Vancouver lawmaker offered her about the so-called ‘wealth tax’ proposed today by Democrats in the Senate and House of Representatives

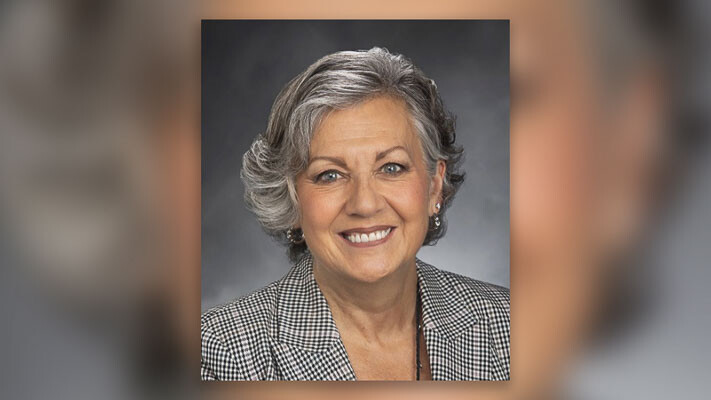

OLYMPIA – The budget leader for the state’s Senate Republicans isn’t buying the idea that Washington needs to slap another tax on residents who are financially successful. Sen. Lynda Wilson, R-Vancouver, offered these remarks about the so-called “wealth tax” proposed today by Democrats in the Senate and House of Representatives:

“On the surface this may have a Robin Hood kind of appeal, but that’s just not enough to make it a good idea. The sponsors know this is constitutionally questionable but are charging ahead anyway. It’s how the state income tax was adopted: push the tax through and cross your fingers that the judicial branch will ultimately come to your rescue. We need less legislating from the bench and more listening to the people.

“The ‘wealth tax’ didn’t make the list of tax options recently recommended to the Legislature by the bipartisan Tax Structure Work Group. You wonder why the Democratic chair of that work group decided to introduce the Senate version of this bill, even though her colleagues on the work group decided the idea wasn’t worth further consideration.

“State government has 6 billion dollars in reserve. Maintaining the programs and services in the current budget will cost 1.5 billion. A lot of good can be done with even a portion of what’s left. The Robin Hood angle falls apart completely when you see the revenue from this tax is aimed at growing government, with no promise of any real tax relief. And why talk about new taxes when the focus should be on using the existing revenue wisely?

“These bills repeat the Democrats’ myth that Washington has the most regressive tax system in the nation. Let’s keep in mind these Democrats just last year refused to join with Republicans on two pieces of progressive tax reform – one to lower the state sales tax, the second being my bill to offer a property-tax exemption that would have benefited owners of lower-value property more. At the same time they have created new laws that increase costs related to driving and energy, both of which hit lower-income people harder. If the Democrats truly want to help people at lower income levels, they should stop supporting regressive taxes and fees, and lower or eliminate the ones they’ve created. A ‘wealth tax’ doesn’t do any of that.”

Also read:

- Letter: ‘We’re going to give them some money and a plane ticket, and then we’re going to work with them’Camas resident Anna Miller supports a new structured self-deportation policy, calling it a balanced approach to immigration and economic needs.

- Pro-Palestinian protesters occupy UW building, 30 arrestedAbout 30 protesters were arrested at the University of Washington after occupying a building and demanding the school cut ties with Boeing.

- Sen. Braun praises UW officials for response to Monday protests, calls for prosecutionsSen. John Braun praised UW officials for their firm response to violent protests tied to the university’s relationship with Boeing.

- Largest parade in Southwest Washington bands together for a better tomorrowThe 59th annual Parade of Bands in Hazel Dell will feature 24 high school bands and more than 120 entries on May 17.

- Don’t leave tax dollars on the table; learn about county’s tax exemption program at May 16 event in WashougalClark County tax exemption specialists will assist seniors and people with disabilities during a May 16 event in Washougal.

- Trades Tuesday is here, hoping to become a trend in area schoolsA new campaign is launching in area schools to inspire students to consider careers in the trades.

- Opinion: What the 2025 legislature tells us about why Washington’s government keeps failingTodd Myers of the Washington Policy Center argues that Washington’s government fails because it resists humility, experimentation, and accountability in its policymaking.