Taking effect for the first time this year, Washington is now the only state in the country to impose a standalone income tax on capital gains

Jason Mercier

Mountain States Policy Center

With property tax assessments increasing rapidly in Wyoming, some have begun to discuss whether there should be changes to the Cowboy State’s tax structure. It is important to first remember that assessed property values do not necessarily drive the actual property tax bill. Instead, that tax obligation is primarily set through the budget process by the amount to be spent (whether approved by government officials or voters through levies).

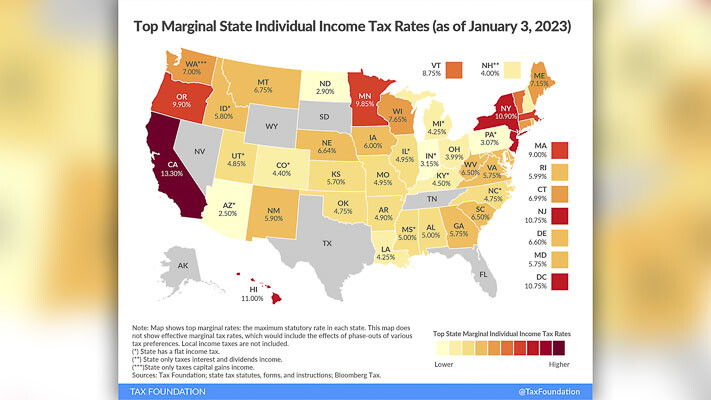

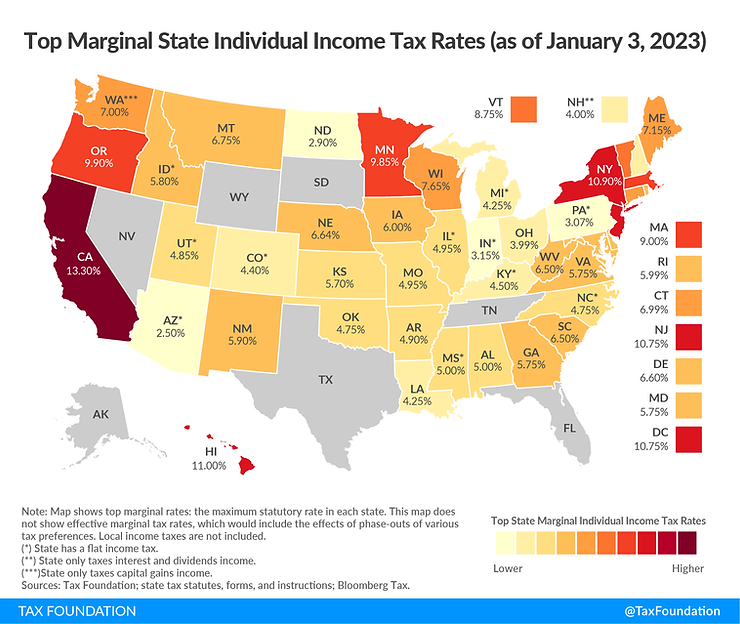

Concerning Wyoming’s current tax structure, as one of just a handful of states without a personal income tax, extreme caution should be taken to avoid losing this economic competitive advantage. This is especially true with any discussion of imposing a highly volatile and unpredictable income tax on capital gains.

Taking effect for the first time this year, Washington is now the only state in the country to impose a standalone income tax on capital gains (other income tax states tax it as ordinary income as part of their income tax codes). The policy choice has resulted in national tax rankings removing Washington’s prior standing of not having a personal income tax.

The federal Internal Revenue Service (IRS) has made it very clear that a capital gains tax is an income tax. Our friends at the Washington Policy Center posted this letter from the IRS clearly explaining this fact.

IRS: “This is in response to your inquiry regarding the tax treatment of capital gains. You ask whether tax on capital gains is considered an excise tax or an income tax? It is an income tax. More specifically, capital gains are treated as income under the tax code and taxed as such.”

Imposing taxes on capital gains income is not a recipe for predictable state revenue.

As explained by the California Legislative Analyst’s Office (LAO):

“California’s tax revenues have numerous volatile elements, but among the more significant sources of revenue volatility are the state’s tax levies on net capital gains through the personal income tax.”

“Capital gains depend heavily on movements in financial markets. As such, capital gains revenue is extremely volatile and difficult to predict. In any given year, there is significant risk that capital gains revenue could fall below budgetary expectations.”

If the goal of structural state tax reform is to improve budget stability and avoid boom-and-bust tax collections, an income tax on capital gains is the worst possible choice Wyoming policymakers can make.

Jason Mercier is the vice president and director of research at the Mountain States Policy Center.

Also read:

- POLL: Why did voters reject all three tax proposals in the April 22 special election?Clark County voters rejected all three tax measures on the April 22 special election ballot, prompting questions about trust, affordability, and communication.

- Opinion: The war on parental rightsNancy Churchill argues that Olympia lawmakers are undermining voter-approved parental rights by rewriting key legislation and silencing dissent.

- Opinion: An Earth Day Lesson – Last year’s biggest environmental victories came from free marketsTodd Myers argues that Earth Day should highlight free-market solutions and grassroots innovation as more effective tools for environmental stewardship than top-down mandates.

- Opinion: Time to limit emergency clauses and give voters a choiceTodd Myers urges the governor to remove emergency clauses from bills that appear intended to block voter input rather than address real emergencies.

- Letter: C-TRAN Board improper meeting conductCamas resident Rick Vermeers criticizes the C-TRAN Board for misusing parliamentary procedure during a controversial vote on light rail.