The district’s Board of Directors is asking voters to consider the same requests that were rejected in the Feb. 14 special election

Dick Rylander

SWWEducation.org

In February, the Washougal School Board asked voters to approve two levies. We ran an article sharing both the Pros and Cons. You can read it by clicking this link: Washougal School District Feb 2023 Levy’s (swweducation.org) Both levy’s failed … but it was close. Now, the district is once again putting the levy requests before voters in the April 25 special election.

The law allows a school board to go to the voters up to two times in a calendar year. Most boards go to the voters in February in a special election for two reasons. First, if the levy fails they can go back a second time. (The windows are February, April, August and November). Almost all districts use April as the second date so they know what their Fall budget/funding will look like. Second, people haven’t received their new property taxes statements so they are more likely to approve a new tax increase.

What’s different about the April levy requests vs. the February levies? Nothing. No reduction.

Let’s start this analysis by sharing the link to the Clark County elections department webpage that has links to the measures passed by the school board: April 25, 2023 Special Election | Clark County (wa.gov) There you can read the exact language of what was submitted.

Ballots will be mailed on April 7 and are due no later than 8 p.m., April 25.

Here’s the link to the sample ballot: APR 2023 SAMPLE BALLOT.pdf (wa.gov)

Let’s start out by sharing the Pro (yes) statements and rebuttals:

Washougal School District – Prop 12 Statement in Favor – Rebuttal

Washougal School District – Prop 13 – Statement in Favor – Rebuttal

Now, let’s share the Con (No) statements:

Washougal School District April 2023 Proposition 12 EP&O No Position

Washougal April 2023 Proposition 13 Levy – No Position

Analysis/Comments:

What will the Yes team focus on?

1. Teachers will be laid off. Sports will be cut. Roofs and buildings will fall apart. Technology will fail. Class sizes will increase with 40 teachers heads on the chopping block! Arts programs will fade away.

Side note: It appears that the district has lost about 6% of their student population in the past 3 years. This works out to about 170 students. Each student generates about $12,000 in revenue from the State. That works out to about $2 million/year as a shortfall. This is actually lower than surrounding districts (Evergreen has lost over 12% of students). This will lead to a reduction in workforce because there are fewer students. They don’t tell you that.

2. They will claim this is not a new levy but rather an extension of the expiring levy. However, both levy’s ask for more money. Logically, how can a levy for a new period of time for more money not be new? This is an intentional misdirection that is an attempt to get you to believe nothing has changed…which is simply not true. THEY WANT A LOT MORE MONEY.

3. They want you to focus on the “rate”. Note that they project a “rate” of $1.99 per $1000 of assessed property value. They will claim that’s a low rate and your taxes will not go up. In reality that “rate” is meaningless. Worse, it’s an intentional redirect and misdirection. Why, you ask? Because:

- They are asking for a fixed amount of money for a fixed period of time so the “rate” has no impact or value.

- The amount of money is divided by the total assessed value of all properties in the school district. The result? If property values go up the amount of money collected stays the same but the “rate” drops. On the other hand, if property values were to decline the amount of money collected stays the same but the “rate” goes UP! So, in the end they want you to focus on the “rate” instead of the fact that the actual amount of money being collected (in both levy’s) is UP. That’s what you need to focus on…how much higher are the new levy’s than the old and are you ok with that increase?

4. Here’s the exact statement from their Website: Proposed Levies on April 25 Ballot Would Fund Essential Student-Centered Programs – WSD (washougal.k12.wa.us)

- Washougal School District is proposing two levies on the April 25 ballot. These are NOT new taxes. Proposed EP&O and Capital Levy rates are LOWER than what Washougal approved in 2020 ($2.14 and $0.22.) Rates are per $1,000 of assessed property value.

- As you can see they are claiming that the new HIGHER levy amounts, based on the “rate” of $1.99 is LOWER than the 2020 rate of $2.14. Isn’t that incredible? More money but a lower rate…how can that be? Answer: The assessed value of properties in the school district increased at a faster rate than the increase in the levy amounts. So what? This is the misdirection and sleight of hand. Taxes are going up. Please take the time to understand this truth. When they ask more you pay more.

How is the school district doing for test scores and other “report card” factors? Check this link: https://washingtonstatereportcard.ospi.k12.wa.us/ReportCard/ViewSchoolOrDistrict/100286 What will you see in the link?

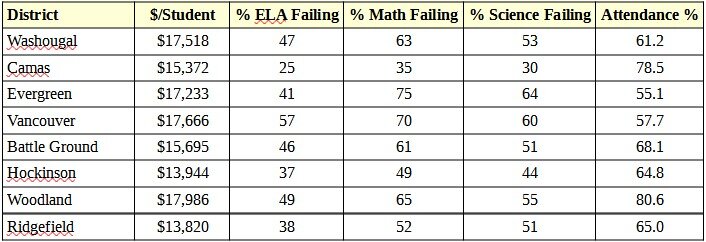

How does Washougal compare to some other school districts in Clark County?

- As you can see Washougal already has the third highest spend per student (even more than Evergreen which is the largest district and has announced cuts of 140 personnel due to loss of students).

