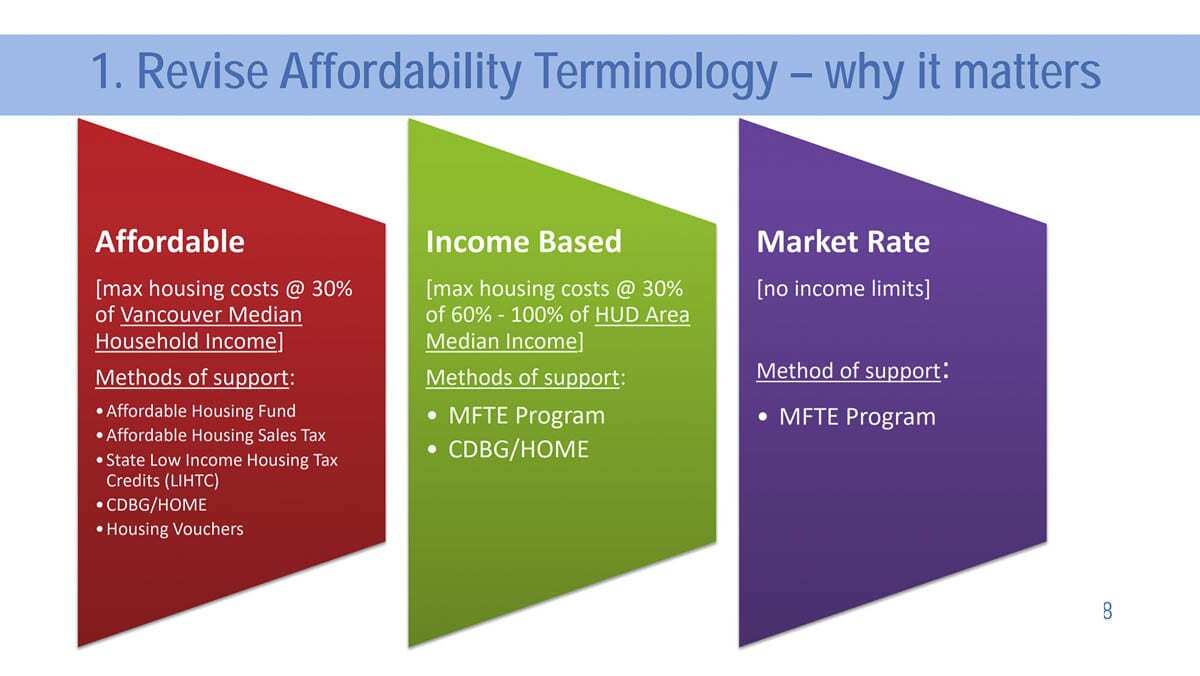

This first phase would include changing qualifying housing from affordable to income-based housing

VANCOUVER — After months of debate, Vancouver City Councilor appears set to approve the first phase in their plan to overhaul the Multifamily Tax Exemption (MFTE).

The MFTE, which has been in place since 1997, has increasingly been used as a tool to incentivize developers to include affordable housing downtown, or along part of the Mill Plain corridor.

Last year however, it came under greater scrutiny after several developers were granted the exemption, and council members noted that what qualifies as “affordable” was defined by the median household income of the Portland metro area, which is approximately 30 percent higher than the median family income of the Vancouver area alone.

In response, the council directed staff to begin looking at ways to adjust the formula to focus on the Vancouver median income, but then balked over concerns the change could put a damper on downtown development.

Instead, the council appears poised to phase in changes to the MFTE, starting with adjusting the terminology. Instead of “affordable housing,” developers could include “income-based housing” in exchange for property tax breaks of up to 12 years.

The council could still work to tie the tax exemptions to affordable housing based on Vancouver median income, but would likely tackle that in phase two later this Summer.

