Indications are some legislators are discussing a new transportation funding package that could include money for the Interstate Bridge Replacement Project

The state legislature will convene next week, beginning their scheduled 105-day session. At the top of their agenda will be passing a new two-year budget for state spending and dealing with numerous aspects of the COVID-19 pandemic and lockdown.

But one item of significant interest to Clark County residents is the discussion over transportation funding, especially related to the Interstate Bridge Replacement Project (IBRP). The 16 members of the Bi-state Bridge Committee were briefed in November that if the project were built today, as envisioned nearly a decade ago, there is a $2 billion funding shortfall.

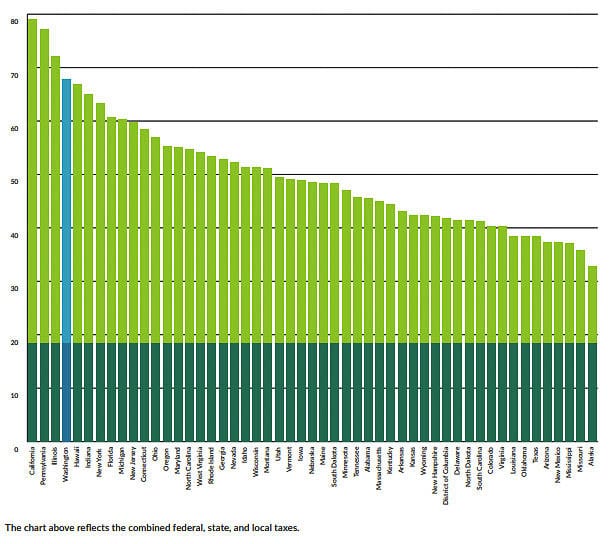

Recent news reports indicate some legislators are discussing a new transportation funding package that could include money for the IBRP. Usually transportation packages involve raising the gas tax and vehicle registration fees. The legislature’s last transportation package was passed in 2015, raising gas taxes to their current rate of 49.4 cents per gallon. Washington has the nation’s 4th highest gas taxes according to WSDOT.

The current effort may include a carbon tax, one of Gov. Jay Inslee’s signature issues tied to climate change. Others are discussing a mileage-based tax. The governor wants to delay spending on certain (unspecified) projects that have already been funded.

Sen. Steve Hobbs (44th District), chairs the Senate Transportation Committee. He hopes to make a third attempt at brokering a multibillion dollar Forward Washington plan according to a recent news report. His constituents want to replace the jammed Highway 2 westbound trestle, which connects his constituents to Everett.

Will taxpayers stomach increased taxes, especially in the midst of the pandemic lockdown? Clark County Today reached out to several legislators to get their sense of what may happen related to a transportation package, increased taxes, and issues related to the Interstate Bridge.

“Within this fractured economic time dominated by virus implications, I can’t imagine that there is any appetite for raising any taxes much less our already high gas tax,” said Rep. Larry Hoff, (18th District). “I’ve long been an advocate for major bridge replacement funding to be received from our federal government. Although I understand that federal funding is essentially gathered from all citizens initially, having the Fed’s chip in for the lion’s share of a new I-5 bridge would either eliminate or reduce the heavy load our commuters and Washingtonians in general would be asked to carry.”

Rep. Vicki Kraft, (17th District) has heard there has been significant work to introduce a “big transportation package” in the house. Rep. Jake Fey (27th District) will likely introduce this as chair of the House Transportation Committee and it will be designed to raise revenue according to Kraft.

While Senator Hobbs believes there is an appetite for increasing gas taxes, Kraft thinks otherwise. “If you consider people across the entire state, I would expect most would not be in favor of a gas tax,” she said. “Maybe in King County they’d be open to it but they aren’t representative of most other areas in our state.” This is especially true in a year where many have lost their job or their business and are seriously hurting financially Kraft points out.

Kraft spoke about what transportation projects are needed, specifically to benefit Southwest Washington citizens. “A third bridge, preferably west of I-5 between Washington and Oregon to provide real traffic congestion relief to drivers.”

