In her weekly column, Nancy Churchill takes a deeper look at Washington’s ever-increasing gas prices

Nancy Churchill

Dangerous Rhetoric

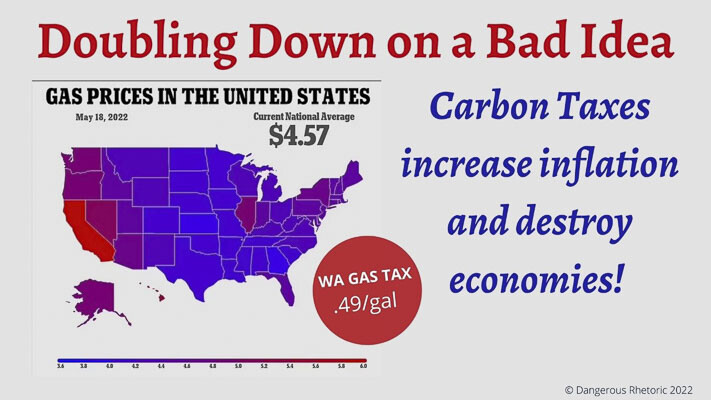

It’s getting more and more difficult to pay for a tank of gas! The UK Daily Mail reported some Washington state gas stations are reprogramming their equipment to allow for $10/gallon gas. They also reported that Washington’s average gas price is around $5.03/gallon. Washington’s gasoline prices are some of the highest in the nation, behind California, Hawaii, and Nevada.

Sen. John Braun, Washington state’s senate minority leader, is calling for a special session of the legislature to suspend the state’s current $49.4 cent/gallon gasoline tax. Braun points out that because of record revenue collections this tax could be waived for the rest of the year without jeopardizing state programs or services. Braun said, “How much higher does it have to go before our Democratic colleagues decide their constituents should get some relief?”

Braun pointed out that the federal government has been ineffective at reducing energy costs. Like the state Democratic party, the federal democratic policy makers are pursuing policies that increase inflation by increasing the costs of producing goods and services in a way that is regressive, destroys the economy and will have almost no positive environmental impact.

What is a Carbon Tax?

A carbon tax is a tax on the hydrocarbons needed to produce a good or service. Investopedia tells us “Hydrocarbons are naturally-occurring compounds and form the basis of crude oil, natural gas, coal, propane, and other important energy sources. Hydrocarbons are highly combustible and produce carbon dioxide, water, and heat when they are burned. Therefore, hydrocarbons are highly effective as a source of fuel.”

Here in Washington State, our Democrat-controlled legislature has implemented several carbon tax policies like cap-and-trade and low carbon fuel standards. These are carbon taxes. At the national level, some federal legislators, both Democrats and Republicans, have begun promoting a similar idea: a “carbon border tariff”. Same pig, different lipstick. Carbon taxes and carbon border tariffs are the same thing.

Everything requires energy to make!

Every product or service has an energy component. According to the Manhattan Institute’s Mark P. Mills on The Last Optimist podcast, energy typically accounts for about 10 percent of the costs to provide a product or service. If the cost of energy doubles, the product cost increases by about 10 percent … driving inflation higher!

Since every product or service has an energy component, carbon taxes are inflationary. A carbon tax is essentially an indirect tax on EVERY product or service produced in the economy.

This is a big problem, because this type of tax is regressive: it hits fixed-income, low-income and working-class people the hardest, taking a bigger percentage of their income. This is what we are experiencing at the pump as we start to make choices between buying gasoline to get to work and buying food to put on the table.

Has there ever been a worse time to implement a policy that automatically increases the price of EVERYTHING?

The Perfect Storm of Energy Inflation

Internationally, we have government policies in Europe and the USA that are hostile to energy production of hydrocarbons. From oilfields, to pipelines, to refineries, to transportation — politicians are deliberately implementing policies that increase the cost of hydrocarbons and limit the supply.

In addition, we have the disastrous government-mandated lockdowns for disease control that have disrupted or destroyed energy supply chains. It’s not possible to just “flip a switch” and increase energy supply; it will take time to restore these supply chains. There is also the Ukraine-Russia conflict, which intensifies the interruption to energy supply chains, thereby increasing inflationary pressure.

Politicians are now adding two more policies that are inflationary. They are increasing taxes on the primary sources of energy that keeps the world operating (hydrocarbons) via carbon taxes of all kinds. Additionally, national and international politicians are imposing sanctions on Russian energy.

Alternative Energy Technology is not ready for prime-time

No matter what you think about the use of hydrocarbons, alternate energy sources like windmills, solar, and batteries are technologies that are not yet ready to replace the consumption of hydrocarbons anytime soon. Hydrocarbons are used because they are both inexpensive and reliable.

Alternate energy technology is more expensive to produce (also inflationary) and uses lots of minerals. It will require a 1000 percent increase of mining production to produce the same unit of energy produced by hydrocarbons. This increase in mining would be bad for the environment, and cause higher mineral prices — more inflation!

Politicians are trying to force an energy technology shift via punitive taxation and rebate schemes. They’re willing to cause a lot of economic pain and destruction in their quixotic quest for energy nirvana.

Unfortunately, bad policy leads to bad outcomes. History shows us governments which deliberately increase the costs of core goods and services tend to create war, famine, and economic destruction. Washington state lawmakers should agree to Senator Braun’s request for a special session to lower energy costs … before our economy collapses under the weight of a powerful inflationary death spiral.

If Washington state Democrats fail to take action, please support your favorite Republican legislative campaign. Until Republicans are the majority party in Olympia, we the people will remain under the boot heel of those intent on our economic destruction.

Nancy Churchill is the state committeewoman for the Ferry County Republican Party. She may be reached at DangerousRhetoric@pm.me. The opinions expressed in Dangerous Rhetoric are her own.

I appreciate Sen. Braun’s position on this, much like I appreciated his pledge to only run for two terms (he’s on his 3rd) but is this where I point out that the huge gas taxes we’re paying now originated in the Republican caucus of the State Senate when they were under GOP control?

Yes, the massive (almost 13 cents a gallon) gas tax and the tab fee increases we have to put up with now originated in the GOP caucus of the Washington State Senate.

He needs to be careful when he complains about how high that tax happens to be.

Just sayin’.

Gov. Jay Inslee will ban the use of natural gas in Washington state

“After passing a new low-carbon fuel standard last year and a cap-and-trade system through the new Climate Commitment Act, Gov. Jay Inslee is now focused on the next step of his climate policies: Eliminating the state’s natural gas industry.” See link for full article