revenues. Sales and use taxes make up 48 percent of revenue; Business and Occupation taxes make up 20 percent; Property Taxes 14 percent; with Real Estate Excise, Alcohol, Tobacco, Cannabis and Lottery, Utility, Capital Gains, Estate and other taxes making up the balance.

The state takes 6.5 percent of the sales price, with local entities adding to that amount. The total state and local sales tax rate varies from 7 percent to 10.6 percent. The average statewide is 9.38 percent. Additionally there are 230 sales and use tax preferences, including exemptions.

Property taxes bring in about $9 billion and make up 14 percent of state revenue. Currently, levy amounts can rise by 1 percent of assessed value each year, plus new construction. Last session there was a proposal to raise the maximum increase to 3 percent, triple the current amount, but it didn’t pass.

Business and Occupation taxes raise about 20 percent of revenues. Approximately 384,000 businesses pay this tax. Rates vary depending on business activity, from 0.138 percent to 3.3 percent. These taxes are applied to gross receipts, not profits. An unprofitable business would have to pay these taxes. There are four main rate categories – retailing, wholesaling, manufacturing, and services.

A new Capital Gains tax began in 2022, and the Climate Commitment Act tax began in 2023. In 2023, over two thirds of the Public Works Assistance Account funding from REET taxes was redirected to the Education Legacy Trust Account.

Expenditures

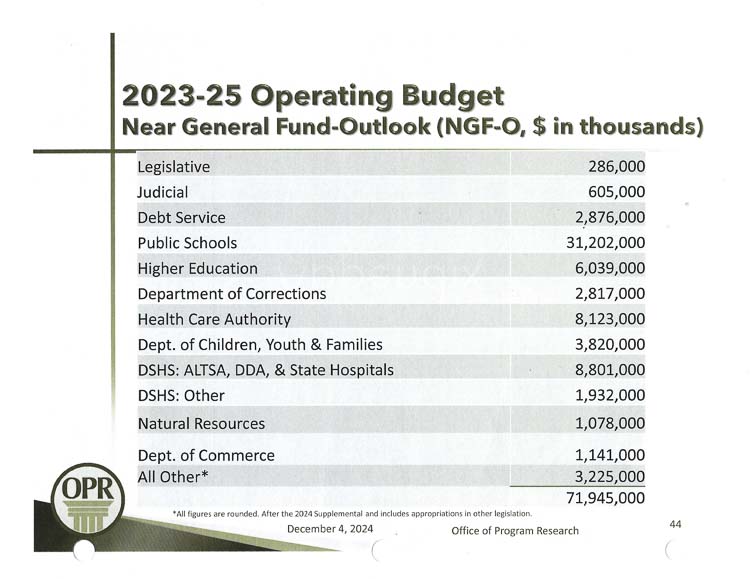

The state budget planned to spend a total of $173 billion for the 2-year 2023-25 biennium, in three different budgets. The two year operating budget (General Fund) is $140.9 billion; the Transportation budget is $14.7 billion, and the Capital budget $17.8 billion. These budgets can overlap. For example the General Fund pays for the staffing of the Department of Transportation, while the Transportation budget pays for numerous “projects” including construction of new facilities, maintenance, the state patrol, the state ferry system, and more.

Public schools (K-12) get the largest share of state spending at 43 percent. Higher Education (colleges) gets 8 percent, the Health Care Authority gets 8 percent; the Department of Social and Health Services (DSHS) gets 10 percent plus handles another 3 percent; Children, Youth and Families receives 5 percent; and Behavioral Health gets 5 percent. Debt service consumes 4 percent of the spending.

The state has 1.9 million of our citizens on Medicaid, nearly 24 percent of our population. We have over 90,000 adults receiving mental health services, a 54 percent increase from a decade ago. There are also nearly 42,000 children getting mental health services, up almost 40 percent. Our Community Behavioral Health funding has nearly tripled to almost $3 billion.

Looking ahead, there are negotiated state employee pay raises that add to budget pressures. Governor Inslee instituted a hiring freeze earlier this month. He will submit his suggested 2025 budget later this month.

The incoming legislators were told there is a very large range in forecast state tax revenues. The pessimistic and optimistic revenue forecasts vary by over $6 billion, from the baseline projection. Recent lower REET revenues were due to high interest rates slowing home sales. That is expected to change as the Federal Reserve continues lowering interest rates.

As your representative, I welcome citizen input on revenues and expenditures. You can visit the Office of Financial Management (https://ofm.wa.gov/) for more details on any aspect of the state budget. Thank you for your input, support, and encouragement.

John Ley is the new state representative for the 18th District (position 2) effective Jan 13, 2025. He will regularly provide Clark County readers with his capitol perspective.

Also read:

- Public comment prevails: No action taken on Clerk agenda item at Clark County Council meetingClark County Council declined to advance a proposal to make the County Clerk position appointed, deferring the issue to the Charter Review Commission after public concerns over transparency.

- Opinion: ‘Today’s Democratic Party is not our father’s Democratic Party’Editor Ken Vance reflects on how today’s Democratic Party diverges from the values he associates with his father’s generation, citing issues like taxation, gender policies, and shifting ideology in Washington state politics.

- Trump signs ‘big, beautiful bill’ during White House July 4 celebrationPresident Trump signed the “big, beautiful bill” on July 4 during a White House event featuring a military flyover and Republican leaders.

- Opinion: Your cost of living is about to go up as the majority party’s new taxes and fees kick inRep. John Ley shares a legislative update on rising costs across Washington, including gas taxes, childcare, housing, and business impacts. He highlights concerns about state spending and new transportation policies.

- US Senate narrowly passes GOP megabill after overnight session, sending it to HouseVice President JD Vance cast the deciding vote on a sweeping GOP tax and spending package that now heads back to the House, sparking reactions across the aisle.

John,

First and foremost, thank you for being open, transparent, and forthright in explaining the current budget situation. I hope you continue to work tirelessly to stop any and all new attempts at taxation. We the people are truly tapped out, and the government of Washington must learn to live with the current level of budget and stop reaching in to our pockets every year. Please continue to shine you light in the dark corners of Olympia, and keep us educated on what we can do to help make things better.

Jared

We are so blessed to have John Ley in the saddle; an exceptional qualified individual in so many areas. There is no other person that possesses the expertise in the transportation system as he does. People!… Listen to his sage advice on this subject as well as in other areas

Washington has a spending problem, not a revenue problem. For just one example, how much of the Transportation budget goes to pay for repeatedly sweeping homeless camps over and over again?? How much other money goes toward supporting those same “chronic homeless”??

The City of Vancouver has already jacked up every single tax they can think of to cover their $43M budget “shortfall” while still paying big bucks for a DEI Staff and Homeless “Services” Staff, along with untold millions in “homeless services”.

As for jail overcrowding, how many of those detainees need to be deported back to their home country?? Potentially lots of space in local jails.

We hear a lot about how more money is needed for “under-represented communities”, but the biggest one in Vancouver is anyone who owns a house or runs a business. Our “fair share” will never be defined (except upward), and we will never pay enough.

How about a 2 per cent reduction across all areas of the budget !!!

You were elected to make tough choices, now cut your budget by $12 billion! Live within your means, as us tax payers do.

Our DRS systems have billions of dollars of reserve monies.

Why not borrow enough from the state retirement system to balance the budget over the lean years and simply pay it back. Call it an intra-state IOU.