Rylander offers a look at where the property tax paid by area residents really goes

Dick Rylander

So where does your property tax money really go? When I filed to run for the County Council District 5 position, I started to dig into the county budget and expenses.

As I’ve talked to people, I get the impression that many think the county is swimming in money and has a lot of fat. Some ask what can be done to reduce costs and taxes. Today, I would like to share what I’ve learned so far.

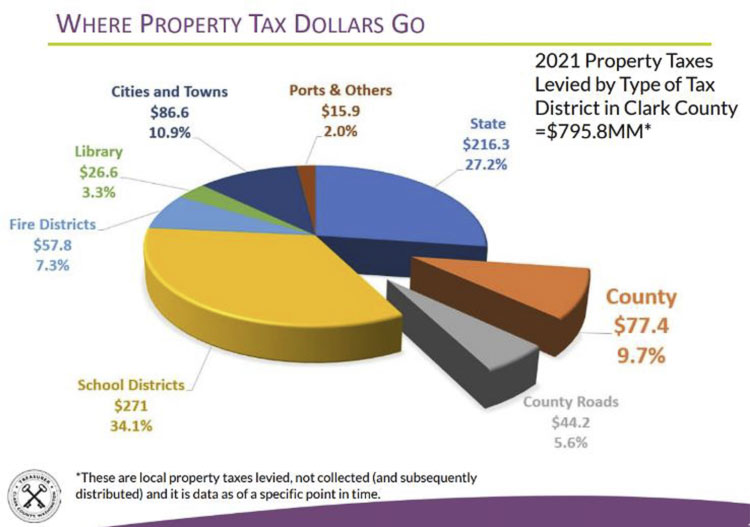

Let’s start by looking at a breakdown of the projected 2021 distribution of property tax dollars. This pie chart does a good job showing the flow of money. Let’s take a look and then analyze the data. (If you want to watch the 2021 presentation made to the County Council click this link: link). Specifically, the following pie chart is discussed starting at about minute 36:

The largest recipient of property taxes are schools at 34.1% = $271 million.

The second largest recipient is the State of Washington at 27.1% = $216 million.

Coming in at #3 are Cities/Towns at 10.9% = $86.6 million.

At #4 is Clark County getting 9.7% = $77.4 million.

#5 are the Fire Districts at 7.3% = $57.8 million.

County Roads comes in at #6 with 5.6% = $44.2 million.

The Library system gets 3.3% of your property taxes = $26.6 million.

Finally, at #8 and dead last is the Ports/Others with 2% = $15.9 million.

If the County and Roads are combined, we get to keep 15.3% of the property taxes = $121.6 million (out of a projected $795.8 million).

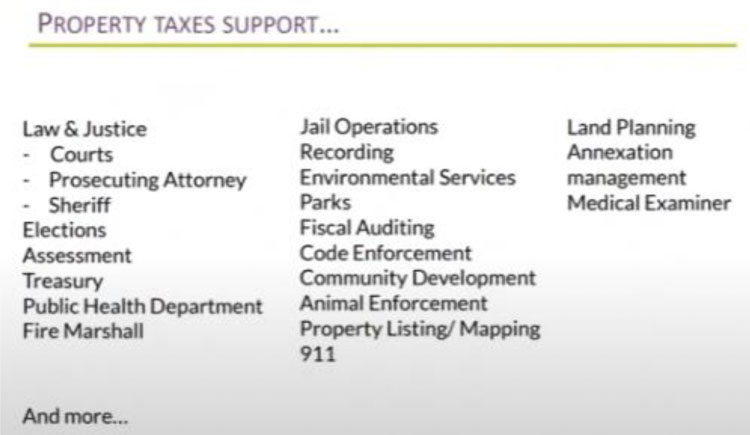

The County Council gets a small slice of the pie to run things. Wait … you ask what services the county is responsible for delivering? The following snapshot helps tell the story and can be found at minute 49:18.

Of the services listed above, Law and Justice (combined) consume just over 70% of the entire County budget.

Some questions to ponder:

• 1) If we need to trim expenses – where do we do it?

• 2) We are in a period of hyper-inflation. The last two years inflation appears to be about 15% combined. That means that $1 is now worth $0.85.

• 3) Is the question “what can we cut” or should the question be what services do we need to reduce without raising taxes (which people have no appetite for)?

The first thing we, as residents and tax payers in Clark County, WA, need to do is understand the numbers. Next we need to discuss the options. Given that the county gets 15.3% of the property tax that means that almost 85% of our property taxes go elsewhere. I suspect citizens’ frustration with ‘high taxes’ comes more from the 85 percent than it does coming from the 15 percent. Is it unreasonable to look at the budget and expenses outside the county government as closely as we look inside the county?

If budget cuts are needed where would you like cuts to come from? What programs do you want protected? Are there areas you would like to see more spending and if so which (and how much)? Your county councilors need to hear from you. They need to know what you want and what questions you have.

Dick Rylander is currently the Clark County Councilor for District 5. He was appointed to the council by Gov. Jay Inslee in April and sworn in May 3. He has filed as a candidate for the same position in the Aug. 2 primary election.

Also read:

- Opinion: In-n-Out Burger is so much more than fast food for so many of usPaul Valencia shares why In-n-Out Burger means more than just fast food for countless fans as Ridgefield nears its grand opening and Vancouver’s location begins construction.

- Opinion: Washington’s June 2025 budget revisions – revenue up spending up moreMark Harmsworth of the Washington Policy Center critiques the state’s latest budget revisions, warning that new taxes—not organic growth—are driving revenue. He calls for fiscal restraint and long-term reform.

- Opinion: Pedestrian control signalsDoug Dahl explains Washington state law regarding crosswalks and pedestrian signals, offering safety insights and common misunderstandings about traffic control at intersection

- Letter: ‘How can five part-time legislators without research support or reliable access to information serve as an effective check on six full-time elected executives’Bob Zak expresses agreement with recent opinions on the Clark County Charter’s imbalance and endorses John Ley’s transit preference while questioning light rail costs and Council effectiveness.

- POLL: Should the Clark County Clerk remain an elected position?Following public opposition, Clark County Council dropped a proposal to make the clerk an appointed role. Readers can now weigh in through this week’s poll on whether the clerk should remain elected.