The libertarian Cato Institute released the report, which graded states by spending, revenue and taxes

Casey Harper

The Center Square

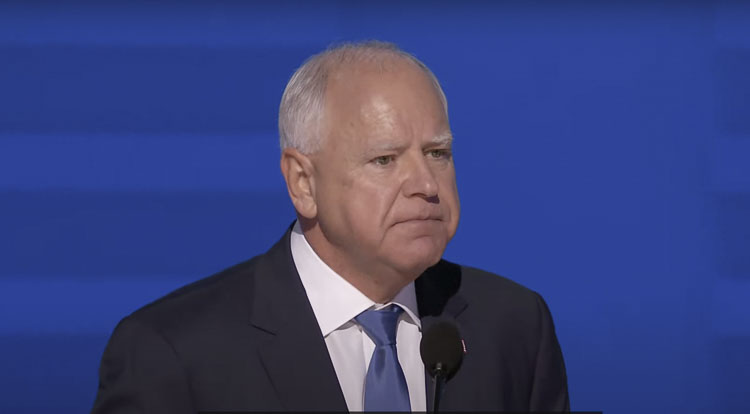

A newly released analysis of fiscal policy ranked all 50 states with Iowa Gov. Kim Reynolds’ state coming in first and Democratic Vice Presidential Nominee and Minnesota Gov. Tim Walz in last.

The libertarian Cato Institute released the report, which graded states by spending, revenue and taxes. The top ten states in the rankings starting at the top are Iowa, Nebraska, West Virginia, Arkansas, South Dakota, Montana, Hawaii, Georgia, Idaho, and Vermont.

The bottom ten states, according to the analysis, are New Mexico, Missouri, Oregon, Michigan, Wisconsin, Delaware, Washington, Maine, New York and lastly, Minnesota.

The bottom six states received a grade of “F.”

Walz’ poor rating comes just three weeks before the presidential election where he and his running mate Vice President Kamala Harris are in a nearly tied race with former President Donald Trump and his running mate, Sen. J.D. Vance, R-Ohio.

The report explains the reasoning for Walz’ low score, pointing to a series of tax hikes under his leadership as well as spending increasing by 36% since 2022, from from about $52 billion to nearly $71 billion.

From the report:

In 2019, Walz’s budget would have added ‘$2 billion more in new spending and taxes would increase by $1.3 billion to pay for it, with the rest of the money coming from an existing surplus.’ But he compromised with the legislature, and the final tax increase was about $330 million annually. Walz also pushed for higher gas taxes and higher vehicle fees to raise about $1 billion annually for transportation, but those increases were rejected.

Walz pushed for more tax hikes in 2021. He proposed adding a new individual income tax rate of 10.85 percent above the current top rate of 9.85 percent, a surtax on capital gains and dividends, and a hike to the corporate tax rate from 9.8 percent to 11.25 percent. The proposals—which would have raised about $1.6 billion annually—were rejected by the legislature…

Walz hit the middle class with HF 2887, which raised taxes and fees on vehicles and transportation. The increases included indexing the gas tax for inflation, increasing vehicle registration taxes, raising fees on deliveries, and raising sales taxes in the Twin Cities area.

This report was first published by The Center Square.

Also read:

- WA governor pressed to veto $1.8B piece of Democrats’ tax billGrocers and restaurateurs are urging Gov. Ferguson to veto a surcharge in HB 2081 that they say will raise food prices statewide.

- Letter: ‘It’s said sarcasm is the lowest form of wit’Amboy resident Thomas Schenk criticizes Olympia’s use of “emergency clauses” and other legislative tactics that limit public participation.

- Opinion: What the 2025 legislature tells us about why Washington’s government keeps failingTodd Myers of the Washington Policy Center argues that Washington’s government fails because it resists humility, experimentation, and accountability in its policymaking.

- Town hall: Republicans say they are the ones fighting for the working classFour Republican legislators gathered in Battle Ground for a town hall to address rising taxes, education concerns, and their push to support Washington’s working class.

- Pooneh Gray Files for Vancouver City CouncilPooneh Gray has filed to run for Position #1 on the Vancouver City Council, emphasizing public safety, homelessness solutions, and community justice.