Jason Mercier of the Washington Policy Center offers a decade of research and short educational videos discussing this income tax

Jason Mercier

Washington Policy Center

The State Supreme Court will hear oral arguments on the capital gains income tax lawsuit at 9 a.m. on January 26. TVW will broadcast the hearing. Here is a decade of research and short educational videos discussing this income tax:

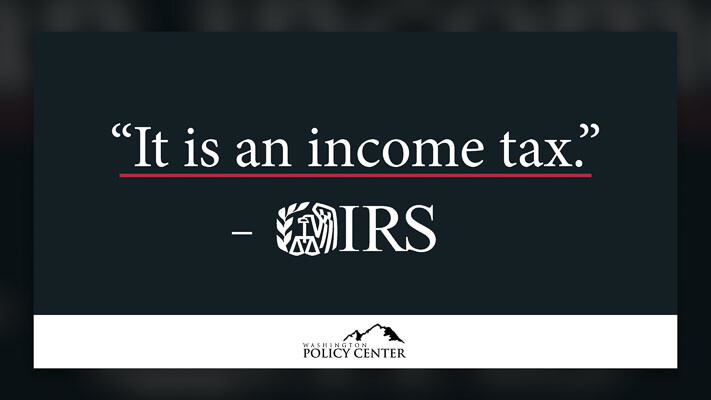

- IRS: Capital gains tax “is an income tax”

- Summary of capital gains income tax amicus briefs

- Washington’s constitution has broadest definition of property in the country

- Lawmaker’s emails confirm goal for capital gains proposal is broad income tax

- Public records reveal WA DOR’s thoughts on capital gains income taxes

- State Revenue Departments Describe Capital Gains Income Taxes

- Capital gains income tax quotes – who said it?

- State tax officials across country agree – capital gains income taxes are extremely volatile and unpredictable

- WA Department of Commerce: No state income tax “is great marketing” for Washington

- Attorney General goes on capital gains income tax rabbit hunt

- Capital gains income tax webinar with Rob McKenna

- Former IRS attorney “dumbfounded” by Washington’s capital gains income tax arguments

- UW Tax Law Professor on new capital gains income tax: “It’s going to be found unconstitutional”

- WPC played important role in capital gains income tax being ruled unconstitutional

Jason Mercier is the director of the Center for Government Reform at the Washington Policy Center.

Also read:

- Opinion: Taxes and assessed valuesDick Rylander explains how property tax proposals are calculated and urges Clark County residents to understand assessed values before voting on new taxes.

- Opinion: Why has Vancouver hired a shelter provider with a record of failure?Amy Harris questions Vancouver’s decision to hire Do Good Multnomah, citing documented failures and urging city officials to explain their choice.

- Opinion: Predators, politics, and public recordsNancy Churchill criticizes four Fish and Wildlife commissioners for secrecy and anti-hunting bias, calling for their removal and reform of the appointment process.

- Opinion: TriMet Better Red cost allocation revealedJohn Ley examines TriMet’s $204 million Better Red project, showing most of the spending wasn’t on vehicles or tracks—raising questions about cost transparency and regional funding.

- Letter: ‘This administration’s trade stance is bold, but it’s producing results’Camas resident Anna Miller argues that recent federal revenue gains show President Trump’s tariff policies are reshaping the nation’s fiscal outlook.

The Court will rule in favor of the AG. Not because the AG is correct. But because trivial matters such as constitutions and settled law should not stand in the way of ‘progress’. This is, after all, 2023. Progress is the new King. The King is throwing out any and all references to past standards.

Thank you, Jason Mercier and Clark County Today for this excellent research and information.

Clearly, the “law” and past court rulings indicate this is an income tax, which must be “equal” for all citizens to pay. Because it targets only certain citizens incomes, it goes against established law.

We, the people, shouldn’t have to “hope” the state Supreme Court does the right thing, once again, and rules this unconstitutional. Nonetheless, I join my fellow Washington citizens in hoping and praying the court does the right thing.