The IRS is currently paying out $2 trillion in stimulus package funds to the American people due to COVID-19

CLARK COUNTY — The U.S. Congress recently passed emergency legislation and the IRS is paying out $2 trillion in aid money to the American people. Chances are, you will get some money. The question is, what to do with it?

With the novel coronavirus, COVID-19, causing mass closures of businesses and institutions across the country, not to mention stay-at-home orders, the American economy is struggling. This is just as true in Clark County, with many restaurants and small businesses closing and laying off workers.

The Coronavirus Aid, Relief and Economic Security (CARES) Act is a financial stimulus package designed to inject funds into the economy and sustain people through a time of scarcity.

This article will not be a total breakdown of the conditions and information within the CARES Act or who gets money, considering this topic has been discussed at length and reported by the national media. Instead, this is a breakdown with suggestions of what to do with the $1,200, or $2,400, or larger figure you receive.

We did, however, find this article by Square Inc.’s Cash App to have robust and tangible information on who gets what and how much through the payout.

“My advice to anyone that gets a large sum of money is don’t do anything,” said Jeff Solscheid, who has worked in the financial industry, both private and public, for nearly 40 years. “I don’t mean that indefinitely, but I say for at least 24 to 48 hours because typically what happens is that when people get that money, and they have it in hand, the emotional aspect of having that money kicks in. A lot of times when emotions are the impetus and the driving force, for making decisions, it’s not always the best.”

According to the Northwest Credit Union Association (NWCUA), some 50 million Americans will be receiving money through direct deposit, if they have an account on file with the IRS or Social Security Administration. Still more people will receive their packages in the next few months via mailed checks.

“In this time there’s a lot of uncertainty. People may be out of work and not sure when they are going to go back. Probably the best thing to do is just hold on to the money and save it for a true emergency,” said Greg Railsback, who operates Railsback Johnson, P.C. in Vancouver. “If you need it to help pay for groceries, rent, mortgage payment, you know those types of absolute necessities, [that’s better] than going out and spending time on Amazon, ordering a bunch of stuff.”

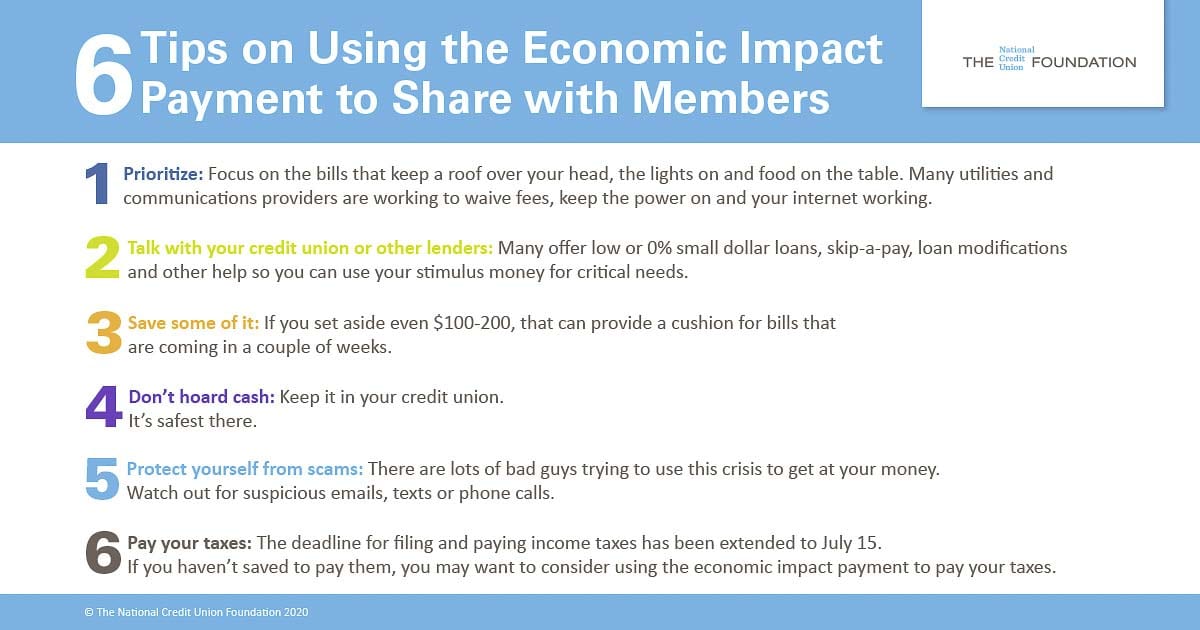

The NWCUA recommends several things when planning to use or receive your stimulus package money. The first is to prioritize. This relates to what Railsback explained, with regard to absolute necessities. Many utilities are also waiving certain fees to lessen the load, and reaching out to your providers can help garner a clearer picture.

