House leader says he will remove fuel export tax from transportation package

The head of the Washington Senate Transportation Committee and lead author of the $16.8 billion transportation package has issued an apology to Oregon Gov. Kate Brown. On Thursday, Sen. Marko Liias (Democrat, 21st District) was on the John Carlson radio show (KVI Seattle) and went on a rant over Brown pushing back against his proposed 6 percent tax on refined fuel exported out of the state.

“I lost my temper … and made some intemperate and disrespectful remarks,” Liias wrote in an email to the governor Thursday night. “It is too easy in politics to get upset and say unkind things, and much too difficult to express regret. Governor Brown has been a wonderful partner with Washington on so many issues, I am sorry my words clouded that proud record.”

Additional fallout resulted Saturday, when House Transportation Committee Chair Jake Fey (Democrat, 27th District) announced he would be removing the fuel export tax from HB 2019, the funding legislation for the transportation package. The “Move Ahead Washington” package has already passed the Senate.

“People told us loud and clear that this was not going to work,” said Fey. “From the beginning, this package has been about listening to people’s needs and making historic investments in Washington for years to come. We’ve come up with a reasonable, workable solution that takes the pressure off working people and contributes to a stronger partnership with our neighbors in other states.”

Liias faux pax

Carlson had read Governor Brown’s public comments to Liias, regarding her conversation with Gov. Jay Inslee. She said the fuel export tax was “unacceptable.”

“Governor Brown’s line is a joke,” Liias responded. “The State of Oregon charges $300 million on Washingtonians that crossed the border to work there every year.” He said the 6 cent tax is not an “onerous burden.”

“Her state basically lived off of Washington state residents $300 million, Our residents aren’t benefiting from their pain and income taxes to Oregon,’’ Liias said. “This governor down in Oregon is living in Fantasyland. She’s in the last few months of her term. She’s losing relevance. She’s a lame duck. Obviously, she’s grasping for something to stay in the headlines.”

Liias believes the proposed law is constitutional, but admits lawsuits will determine that once the law is enacted. Governor Inslee “strongly” supports the measure and has indicated he will sign it. The export fuel tax is expected to contribute $2 billion to the overall package. But that was before the Liias outburst and ensuing additional outrage from neighboring states.

On Thursday afternoon, Liias sent Brown an apologetic email. On Friday he reached out with a further apology according to news reports in remarks to his fellow senators.

“It is too easy in politics to get upset and say unkind things, and much too difficult to express regret,” Liias wrote. “Moving forward, I plan to stick to the merits of our transportation proposal and leave the interstate dimensions to cooler heads and wiser voices.”

Sen. Marko Liias and KVI radio host John Carlson discuss the $16.8 billion transportation package. Liias believes the Democrat proposal is constitutional. He defended many facets of the package including a large allocation to transit and the export fuels tax. Audio courtesy KVI

The pushback

The proposed tax has raised the hackles of neighboring states. Lawmakers in Alaska have threatened retaliatory taxes on fish, moorage and crude oil. Idaho legislators said they would “take any and all actions necessary to block this new tax.” Two Oregon Republicans said they would walk away from the joint committee responsible for oversight of the Interstate Bridge Replacement (IBR) program. a replacement for the portion of I-5 over the Columbia River.

In an op-ed last week, Brown called on Inslee to shelve the tax. “Oregon will not stand for taxation levied by Washington leaders with no consultation with our state government, our business community or our residents,” Brown wrote.

On Friday, Oregon lawmakers stepped up their opposition. Brown, with the leaders of both the Democratic and Republican caucuses, called on Washington legislators to remove the tax from the overall package, saying it could hurt progress on completing the I-5 crossing.

“If this tax moves forward, not only will our states’ relations be strained, but we will both be caught up in lengthy and costly legal battles,” they said in a letter to Washington legislators. “For you in Washington, this means stalled progress on the exact projects being funded through this bill – including likely missing the huge opportunity to apply for the Mega Projects grant in the Infrastructure Investment and Jobs Act (IIJA) for the Interstate Bridge.”

“Imposing a harsh export tax on something as essential as gas is hardly justified in the worst of times, and certainly not at a time when both our states are seeing revenue projections unlike any time in history,” they wrote. “Nor is it justified while our citizens – in both states and across the nation – are facing severe cost of living challenges with rising inflation.”

Vancouver Sen. Annette Cleveland (Democrat, 49th District) has worked closely with Liias. Earlier in the week she had successfully lobbied to add $200 million to the funding allocated for the IBR program, bringing it to $1.2 billion. This follows the failure of the Columbia River Crossing (CRC) effort a decade ago where each state was supposed to contribute $450 million for the $3.5 billion light rail and bridge project. The IBR team now projects a replacement could cost between $3.2 billion and $4.8 billion.

Oregon legislators on fuel tax war.jpg) The two page letter sent by Oregon Gov. Kate Brown, and four Oregon legislators, objecting to the 6 percent Washington export fuel tax proposal. Over the weekend, Rep. Jake Fey announced he would amend the bill in the House to remove the tax which has already passed the Senate. Graphic courtesy Oregon State Legislature

“My people pay 10 percent Oregon income tax if they don’t have a job on my side of the river,” said Rep. Sharon Wylie (Democrat, 49th District). She believes that since Oregon taxes her constituents, it’s okay to reciprocate and tax them.

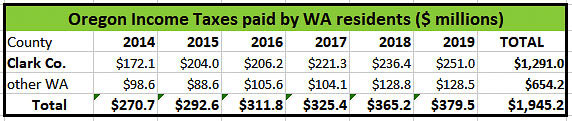

The Oregon treasurer produces a report annually showing where income tax revenues come from by county. The most recent report comes from the 2019 income tax returns file in Oregon. Clark County had 78,662 residents pay $251 million in Oregon income taxes. Furthermore, another 47,264 “other Washington” residents paid $128.5 million. That indicates Oregon received $379 million from citizens in Washington.

The largest share of those “other” Washington residents come from Southwest Washington, either Cowlitz County or Skamania County, followed by citizens in the White Salmon area who work in Hood River.

Since the CRC was put into a coma in late 2013 or early 2014, Washington residents have paid nearly $1.3 billion in income taxes to Oregon. For all Washington citizens, they paid $1.945 billion.

That data is for the six years through 2019, so we know the 2020 taxes have been paid, and citizens will pony up even more in April when they file their 2021 tax returns.

Additional concerns for Southwest Washington residents is Oregon’s plan to tolling all freeways beginning “at the border” with Washington state. In the CRC, forensic accountant Tiffany Couch estimated that Washington residents could pay around 60 percent of the $3.3 billion in tolls, taking an estimated $2 billion out of the pockets of residents north of the Columbia River.

The Southwest Washington citizens trying to cross the Columbia River have been fighting congested freeways for decades. According to transportation officials, the Interstate Bridge reached its design capacity in the 1990’s, and the I-205 Glenn Jackson Bridge reached its design capacity a decade later.