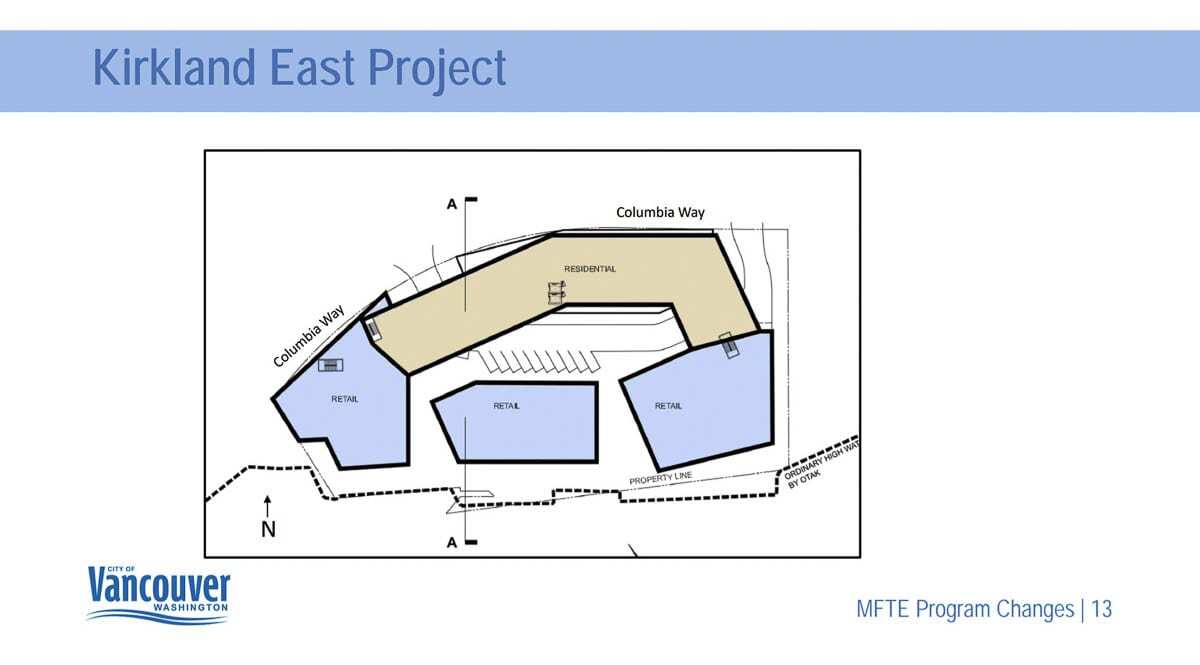

The plan presented at a first hearing on Monday night would also remove a number of public improvements that currently allow developers to qualify for property tax breaks, and would expand the MFTE boundary slightly east of the Interstate Bridge to include a 2-acre parcel of land currently home to the Who Song and Larry’s and Joe’s Crab Shack restaurants.

The site’s owner, Kirkland Development, has proposed a multi-story building on the site, with up to 220 market-rate housing units and 140,000 square feet of office, retail and restaurant space.

Chad Eiken, the city’s Community and Economic Development director, said Kirkland would tear down and rebuild the city-owned pier along the waterfront, which has been closed due to concerns it could collapse.

“We don’t have a cost estimate, but it would be a considerable cost to the city to remove that structure,” Eiken told the council. “And so that is what the developers are proposing to do for the city. And then they would construct the shoreline path on the upland portion of the site.”

Councilor Sarah Fox was the lone no vote on the proposal as it currently exists.

“I’ve been pretty consistent about my reluctance to expand the boundary of our MFTE area when we still have what looks like a lot of work ahead of us,” Fox explained. “Expanding the boundary before we’ve really come to an agreement about what this program should look like… It’s just not ready.”

The current proposal would broaden the definition of what qualifies as a public benefit, but mandate that it cost at least 25 percent of the overall tax benefit to the developer.

Parking also previously qualified as a public benefit, but would now do so only if it were contained within a structure, rather than on-street, and only at 10 percent or more over the current parking minimums for downtown.

Some of this could be a mute point after the Washington legislature wraps up their work.

“There is some movement at the state level to make some changes to the state’s requirements for multifamily tax exemptions,” Eiken noted. “We’re monitoring that closely, and we’ll know more once the legislative session concludes about how that will affect the city’s local ordinance.”

Energy efficiency standards removed

Another change would remove energy efficiency as a potential public benefit option, though Eiken said developers could still propose it in exchange for tax incentives.

“The burden is on staff as well as you, as the decision makers to say, ‘Alright, how much of a benefit is that? And is it enough of a benefit?’” said Eiken. “And it’s really hard to quantify things like enhanced landscaping and energy efficiency.”

Councilor Ty Stober said the removal of the energy efficiency public benefit item “gives me a lot of heartburn,” but that the city is also working to finalize its Climate Action Plan and could revisit the subject as part of that process.

“The benefits are really through the roof when it comes to providing renewables in an urban area,” agreed Councilor Bart Hansen, “and this might be one of the incentives that we could provide, in order to make that a possibility.”

The council will hold a public hearing on the proposed changes at their March 15 meeting, with a potential final vote to follow.