She also mentioned the Northeast 179th Street exit interchange at I-5, and the SR-500 and Fourth Plain Blvd. intersection to relieve the traffic congestion along those corridors.

Rep. Ed Orcutt (20th District), took a broader view. “It is hard to know what some people in various areas of the state might support for a gas tax,” he said. “Most in SW Washington have opposed higher gas taxes in the past.”

He pointed out that voters rejected a referendum to raise gas taxes by 10 cents per gallon in 2002. Yet gas taxes have risen by 26.4 cents – more than doubling the 23 cents in effect at that time.

Orcutt mentioned that in addition to gas tax increases, new fees were created in the form of weight fees on passenger vehicles and raised on commercial vehicles. “Because of these past increases, I question whether citizens would support any additional tax increases,” he said.

As far as projects for Southwest Washington citizens, Orcutt said people want a third bridge. “There needs to be an upgrade to (replacement of) the current I-5 bridge to create a better approach to the bridge, wider lanes and shoulders on the bridge, better sight distance, and fewer delays due to bridge lifts.”

“But any replacement of the I-5 span should be in addition to a third bridge and focus on vehicular traffic – not light rail,” he said. “Funding for a bridge should be for a bridge – not projects unrelated or minimally related to the I-5 crossing.”

Orcutt also mentioned improvements for other bridges which are functionally obsolete or structurally deficient or which decrease congestion – the Camas Slough on SR 14 and I-5 bridges in the north portion of the county.

“We cannot afford the monstrosity they were looking at a few years ago,” he said, referencing the failed Columbia River Crossing effort. “It would have tripled or quadrupled the footprint of the corridor, especially on the Oregon side.”

He believes we should focus only on replacing a bridge, not creating a transit corridor for light rail. “We should not be funding projects not directly related to the bridge,” he said. “Previous information indicated that the actual bridge would cost about $1 billion.”

There would likely be a battle over whether carbon taxes should be spent on transit as opposed to gas and diesel fuel taxes which the state constitution’s 18th Amendment reserves for roads.

