Todd Myers of the Washington Policy Center believes that if legislators think the tax on CO2 emissions is raising prices too rapidly, there are several things they can do to fix that

Todd Myers

Washington Policy Center

As intended, Washington state’s new tax on CO2 emissions is increasing the price of gasoline, diesel, and other fossil fuels. However, some of the legislators who supported that increase have proposed a bill that would prevent fuel suppliers from making the cost of that tax clear to consumers.

The state’s first auction of CO2 allowances occurred at the end of February, with the average price reaching $48.50 per metric ton (MT). We noted that at that price it would add about 39 cents to a gallon of gasoline and 47 cents per gallon for diesel.

Many fuel suppliers had been charging less than that for the first two months of the year because the actual price of the CO2 allowances wasn’t known. As a result, they appear to be increasing prices above the allowance price to recover the costs from undercharging during the first two months.

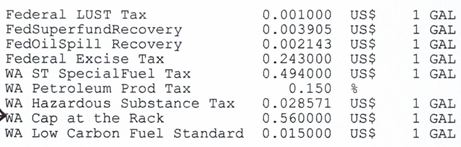

For example, invoices from BP show a line item for the state’s cap-and-trade CO2 tax – listed as “WA Cap at the Rack” – for diesel without the 5% biodiesel blend, of 56 cents per gallon, which translates to about $55 per MT of CO2. They also added 1.5 cents per gallon for the state’s new Low Carbon Fuel Standard.

BP is not alone in adding the cost of the CO2 tax. Other fuel suppliers, including those who sell propane, are increasing their costs in response to the tax. BP’s increase is notable, however, because the company lobbied for the CO2 tax.

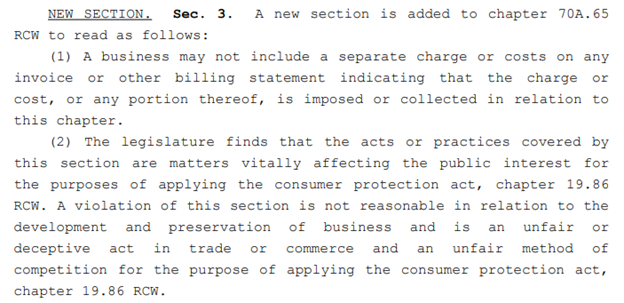

The high prices are already causing alarm among some legislators who supported the CO2 tax. As a result, two senators have introduced Senate Bill 5766 to address some flaws with the implementation of the CO2 tax. Section 3 of that bill looks to prohibit fuel suppliers from listing the cost of the CO2 tax on invoices like the one I provided above. There are several problems with this.

First, this is undemocratic. There is no compelling reason why consumers should not know the cost of the taxes imposed by the state. As you can see from the portion of the invoice I included, there are many taxes which are itemized. Singling out the tax on CO2 emissions makes no sense and is clearly about politicians wanting to hide the cost of their own policies.

Second, the purpose of imposing a tax on CO2 is to raise the cost of fossil fuels. Those who want to reduce emissions should want those costs to be transparent to encourage people to conserve. Hiding the costs undermines the purpose of the tax.

Finally, the section says this is about consumer protection and implies listing the tax is “deceptive.” The governor and staff from the Department of Ecology have made similar claims. The irony is that hiding the cost is the truly deceptive practice. California and Oregon are both very open about the fact that taxes on CO2 emissions increase prices. They specifically estimate those costs, using the same method I do. Washington legislators would pretend these costs don’t exist and propose using the force of law to hide the impact.

If legislators think the tax on CO2 emissions is raising prices too rapidly, there are several things they can do to fix that. They could lower the price cap to prevent high prices. Senator Mullet, one of the sponsors of the bill to prevent listing the CO2 tax, also offered a bill to do just that, limiting the price to 20 percent above California’s CO2 price. Washington’s CO2 price is currently about 75 percent higher than California’s.

The legislature could allow fuel suppliers and other covered entities more leeway in investing in projects that reduce CO2 emissions (commonly known as “offsets”). They could change the cap level to allow more time for the economy to decarbonize.

Any of these options would prevent prices from jumping as rapidly as they have and increasing costs to Washington’s economy. Any of those options would be better than trying to hide the cost of the state’s CO2 policy.

Todd Myers is the director of the Center for the Environment at the Washington Policy Center.

Also read:

- Opinion: In-n-Out Burger is so much more than fast food for so many of usPaul Valencia shares why In-n-Out Burger means more than just fast food for countless fans as Ridgefield nears its grand opening and Vancouver’s location begins construction.

- Opinion: Washington’s June 2025 budget revisions – revenue up spending up moreMark Harmsworth of the Washington Policy Center critiques the state’s latest budget revisions, warning that new taxes—not organic growth—are driving revenue. He calls for fiscal restraint and long-term reform.

- Opinion: Pedestrian control signalsDoug Dahl explains Washington state law regarding crosswalks and pedestrian signals, offering safety insights and common misunderstandings about traffic control at intersection

- Letter: ‘How can five part-time legislators without research support or reliable access to information serve as an effective check on six full-time elected executives’Bob Zak expresses agreement with recent opinions on the Clark County Charter’s imbalance and endorses John Ley’s transit preference while questioning light rail costs and Council effectiveness.

- POLL: Should the Clark County Clerk remain an elected position?Following public opposition, Clark County Council dropped a proposal to make the clerk an appointed role. Readers can now weigh in through this week’s poll on whether the clerk should remain elected.

As soon as I hear “CO2” it becomes very apparent that there is a whole bunch of lying going on.