Jason Mercier of the Washington Policy Center shares that whether or not Washington has a death tax, ensuring an operable inflation index to avoid bracket creep should be an easy call for lawmakers

Jason Mercier

Washington Policy Center

As noted by Benjamin Franklin, “in this world, nothing is certain except death and taxes.” For some taxpayers in just a few states, that quote can be changed to include taxes for dying as well. Washington is one of just 12 states that impose an estate tax (commonly referred to as a death tax) and is the only state without a personal income tax to have one.

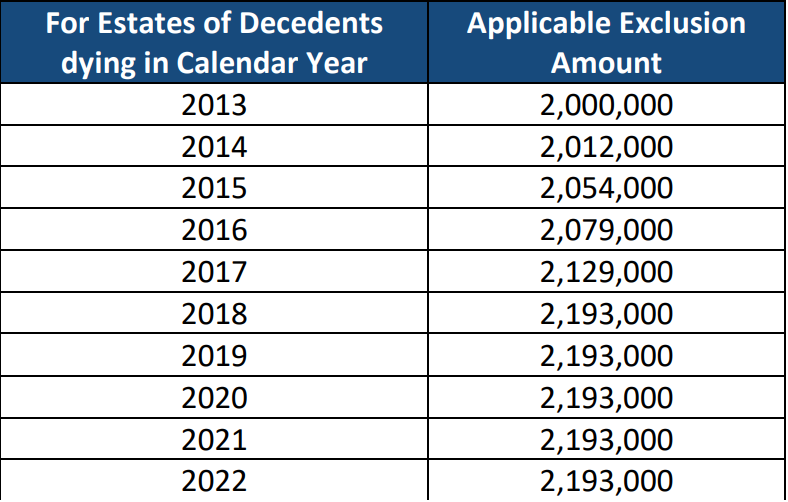

To make matters worse, our estate tax currently has an inoperable inflation index, meaning more and more taxpayers are falling prey to it. The reason for this is that the federal report our law was linked to that determined inflation increases hasn’t been published since 2018. This means that there have been no inflation increases to the state’s death tax since then.

Since 2014, approximately 75% of taxpayers that paid the state’s death tax were for estates valued at less than $5 million according to data from the Department of Revenue. With no functional death tax index for inflation, coupled with increasing property values, that number is likely to grow to capture even more taxpayers than was envisioned under the original law.

A new bill proposed by Rep. Orcutt and Rep. Jacobsen would correct this oversight and restore a working inflation index for the state’s death tax. Their proposal, HB 1484 (Updating the estate tax exclusion amount), not only restores the inflation calculation but also tries to correct for the fact the state estate tax hasn’t been adjusted for inflation since 2018 by increasing the 2023 exemption so that it would reflect the amount had inflation been calculated.

Along with the lack of a working death tax inflation index, our state is tied for the highest estate tax rate in the country. According to the Tax Foundation:

“Estate taxes are paid by the decedent’s estate before assets are distributed to heirs and are thus imposed on the overall value of the estate . . . Hawaii and Washington have the highest estate tax top rates in the nation at 20 percent . . . Estate and inheritance taxes are burdensome. They disincentivize business investment and can drive high-net-worth individuals out-of-state. They also yield estate planning and tax avoidance strategies that are inefficient, not only for affected taxpayers, but for the economy at large. The handful of states that still impose them should consider eliminating them or at least conforming to federal exemption levels.”

Whether or not Washington has a death tax, ensuring an operable inflation index to avoid bracket creep should be an easy call for lawmakers. Especially since the original law included this type of standard inflation tax protection yet it hasn’t been realized since 2018.

HB 1484 is currently scheduled for a public hearing on Thu., Feb. 9 at 1:30 p.m.

Jason Mercier is the director of the Center for Government Reform at the Washington Policy Center.

Also read:

- Opinion: Employers shouldn’t pay workers not to work: Paying people to strike should be a union’s jobElizabeth New of the Washington Policy Center argues that Senate Bill 5041 would burden employers and taxpayers by using unemployment funds to pay striking workers instead of requiring unions to support their members.

- POLL: Should Washington Raise the 1% Cap on Property Tax Increases?Clark County Today’s weekly poll asks whether Washington lawmakers should raise the current 1% cap on annual property tax increases.

- Letter: The more you knowCamas resident Anna Miller criticizes a recent remark by Rep. Jasmine Crockett as racist and demeaning, and outlines Republican contributions to civil rights history in her letter to the editor.

- Letter: City vehicles speeding on the highwaysVancouver resident Peter Bracchi raises concerns about excessive speeding by city-owned vehicles, based on GPS data received through a FOIA request.

- Opinion: The stage is set for a battle royaleRep. John Ley outlines key legislative battles in Olympia, raising concerns about tax hikes, tolling, and spending priorities in Washington state.