Todd Myers of the Washington Policy Center says legislators and activists understand that residents want to improve the safety and efficiency of our transportation system

Todd Myers

Washington Policy Center

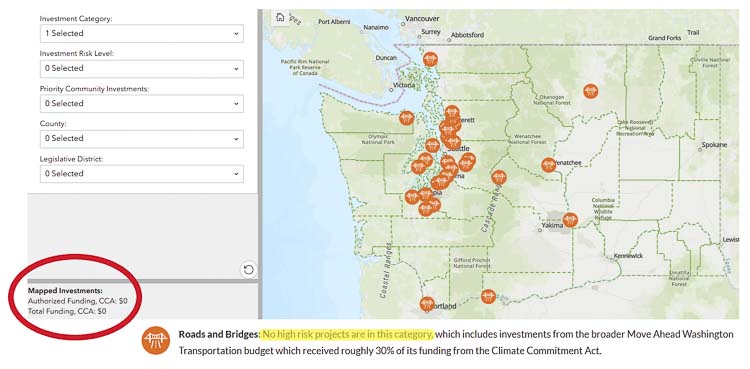

One of the primary arguments made by supporters of Washington’s tax on CO2 emissions, called the Climate Commitment Act (CCA), is that if the state loses the billions in new tax revenue, it will reduce funding for “roads and bridges.”

Legislators and activists understand that residents want to improve the safety and efficiency of our transportation system.

For example, the Chair of the Senate Transportation Committee, Sen. Mark Liias, tweeted in February that passage of I-2117 to repeal the tax on CO2 emissions would “put at risk funding for critical work on transportation projects such as the widening of SR 18 near Snoqualmie.”

That threat has become a common theme for the campaign to keep the CO2 tax. The voters’ pamphlet statement against I-2117 claims that passage of the initiative would put “major road and bridge projects addressing congestion, safety and freight mobility in danger of severe delays or outright cancellation.”

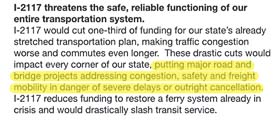

This claim, however, is completely false. In fact, some of the legislators making this claim specifically added language to the CCA making it illegal to use the revenue from the CO2 tax for roads and bridges.

And the web page of a group dedicated to supporting the CO2 tax admits that none of the funding goes to roads and bridges.

The goal of the CCA is to reduce driving, not just of gas-powered vehicles but to reduce the number of miles traveled by passenger vehicles, even if they are zero-emission vehicles like electric cars. To ensure that CO2 tax money doesn’t undermine that goal, the legislation specifically prohibited any of the revenue from being used to fund roads, bridges and other highway purposes covered by the 18th Amendment to the state constitution. The only exemption in the law is for electric ferries, which are considered part of the state’s highway system. Otherwise, the CCA specifically prohibits funding for road construction, maintenance, or safety improvements for bridges.

The claim by Sen. Liias that the expansion of Highway 18 could be put in jeopardy if I-2117 passes, is simply false. That project is funded by Washington’s gas tax, which is one of the highest in the nation, and is not impacted by I-2117.

That fact was confirmed by The Seattle Times in their fact check of the editorial board debate on I-2117. Noting the prohibition on using CCA funds for highway projects, Times editors wrote, “Thus losing the act’s funding won’t directly affect road and bridge projects.”

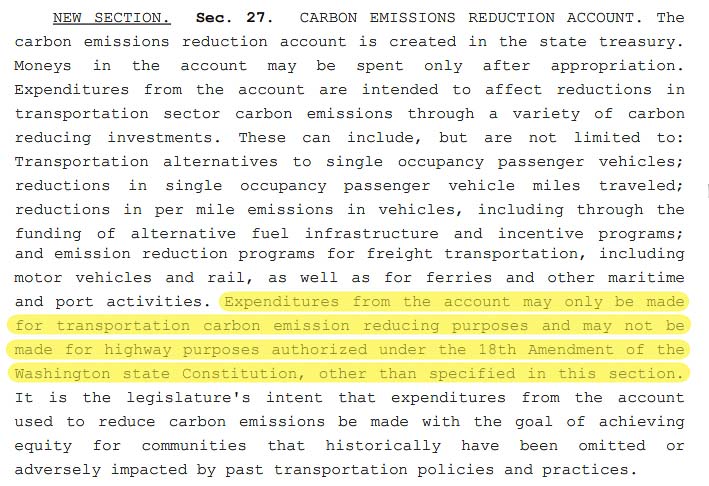

Even the “Clean & Prosperous Institute,” an organization that counts the CCA’s prime sponsor, Reuven Carlyle, as a board member, admits that zero dollars will be cut from roads and bridges if voters approve I-2117.

