Jason Mercier discusses the concept of providing an itemized receipt for taxpayers about their tax dollars and it relates to government

Jason Mercier

Mountain States Policy Center

We’re all familiar with the shopping experience of seeing the total amount we owe ring up on the register and then being provided with an itemized receipt showing what we purchased. This simple sheet of paper helps us remember and understand where our shopping dollars went. Now imagine if you were provided with a taxpayer receipt providing the same information for your tax dollars and how it relates to government spending.

Utah is doing just this. Adopted by lawmakers in 2013, HB 129 required the Office of Legislative Fiscal Office:

“To develop a taxpayer receipt:

(i) available to taxpayers through a website; and

(ii) that allows a taxpayer to view on the website an estimate of how the taxpayer’s tax dollars are expended for government purposes; and to publish or provide other information on taxation and government expenditures that may be accessed by the public.”

Utah’s taxpayer receipt (available here) allows users to see what their tax dollars buy by an individual providing information on household size, income, amount of home value or rent, and type of cars and miles driven. The taxpayer receipt site notes:

“Your data is not stored or sent to any government entity. Results are illustrative of a typical full-year Utah resident with similar circumstance. Only State of Utah imposed taxes. Does not include local sales or property taxes or federal fuel or income taxes. Does not include fines, fees, or other taxes and charges paid to state government.”

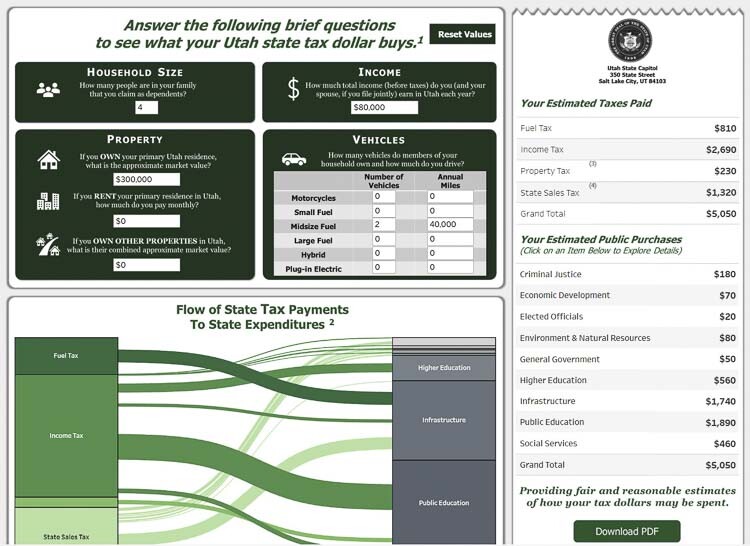

Here is an example of what the Utah taxpayer receipt looks like by using these data points: A family of four, with $80,000 in income, a home valued at $300,000, and two mid size cars driven for a combined 40,000 miles a year.

According to the Utah taxpayer receipt, our sample family would owe $810 in fuel taxes, pay $2,690 in income taxes, $230 in state property taxes, and $1,320 in sales taxes for a total state tax liability of $5,050.

The estimated use for these tax dollars would be for the following: $180 for criminal justice, $70 for economic development, $20 for elected officials, $80 for environmental and natural resources, $50 for general government, $560 for higher education, $1,740 for infrastructure, $1,890 for public education, and $480 for social services ($5,050 in state spending).

Users of the Utah taxpayer receipt site are also able to drill down further on the data for additional information.

Idaho State Controller Brandon Woolf is looking to add a similar feature in the future to the current Transparent Idaho budget transparency portal. Controller Woolf told me:

“The taxpayer receipt initiatives in Utah stand as a commendable tool, allowing citizens direct interaction with their government. Aligned with our unwavering commitment to transparency, Idaho is actively enhancing our Transparent Idaho website and looking to introduce a comparable tool in the future. Presently, the site empowers citizens with a firsthand look into the intricate journey of their tax dollars across state and local government. It’s about giving our citizens the robust knowledge of how their tax dollars dynamically shape the very fabric of the communities we all call home.”

By combining a taxpayer receipt with a tax transparency website and state budget transparency resources, policymakers can help put taxpayers in the driver’s seat to understand where their tax dollars are going and how much they are paying for those government services.

Additional Information

Do you know who you are paying taxes to? A tax transparency website would help

Jason Mercier is the vice president and director of research at the Mountain States Policy Center.

Also read:

- Opinion: In-n-Out Burger is so much more than fast food for so many of usPaul Valencia shares why In-n-Out Burger means more than just fast food for countless fans as Ridgefield nears its grand opening and Vancouver’s location begins construction.

- Opinion: Washington’s June 2025 budget revisions – revenue up spending up moreMark Harmsworth of the Washington Policy Center critiques the state’s latest budget revisions, warning that new taxes—not organic growth—are driving revenue. He calls for fiscal restraint and long-term reform.

- Opinion: Pedestrian control signalsDoug Dahl explains Washington state law regarding crosswalks and pedestrian signals, offering safety insights and common misunderstandings about traffic control at intersection

- Letter: ‘How can five part-time legislators without research support or reliable access to information serve as an effective check on six full-time elected executives’Bob Zak expresses agreement with recent opinions on the Clark County Charter’s imbalance and endorses John Ley’s transit preference while questioning light rail costs and Council effectiveness.

- POLL: Should the Clark County Clerk remain an elected position?Following public opposition, Clark County Council dropped a proposal to make the clerk an appointed role. Readers can now weigh in through this week’s poll on whether the clerk should remain elected.