Todd Myers of the Washington Policy Center reveals what the expected impact will be if I-2117 passes

Todd Myers

Washington Policy Center

Will prices at the pump fall if voters pass I-2117 and repeal the state’s CO2 tax? One of the largest donors to the campaign to keep the carbon tax admits they will fall. Significantly.

One of the main messages of the campaign to keep Washington’s CO2 tax, known as the Climate Commitment Act (CCA), is that there is no “guarantee” that gas prices will go down if I-2117 passes and the CO2 tax is repealed.

Rachel Smith, the head of the Seattle Chamber of Commerce, made this implausible claim in front of The Seattle Times editorial board. I offered to bet her $100 to charity that if I-2117 passes and the CO2 tax is repealed, prices would go down. Not surprisingly, she refused. She knows her claim is false.

Now, Smith’s claim is contradicted by one of her own allies and one of the largest donors to the campaign to keep the CO2 tax.

Oil giant BP’s own invoices show that if the CO2 tax is eliminated, prices at the pump will go down.

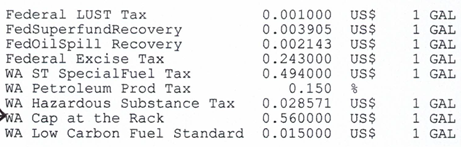

BP sells fuel on the wholesale market and after the state’s CO2 tax went into effect, the company began showing the cost of that tax on customer invoices. The cost of CCA allowances is listed on the invoice as “WA Cap at the Rack.” CCA is also called a cap-and-trade system and “the rack” is the term for wholesale fuel sales – hence “Cap at the Rack.”

Last summer, when the price of CO2 allowances in the CCA hit $56.01 per metric ton, BP added 56 cents per gallon for diesel fuel for “Cap at the Rack,” closely reflecting the cost of the tax. One gallon of diesel emits about 1.01 percent of a metric ton of CO2, so the cost is basically one percent of the cost of the CO2 allowance. There was a technical delay in setting the price of the tax for the first two months of the year, so some fuel distributors were under-charging early in the year and increased prices later to make up the gap. That may be why BP’s price was slightly higher than the CO2 tax price would imply.

Since that time, the price of CO2 allowances has fallen significantly. In the most recent auction, the price fell to $29.88 per metric ton, which translates to about 30 cents per gallon of diesel. BP marked up the price to 28.4 cents per gallon, just slightly less than the price implied by the tax.

If Seattle Chamber’s Rachel Smith and the campaign to keep the CO2 tax are right that eliminating the CO2 tax won’t reduce prices at the pump, why did their own ally cut prices when the CO2 price went down?

Because their claim is obviously false. If the CO2 tax is repealed and the price goes to zero, the price charged by BP will too.

I emailed BP to ask if they would eliminate the Cap at the Rack charge if I-2117 passes. They responded that they don’t comment on pricing issues. Fair enough.

Actions speak louder than words. When the price went down, BP cut their price by virtually exactly the drop in the price of the tax. If the tax goes away, so will their charge.

Rachel Smith and the others know this. They know that eliminating the CO2 tax will cut gas prices. They appear to have decided that the policy identified by The Seattle Times columnist Danny Westneat of “strategic misinformation” – i.e. lying – is the only way to defend a policy they know would be unpopular if they told the truth.

And while BP’s actions show that they know the claim is false – they’re still funding the campaign to make these disingenuous claims.

Some say there is no “mechanism” in I-2117 to reduce prices. The market is the mechanism. If BP had refused to cut their prices when the tax went down, their customers would have simply gone to their competitors.

It is absurd to have to keep dealing with this issue, but the number of stories CO2 tax advocates can simply make up appears to be endless, and they are bound only by creativity, not reality.

Thus far, they have claimed – among other things – that:

- The cost would only be “pennies” (it added more than 40 cents per gallon of gasoline).

- That prices didn’t increase due to the tax (they did and the governor knew it).

- That prices increased because a pipeline was closed down (it wasn’t closed).

- That prices increased because oil companies suddenly became greedy (but only in Washington state and by virtually the exact amount of the CO2 tax).

- That it is impossible to know why prices change (even when everyone else, including the State of California and environmental activists like Climate Solutions say CO2 taxes increase prices).

None of these things were true and each time one is disproven, supporters of the CO2 tax simply move to the next excuse promising that this time the public can trust them.

Once again, however, their own actions contradict their rhetoric. The simple truth is that if people vote “Yes” on I-2117, they will pay less.

Todd Myers is the vice president for research at the Washington Policy Center.

Also read:

- POLL: Why did voters reject all three tax proposals in the April 22 special election?Clark County voters rejected all three tax measures on the April 22 special election ballot, prompting questions about trust, affordability, and communication.

- Opinion: The war on parental rightsNancy Churchill argues that Olympia lawmakers are undermining voter-approved parental rights by rewriting key legislation and silencing dissent.

- Opinion: An Earth Day Lesson – Last year’s biggest environmental victories came from free marketsTodd Myers argues that Earth Day should highlight free-market solutions and grassroots innovation as more effective tools for environmental stewardship than top-down mandates.

- Opinion: Time to limit emergency clauses and give voters a choiceTodd Myers urges the governor to remove emergency clauses from bills that appear intended to block voter input rather than address real emergencies.

- Letter: C-TRAN Board improper meeting conductCamas resident Rick Vermeers criticizes the C-TRAN Board for misusing parliamentary procedure during a controversial vote on light rail.