Their own dashboard of projects funded by the CCA has a selection for “Roads and Bridges.” That dashboard notes there are no projects at risk of being cut and lists the amount of “authorized funding” from the CCA as $0.

Supporters of the CO2 tax, however, claim that if the billions in new taxes go away, legislators would take funding away from existing road projects. The Seattle Times fact check claims, “if the initiative passes, lawmakers will have to decide what stays in the overall existing budget, and what is cut.” However, because the state has already collected billions of dollars in CO2 tax revenue, which is money in the bank, the legislature will still be able to spend those funds if voters approve I-2117. The legislature will face difficult budget decisions, as they do every session, but gas tax revenue is dedicated to highway projects and the legislature cannot re-direct that revenue to other purposes regardless of what happens with I-2117. Therefore, retroactively cutting projects that were fully funded in 2022 because a new tax goes away in 2024 doesn’t make sense.

The only reason legislators would steal from roads and bridges is their own decision, not because I-2117 which would not require any such action.

Senator Liias isn’t the only one threatening to take money away from roads and bridges as retribution for losing the CO2 tax. Rep. Joe Fitzgibbon told The Seattle Times editorial board that because “the electrification of our ferries is a priority,” and if the CCA funding went away, legislators would take money from roads and bridges to fund the extremely expensive electric ferries. Fitzgibbon and other legislators could simply choose to build less-expensive clean-diesel ferries rather than raiding funding for roads, or fund ferry projects from other revenue sources.

When talking with The Seattle Times editors, Fitzgibbon cited another reason road funding might be cut. “We’re already having to look to scale down the 520-bridge replacement because it came in so much over budget,” he said. Again, the bridge replacement isn’t funded by the CCA, so repealing the CO2 tax would have no impact on that project. Fitzgibbon is using cost overruns and poor management by the Washington State Department of Transportation to argue for a CO2 tax that doesn’t even address that problem.

Also read:

- Letter: ‘There will be consequences’Hazel Dell resident Bob Zak criticizes Democratic lawmakers for advancing ESSB 5181, arguing it undermines parental rights and defies biblical principles.

- Op-Ed: La Center Schools — Committed to families and their childrenIn a public letter, the La Center School Board and Superintendent Peter Rosenkranz affirm their commitment to supporting families and honoring both state law and community values amid state-level scrutiny.

- Letter: Mayor blames others on homelessness problem in Vancouver while she has enabled a lawless encampment zoneVancouver resident Peter Bracchi urges city leaders to enforce laws and end permissive policies that have allowed unsafe encampments to overrun public spaces near the Share House.

- Letter: ‘Look it up for yourself’Camas resident Anna Miller encourages skeptics of Elon Musk’s claims about government waste to do their own research using official resources.

- Opinion: Defending the indefensibleNancy Churchill argues that Washington’s lawsuit against a sheriff cooperating with ICE reveals a deeper political agenda that puts public safety at risk.

Todd Myers is the vice president for research at the Washington Policy Center.

Climate change is a scam used by politicians to garner funding and power.

A new study mathematically proves CO2 and fossil fuels have nothing to do with an uptick in global temperatures.

The study is found at this link: https://www.zerohedge.com/weather/sunlight-and-clouds-not-co2-drive-earths-climate-shocking-new-study-finds

Further, read for yourself HB 1170, passed by the Legislature in Olympia in 2023, which outlines the State government preparing for a response to an “imagined” climate disaster.

If you thought the Covid 19 lockdowns and the Governor’s unlimited emergency powers were way over the top…HB1170, in my opinion, follows that blueprint, giving the Department of Ecology and other state entities enormous potential to affect, no run, the lives of Washingtonians.

There are very few specifics in it except for the sweeping scope of what it can do when someone? decides we are in a climate emergency and who would that be? Politicians?

There are no independent third parties that can be trusted…there is always a way to fudge the statistics, especially when it comes to funding. Money always seems to have a way of corrupting honesty.

Government, Federal or State, no longer operates for the benefit of the citizens, they are monsters feeding at the trough of taxpayers pockets.

Governments are like addicts…there is never enough money for the continual expansion of their pet projects, say for instance the “open border” and the millions here illegally who are receiving untold benefits while Americans go without…that’s just one example.

We are the frogs in the pot of water. State Government has been turning up the flame ever so slowly and surreptitiously. It’s time to wake up and take back our representation in Olympia!