- Attendance is the third worst

- Test scores put them in the middle of the pack

- Next door Camas (to give credit where it’s due) spends over $2,000 LESS per year/student with the test scores much better

- Comparing Washougal with Hockinson, Woodland, Camas and Ridgefield we see that in nearly every area of comparison Washougal is spending $2,000 to $4,000 more per student vs. comparable size districts in southwest Washington with, in a number of test scores, doing worse. WITHOUT this increase.

If you are a “data” person stop by the website in this link and get ammunition: Washougal School District | The School Data Project.

You can also look at the “cost impact analysis” of the levies in this link: School District Measures April 25th 2023 | The School Data Project.

So … what says that giving more money makes sense? Perhaps the REAL need is to focus on academics? Washougal needs to go under a magnifying glass and find ways to spend less and improve results.

If taxpayers continue to give more money without changes it sends the wrong message. Perhaps vote NO because you really love children enough to show tough love?

Finally, on the home budget, mortgage/rent, front how much did your property tax bills go up? Have you looked at it? Ours went up $1100! Almost $100 more per month on a fixed income. What will we cut spending on to pay higher taxes? How’s your income doing?

Whatever you do, vote. Get as much information as possible. Ask questions. Don’t accept anything at face value. Challenge every fact and statement and claim. It’s your money and your choice.

Also read:

- Letter: ‘There will be consequences’Hazel Dell resident Bob Zak criticizes Democratic lawmakers for advancing ESSB 5181, arguing it undermines parental rights and defies biblical principles.

- Op-Ed: La Center Schools — Committed to families and their childrenIn a public letter, the La Center School Board and Superintendent Peter Rosenkranz affirm their commitment to supporting families and honoring both state law and community values amid state-level scrutiny.

- Letter: Mayor blames others on homelessness problem in Vancouver while she has enabled a lawless encampment zoneVancouver resident Peter Bracchi urges city leaders to enforce laws and end permissive policies that have allowed unsafe encampments to overrun public spaces near the Share House.

- Letter: ‘Look it up for yourself’Camas resident Anna Miller encourages skeptics of Elon Musk’s claims about government waste to do their own research using official resources.

- Opinion: Defending the indefensibleNancy Churchill argues that Washington’s lawsuit against a sheriff cooperating with ICE reveals a deeper political agenda that puts public safety at risk.

Excellent, fact-based article! Just plug in “Vancouver School District” or “Evergreen School District” and the same is true for all of them.

School Districts are saying “more money, more money, more money… and don’t hold us accountable.”

Washougal voters beware… this has a direct impact on your property taxes! It IS a “new” tax in that you do NOT currently pay the amount you will be paying if the levy passes.

Our government never has enough money to spend…. We told them in February during that special election, no mo money, and they didn’t listen… Vote NO again….

Voting down a levy for teachers, para-educators and – yes – sports may make you feel better: “That’ll teach ’em” and – if you have no school age children – “save me some money,

But that’s your other orifice talking. Do you think your children will be better educated with fewer teachers? Your property value increase because your schools are regarded as “second rate.”

If you really want to improve your schools, get off your keister and get personally involved. Volunteer to help in the schools. Join your PTA. Attend a School Board meeting.

It’s easy to “vote no.” They even send you a stamped envelope to make it easier.

It’s harder to make a positive difference.

Make a difference. “Vote yes” and visit your local school to see how you can help..

Sorry, but you’re saying more money equals a quality education. This is not true. Schools only know one thing…. they say over and over again “more money, more money, or your kids will fail in life.” There is no correlation between “more and more money” and “good education.” There is no holding school districts accountable for the current low test scores seen across all our local districts.

As to volunteering… you’re joking, right? You want me to give “more and more money,” and then I need to volunteer at schools with the hope that my time and ideas will improve the educational process. Ummm… isn’t that proof that “more and more money” is NOT the answer? You’re saying volunteerism is the answer to making a difference, not money.

Vote NO on school levies.

Voting NO AGAIN. Perhaps the school district should eliminate some administrators and focus on the basics, which would be an improvement.

Yesterday spoke with an older former Washougal resident who moved because property taxes were too high.

Washougal schools are well funded, yet students are not learning the basics of reading, writing, and arithmetic well enough to succeed.

State report finds public schools have failed to teach 40% of K-4 elementary students adequately in readingReading opens the door to learning, yet too many students are not getting the quality instruction they need in public schools today.

Students in private schools do not get any benefit from school levy hikes such as the one proposed. Instead, under the current unfair system, families pay for private school tuition, on top of public school property taxes. School choice would help students gain access to quality education.

More states move forward in providing universal school choice for children

Meanwhile, schools are actively involved in the personal lives of students to the point of aiding a minor to gain access medications or surgeries without parents even knowing about it.

Teen Gets Abortion With Help of Her Seattle High School

And in this session, the democrat majority in the WA legislature passed another bill to secretly offer medications and surgeries to minors without informing parents.

Washington bill allowing government to ‘hide your kid from you’ clears House

This bill has now passed the House and the Senate, and awaits the governors expected signature to be signed into law.