The second recommendation is to communicate with your financial institution. Speaking with your bank or credit union is crucial, according to NWCUA, since this is the starting place when it comes to small-business or self-employed loans as well as payment deferral.

“It really depends on what category you’re in at this time when the stimulus money hits,” said Mark Carter, who has worked in Clark County as an attorney for 25 years with tenants and landlords as well as bankruptcy code. “Are you someone that is part of one third of our economy now, that suddenly lost their job? Or do you still have a job but your budget is tight? Or do you still have your job and your budget’s fine?”

“In that first category, largely the restaurant industry or something like that,” he said. “You’ve lost your job, then number one is do you have money to cover your basics for the next ‘x’ amount of days, weeks, months, until you can get some money coming in.”

The third piece of advice is to save. Depending on how much you or your household receives, it can be a good idea to put aside even a couple hundred dollars. This provides a cushion when expenses come later in the month, according to the NWCUA.

“Take a deep breath, even ask for advice from people that are accustomed and used to having money, because it will change,” Solscheid said. “I’m a big proponent of planning, whether that’s a budget or just saying, ‘Okay, I’ve got $2,400 coming into my personal bank account. How do I need to spend that? And how can I stretch this out as long as possible?’ The biggest question that is unanswered at this point is that we’re getting this money, but how long in the future is this going to take for things to reverse?”

Number four pertains to not hoarding cash. The association points out that funds that are lost or stolen from an individual or home cannot be replaced. On the other hand, funds stored in a credit union, for instance, are federally insured and guaranteed up to $250,000.

“I don’t think you’re going to see a banking crisis where you’re going to have uninsured amounts, that you actually need to keep a large amount of cash in dollars on hand,” Railsback said. “The difference between saving and investing is based on your timeframe. If you have money that you’re not going to need for five or 10 years plus, that money should be invested. Money you’re saving for either cash reserves, working capital or some future planned expenditure in a shorter time horizon, that’s money that’s in short term liquid investments.”

The fifth tip is to be vigilant in protecting your aid money. As the NWCUA points out, scammers and fraudulent persons are also aware of the millions of Americans who will receive money. Be extra cautious about suspicious emails, text messages and phone calls asking for personal information.

Number six deals with taxes. While all stimulus packages are being dispersed tax-free, they could still help you to pay your taxes. With the deadline for filing for 2019 extended to July 15, there is ample time for most receiving aid to potentially use it towards their taxes or other payments such as mortgage or rent.

“What I’ve been hearing from landlords I work with is they want tenants to reach out and say, ‘Hey, I don’t have the full rent, but I can pay this now,’” Carter said. “Pay something and try to work with the landlord, let them know in advance, ‘Here’s what I can do. Here’s my plan going forward.’”

Finally, number seven is perhaps one of the most important of all: supporting others. With the threshold for receiving aid set at those making less than $99,000 a year, or couples making less than $198,000 a year, there is the possibility for some people to receive a package who are not in dire need of it.

The NWCUA as well as many financial experts are recommending several creative ways to give back to a struggling world.

“If you have a heart to help other people, this is a great opportunity to pay it forward and to support the local charities, but even the local businesses that are really, really struggling right now,” Solscheid said. “I think that this is a great opportunity that if your heart is really to help the poor and the needy and the impoverished, just a simple gesture like that goes a long way, because we are all in this together.”

“If you are still working, you still have income that covers your life, but you fall within the category that you’re going to get a stimulus check, how can you use that to hopefully help your local community?” Carter said. “The biggest hitters are these restaurants. The local mom and pops are just getting decimated. So my hope is people will decide, ‘Hey, let’s go buy some takeout. Let’s go buy some gift cards from our favorites.’”

Both Solscheid and Railsback placed heavy emphasis on the Payment Protection Program (PPP) in addition to the stimulus packages. The PPP is for small businesses or even those self-employed. They both encouraged those eligible to, if they haven’t already, apply for the program. More information on the PPP can be found here.

For more information on the stimulus payments and how to check eligibility and amounts, you can visit this webpage.

More coverage:

COVID-19 Information and links