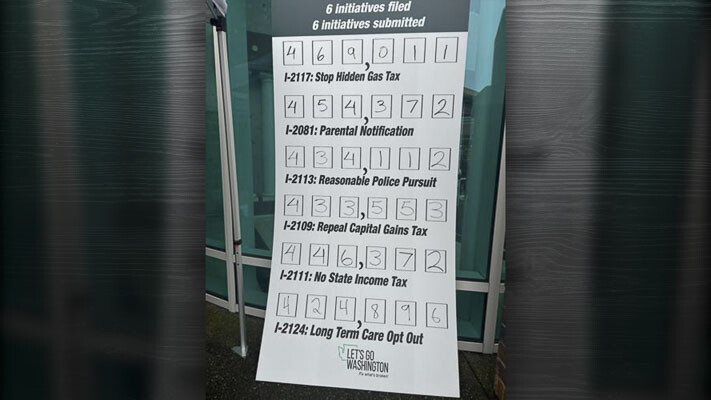

Late last year, Let’s Go Washington submitted several initiatives to repeal the state’s cap-and-trade program, capital gains tax and prohibiting local governments from imposing their own income tax

TJ Martinell

The Center Square Washington

The Washington House is fast-tracking a bill that critics say is a direct response to several ballot initiatives submitted to the Secretary of State’s Office last year seeking to repeal a variety of state revenue sources.

House Bill 2459 would mandate that whenever the Legislature enacts an alternative to a certified voter initiative affecting state revenue is on the ballot, it must be accompanied with a public investment impact disclosure statement written by the State Attorney General’s Office describing specific investments that would be maintained if passed by voters.

Late last year, Let’s Go Washington submitted several initiatives to repeal the state’s cap-and-trade program, capital gains tax and prohibiting local governments from imposing their own income tax. Those three have already been certified by Secretary of State’s Office for the November ballot. When an initiative is certified, the Legislature can enact it into law or decline to consider it and leave it for the November ballot. The Legislature can also enact an alternative initiative.

Currently, when initiatives impact state revenue, they include a PIID that describes investments that will be affected if the measure is adopted.

Sponsor Rep. Mia Gregerson, D-SeaTac, told colleagues at a House State Government & Tribal Relations public hearing that “it’s actually a very simple transparency bill” that would “ensure that we are educating folks on the exact intention of legislature.”

Also in support of the bill was Kathy Sakara with the Northwest Progressive Institute, who said while NPI “supports the citizen’s right to initiative, we also support transparency. I don’t understand how anyone can be opposed to that, but some are.”

However, Rep. Leonard Christian, R-Spokane, argued that the bill presumes how a future Legislature would react to the loss of revenue due to voter approval of an initiative.

“This could be just as confusing,” he said.

Also skeptical was Rep. Greg Cheney, R-Battle Ground, who questioned how the Attorney General’s Office would be able to “predict what a future elected legislature that is not yet convened will decide to with respect to changes in state revenues.”

Testifying against the bill was AG candidate Peter Serrano, who told the committee “having litigated ballot title initiatives, I have significant concern about this bill. My concern here is this seems to violate individual rights as well as the Constitution.”

Another critic was Julie Barrett with the Conservative Ladies of Washington, who noted that the bill was introduced and then immediately given a public hearing the next day. She also remarked that while initiatives certified for the ballot are supposed to “receive the top priority in session by legislators,” none have been given a public hearing.

Instead, lawmakers are considering a bill that is a “direct response to the success of the citizen initiative,” she said.

She added that rather than transparency, the purpose of the bill is to “tip the scales of the outcome of elections” and is a “slap in the face to Washington citizens.”

HB 2459 is scheduled for a committee vote on Friday.

This report was first published by The Center Square Washington.

Also read:

- House Democrats advance $18B in tax hike proposals as session winds downHouse Democrats in Washington advanced several tax hike proposals as the legislative session nears its end, aiming to address a major budget shortfall.

- Republican budget leaders see showdown ahead as Senate Democrats approve trio of major tax increasesSenate Democrats in Washington have approved major tax increases, prompting Republican budget leaders to warn of a growing showdown ahead.

- Representatives from the 18th and 20th Legislative Districts to hold joint town hall on May 3Lawmakers from the 18th and 20th Legislative Districts will host a joint town hall on May 3 at Battle Ground City Hall to review the legislative session and hear from residents.

- Expect delays on northbound I-5 near Ridgefield through May 9Northbound I-5 travelers near Ridgefield should expect delays through May 9 as crews work on improvements at the Exit 14 off-ramp to support future development.

- Brandon Erickson announces candidacy for Clark County Charter Review CommissionBrandon Erickson has announced his candidacy for the Clark County Charter Review Commission, seeking Position 1 in District 2.

- Clark County Sheriff’s Office investigating a reported burglary that led to apparent suicideThe Clark County Sheriff’s Office is investigating a reported burglary in Vancouver that ended with the apparent suicide of Charles Gardiner, interim chief of the Cowlitz Tribal Public Safety Department.

- POLL: Why did voters reject all three tax proposals in the April 22 special election?Clark County voters rejected all three tax measures on the April 22 special election ballot, prompting questions about trust, affordability, and communication.