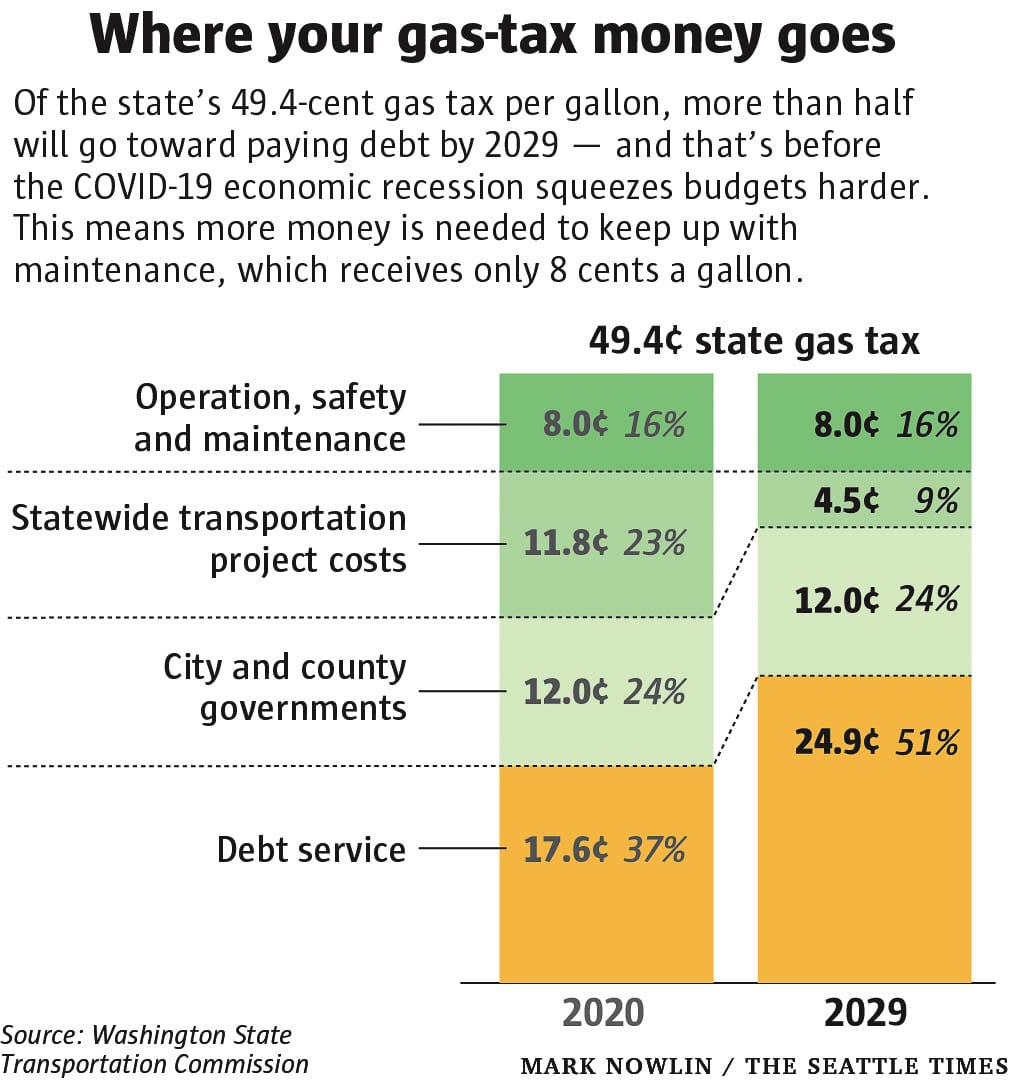

A recent report from the Washington State Transportation Commission indicates that by 2029 over half the gas tax revenue will go toward paying debt. State transportation projects are bought on a credit card, with borrowed money. That same report indicates 16 percent of gas tax revenues go to maintenance, operation and safety of roads and bridges.

The Washington Policy Center (WPC) recently reported that Gov. Inslee has proposed delaying critical transportation projects, while funding electric ferries and high-speed rail. He “intends to engage the Legislature in developing a specific approach to delaying projects” that were committed to the public in past transportation packages, while funding the following efforts:

- $724 million to meet the requirements of a federal court order to remove state-owned fish passage barriers (culverts)

- $190 million ($318 million over four years) to convert ferries to hybrid electric and build terminal charging stations

- $20 million for bike and pedestrian facilities

- $15 million in additional capital grants to electrify transit systems

- $5 million for the regional mobility grants program (rural and small urban transit)

- $3.25 million to fund work on high-speed rail between British Columbia and Oregon

- $1.5 million to promote electric vehicle (EV) adoption

Rep. Andrew Barkis, (2nd District) ranking Republican on the House Transportation Committee, responded to the governor’s proposal, stating it is “out-of-touch with what the people of Washington state can financially afford right now,” according to the WPC. He supports minimal or zero new taxes in 2021 while citizens are still hurting from COVID-related business restrictions. Lawmakers should limit their ambitions to maintenance and projects already approved, he said.

Orcutt also weighed in on another huge concern for SW Washington residents — tolls. “I do not support tolls as it would disproportionately impact Washington residents with much of the economic benefit going to Oregon,” he said. “Funding must be more equitable, therefore, each state — and the federal government — should contribute to the construction of a replacement bridge.

He proposed the legislature should transfer sales taxes paid on transportation construction out of the general fund and dedicate it to transportation.

“With the past increases in the gas tax and the understanding I have of the struggles so many citizens are having due to the COVID shutdowns, I do not support a gas tax increase,” he said. “Furthermore, I am concerned about including the bridge replacement in a package before we have any agreement with Oregon on what the project would be – one which needs to be acceptable to residents on our side of the river.”