Todd Myers of the Washington Policy Center says that using forest fires to justify the CO2 tax is a smokescreen

Todd Myers

Washington Policy Center

In his editorial on Washington’s CO2 tax, Dr. Vin Gupta claims he likes “to go to the data to find the truth.” But he starts by saying something false.

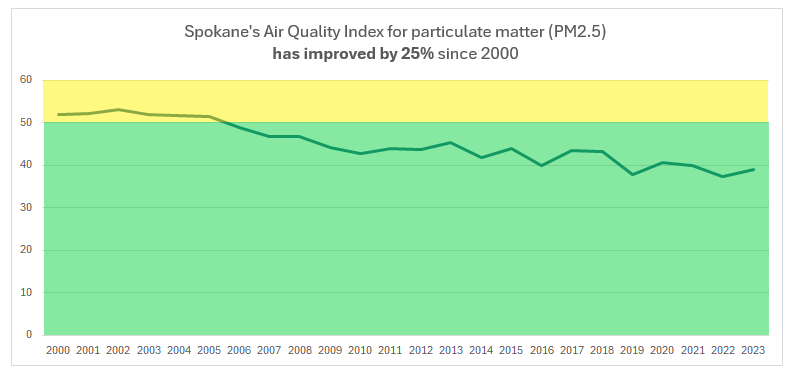

He claims Spokane has “declining air quality.” This is false. EPA data for Spokane County show that since 2000, average levels of particulate matter have fallen by more than 20% – from “moderate” to consistently “good.”

He clearly didn’t look at the data.

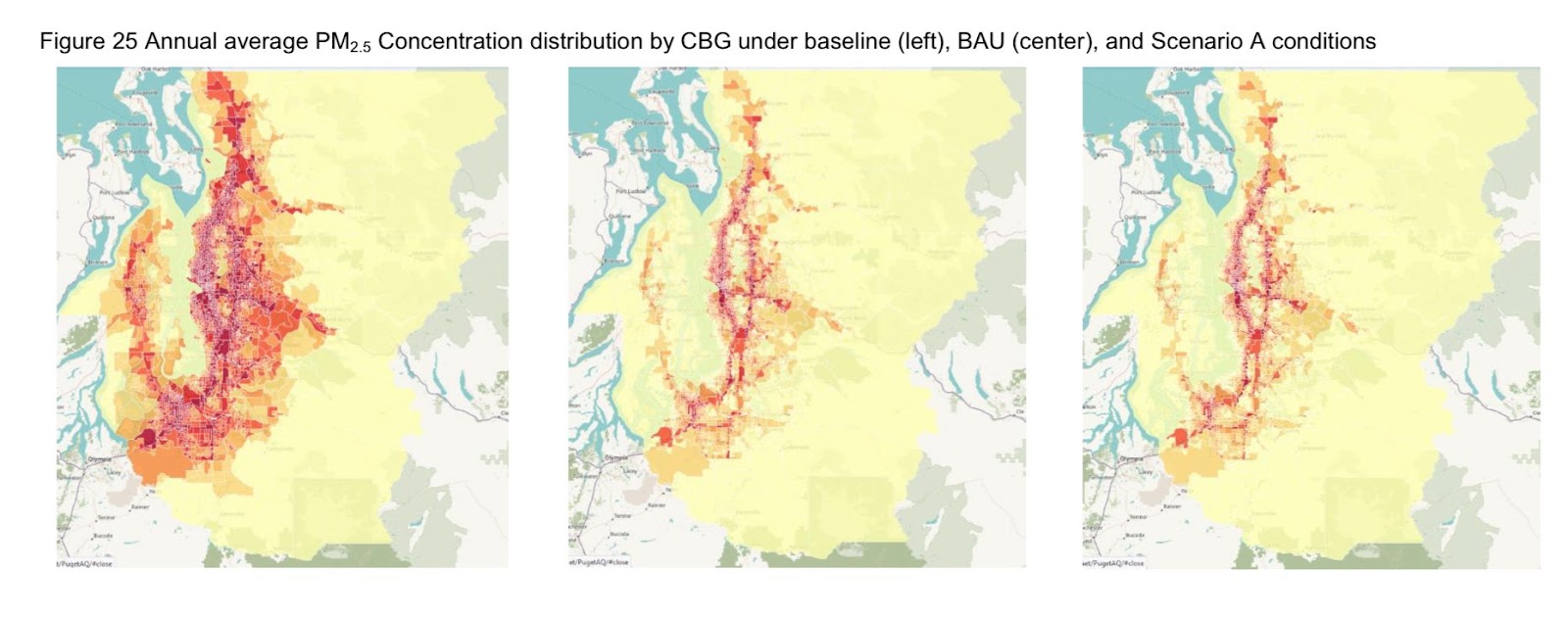

In fact, air quality will continue to improve without the CO2 tax. In 2019, the Puget Sound Clean Air Agency released a report on a proposal for a low-carbon fuel standard showing the impact of the policy on air quality. The study found that between 2019 and 2030 there would be a significant reduction in particulate matter (PM2.5) under the business as usual (BAU) scenario. This was two years before the Climate Commitment Act had been proposed.

Air quality will be better in 2030 with or without the CO2 tax.

Additionally, he says the CO2 tax would reduce the risk of smoke from catastrophic wildfire. Of the $3.2 billion from the CO2 tax, only $12 million – just 0.4% of the tax revenue – is budgeted to go to forest health. By way of comparison, more is spent on funding for government planning than forest health.

If preventing catastrophic wildfire was truly important, the legislature would have used more of the nearly $20 billion in new tax revenue the state received in the past four years.

Instead, the largest threat to projects that reduce the risk of wildfire are the very environmental groups supporting the CO2 tax. When the Colville Confederated Tribes worked with the Forest Service to thin unhealthy forests on their border, Spokane-based environmental groups immediately sued – preventing efforts to improve forest health and prevent catastrophic wildfires.

Using forest fires to justify the CO2 tax is a smokescreen.

Todd Myers is the vice president for research at the Washington Policy Center.

Also read:

- Opinion: In-n-Out Burger is so much more than fast food for so many of usPaul Valencia shares why In-n-Out Burger means more than just fast food for countless fans as Ridgefield nears its grand opening and Vancouver’s location begins construction.

- Opinion: Washington’s June 2025 budget revisions – revenue up spending up moreMark Harmsworth of the Washington Policy Center critiques the state’s latest budget revisions, warning that new taxes—not organic growth—are driving revenue. He calls for fiscal restraint and long-term reform.

- Opinion: Pedestrian control signalsDoug Dahl explains Washington state law regarding crosswalks and pedestrian signals, offering safety insights and common misunderstandings about traffic control at intersection

- Letter: ‘How can five part-time legislators without research support or reliable access to information serve as an effective check on six full-time elected executives’Bob Zak expresses agreement with recent opinions on the Clark County Charter’s imbalance and endorses John Ley’s transit preference while questioning light rail costs and Council effectiveness.

- POLL: Should the Clark County Clerk remain an elected position?Following public opposition, Clark County Council dropped a proposal to make the clerk an appointed role. Readers can now weigh in through this week’s poll on whether the clerk should remain elected.