Jason Mercier of the Washington Policy Center believes lawmakers finally funding this low-income tax relief program is a cause for celebration

Jason Mercier

Washington Policy Center

It took more than a decade, but Washington has now joined several other states across the country by providing a targeted low-income tax credit. Originally signed into law by Governor Gregoire in 2008, it took lawmakers until 2021 to approve funding for the Working Family Tax Credit.

This targeted low-income tax assistance program is modeled after the Federal Earned Income Tax Credit which is also provided at the local level by several states with income taxes. Along with recommending broad-based tax relief (yet to be provided), we encouraged lawmakers to prioritize funding this tax credit during our testimony at a 2019 House Finance Work Session on the state’s tax structure.

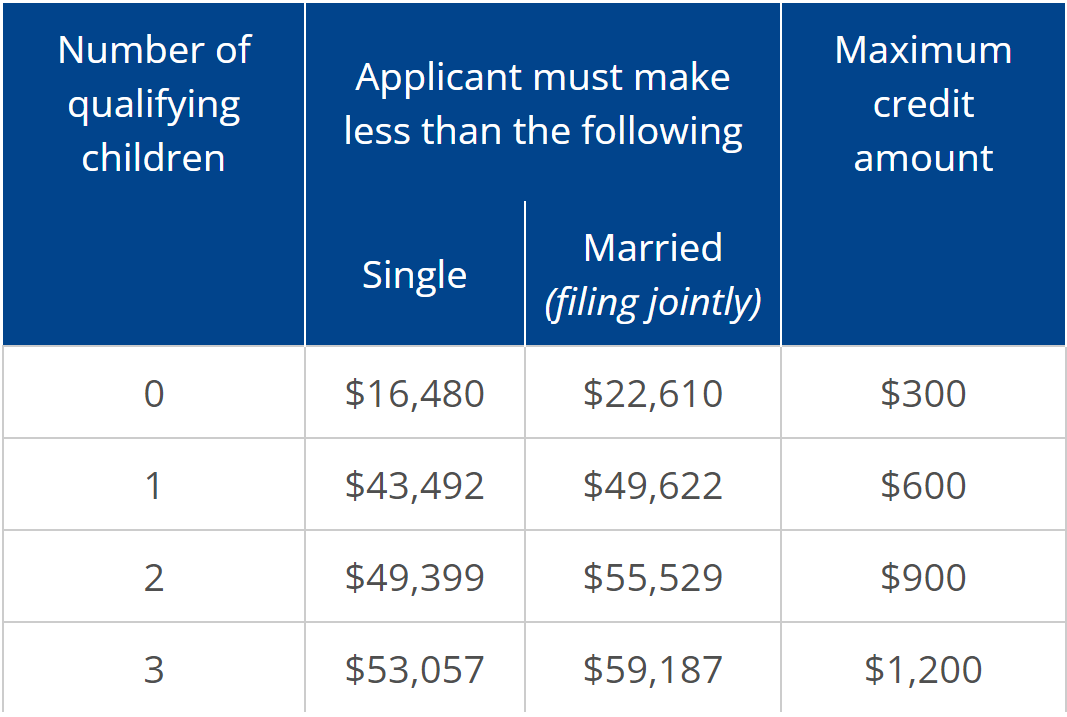

Here are the basics of eligibility for the Working Family Tax Credit according to the Department of Revenue:

- “Have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Lived in Washington a minimum of 183 days in 2022 (over half the year). See our Frequently Asked Questions (FAQs) about residency to learn more.

- Are at least 25 and under 65 years of age OR have a qualifying child in 2022.

- Filed a 2022 federal tax return.

- Eligible to claim the federal Earned Income Tax Credit (EITC) on their 2022 tax return (or would meet the requirements for EITC but are filing with an ITIN). Go to www.irs.gov/EITC to learn more.”

The Washington Working Family Tax Credit is not self-executing. Eligible low-income Washingtonians need to proactively apply for the credit. You can check your eligibility here.

Lawmakers finally funding this low-income tax relief program is a cause for celebration. The next step is for state officials to follow the lead of the rest of the country and also provide inflation-hammered taxpayers with broad-based tax relief, with no eligibility verification or application required.

Jason Mercier if the director of the Center for Government Reform at the Washington Policy Center.

Also read:

- POLL: Why did voters reject all three tax proposals in the April 22 special election?Clark County voters rejected all three tax measures on the April 22 special election ballot, prompting questions about trust, affordability, and communication.

- Opinion: The war on parental rightsNancy Churchill argues that Olympia lawmakers are undermining voter-approved parental rights by rewriting key legislation and silencing dissent.

- Opinion: An Earth Day Lesson – Last year’s biggest environmental victories came from free marketsTodd Myers argues that Earth Day should highlight free-market solutions and grassroots innovation as more effective tools for environmental stewardship than top-down mandates.

- Opinion: Time to limit emergency clauses and give voters a choiceTodd Myers urges the governor to remove emergency clauses from bills that appear intended to block voter input rather than address real emergencies.

- Letter: C-TRAN Board improper meeting conductCamas resident Rick Vermeers criticizes the C-TRAN Board for misusing parliamentary procedure during a controversial vote on light rail.