Nancy Churchill says now is the time to learn how to influence the legislature and help to fight against increased taxation and spending

Nancy Churchill

Dangerous Rhetoric

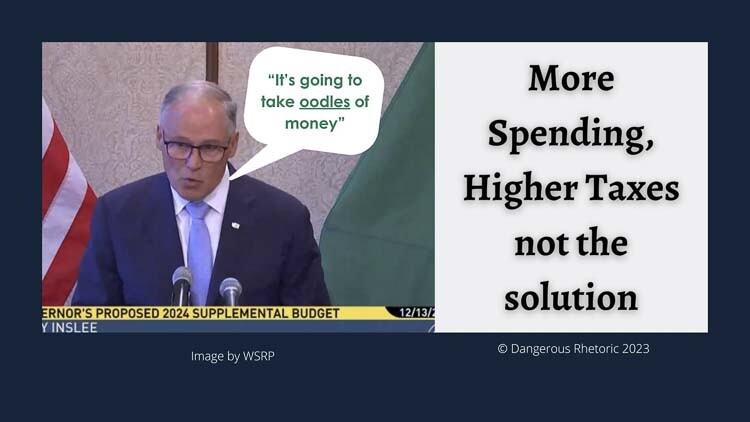

Governor “Grinchlee” is planning on spending and spending and spending, which means that taxes are going to continue to go up, up, up. According to an article in The Center Square Washington, “The governor’s supplemental budget would add $2 billion in spending to the $69.8 billion operating budget the Legislature passed during this year’s session.” I especially appreciated this passage: “There are some numbers attached to it, but the numbers aren’t important,” Inslee said at a press conference announcing his supplemental budget. “What’s important are the lives. There’s a lot of lives that are going to be improved because of the proposals that we are making.”

Translation: “We’re going to be raising your taxes, but never mind that. We’ve got plans to spend your money on our priorities.”

Spending, spending, spending

In a recent press release, Senator Lynda Wilson (R-Vancouver) pointed out that “…the taxes [Gov. Inslee] has already passed continue to fuel rapid growth in state spending. Washington’s new income tax on capital gains and the ‘hidden gas tax’ of the Climate Commitment Act have enabled the governor to more than double state spending during the decade he has been in office. When people wonder why gas prices are climbing, why groceries and housing are more expensive, and why they have less to spend this Christmas — they need look no further than Olympia.”

Rep. Chris Corry pointed out that “Since the Legislature adjourned last session, state tax revenue has increased by nearly $3 billion. So it is astonishing that the governor would propose a budget that not only spends that entire $3 billion, but also raids $800 million from the state’s reserves.” Corry continued, “The governor would shift $250 million in subsidies for solar and electric vehicle owners to the capital budget, effectively paying for these programs by reducing funding for public school construction.”

Rep. Corry continued, “Budgets are about funding policies that improve the lives of Washington families, not spending every dollar on more bureaucracy just because you can… We support tax reform that reduces burdens on working families.”

Are property tax increases coming?

Unfortunately, Democrats believe that increasing taxes IS “tax reform.” I think that 2024 will be the year that the Democrats in the Washington Legislature will eliminate the 1% limit on property tax increases. Democrats introduced three bills last session that would remove the 1% cap on property tax increases: SB 5618, SB 5770, and HB 1670. HB 1670 “Raising the limit factor for property taxes” made the most forward progress last year, so that’s the one I expect to see moving when the legislature resumes on Jan. 8.

Since all of the government institutions funded by property taxes are feeling the pinch of inflation, there’s going to be a lot of pressure on legislators to allow property taxes to increase more rapidly.

It’s a numbers game

Even though the governor thinks that the “numbers aren’t important,” most union labor contracts mandate annual cost of living increases that are at least 2% if not more. Since the revenue for a tax district can only increase by 1% a year, the pressure from the annual wage increases is already causing budget pain for schools, libraries, fire stations and other junior taxing districts.

Right now, the only way to get increased funding is for each district to run a levy lid lift by the voters, but everyone knows that property taxes have already gone sky high due to rising home values. And rising home values are driving property insurance costs through the roof! So, how can the property owners afford to pay an additional 2% in property taxes? The voters would probably reject such a levy lid lift request.

Are you going to let them raise your property taxes?

Given the impact of rising inflation, expect to see at least one of the three bills that would raise property taxes to be passed by the tax-and-spend Democrats, even though doing this will harm property owners all across the state, especially senior citizens on fixed incomes, who are already struggling with inflation.

Furthermore, increasing property taxes will drive rental rates even higher, exacerbating the problem with the lack of affordable rental housing. Spending more of other people’s money and increasing taxes is NOT the solution to homelessness and the lack of affordable housing. It’s obvious that the Democrats “housing first” strategy is NOT working to reduce homelessness. More government spending and increased taxation are the problem, not the solution.

Washington’s legislature will go back to work on Jan. 8. Now is the time to learn how to influence the Legislature and help to fight against increased taxation and spending. You can learn how to do that at www.influencingolympia.com/. When you discover how to participate in the process of lawmaking, you can be part of the team working to stop bad ideas and promote good ones.

Nancy Churchill is the state committeewoman for the Ferry County Republican Party. She may be reached at DangerousRhetoric@pm.me. The opinions expressed in Dangerous Rhetoric are her own.

Also read:

- Letter: ‘There will be consequences’Hazel Dell resident Bob Zak criticizes Democratic lawmakers for advancing ESSB 5181, arguing it undermines parental rights and defies biblical principles.

- Op-Ed: La Center Schools — Committed to families and their childrenIn a public letter, the La Center School Board and Superintendent Peter Rosenkranz affirm their commitment to supporting families and honoring both state law and community values amid state-level scrutiny.

- Letter: Mayor blames others on homelessness problem in Vancouver while she has enabled a lawless encampment zoneVancouver resident Peter Bracchi urges city leaders to enforce laws and end permissive policies that have allowed unsafe encampments to overrun public spaces near the Share House.

- Letter: ‘Look it up for yourself’Camas resident Anna Miller encourages skeptics of Elon Musk’s claims about government waste to do their own research using official resources.

- Opinion: Defending the indefensibleNancy Churchill argues that Washington’s lawsuit against a sheriff cooperating with ICE reveals a deeper political agenda that puts public safety at risk.