Let’s Go Washington Founder Brian Heywood speaks out

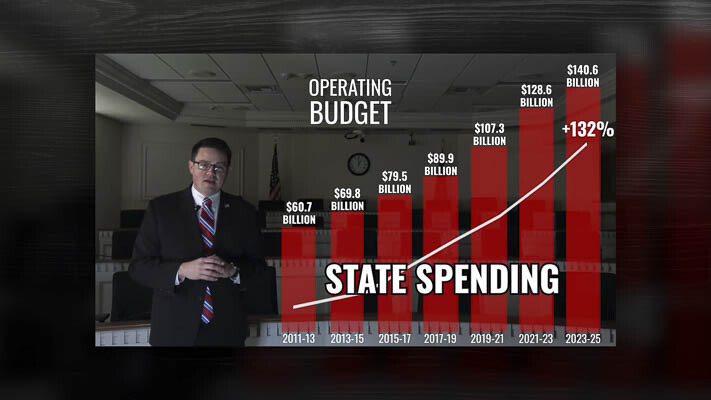

Today (March 6), House Republicans released their budget breakdown that shows radical progressives will take more of your money even if they don’t need it. It proves government greed is driving tax increases, not real public benefit.

Initiative opponents are resorting to scare tactics – but do not be fooled. The truth is, Olympia politicians have a spending problem, not a revenue problem. #waleg #washingtonstate #fixwashington pic.twitter.com/mvIeo3OopZ

— Washington State House Republicans (@WaHouseGOP) March 6, 2024

Radical progressives in Olympia have the money to pay for all the programs they want to and more. However, they would rather tax voters and fund pet projects to keep their special interests happy than do what is right.

This budget release proves, yet again, that common sense solutions are possible and radical progressives are using scare tactics.

“I-2117 will end the hidden gas tax. It will give money back to Washingtonians and keep greedy government hands out of our wallets,” said Brian Heywood, Let’s Go Washington founder. “The ruling class can no longer bully their way into voters’ wallets without consequence. The hidden gas tax has hurt commuters and working Washingtonians the most, and has done nothing to cut back on carbon emissions. Even with all the new spending, we could eliminate the hidden gas tax and the capital gains tax, and still have a surplus. The reality is that radical progressives would rather scare voters or bribe them into supporting their bad policies than actually craft legislation that works for our state. Today we put an end to their continuous drumbeat of lies.”

We join with Max Reede from Liar Liar in wishing that for just one day, radical progressives wouldn’t tell a lie.

Visit letsgowashington.com for more information.

Also read:

- WATCH: Sen. Braun urges Ferguson to get past fearmongering on ‘big beautiful bill’Sen. John Braun criticized Gov. Ferguson’s opposition to the Big Beautiful Bill, calling it partisan fearmongering and defending the bill’s work requirements and spending controls.

- Veteran educator Lorri Sibley announces campaign for Battle Ground School BoardVeteran educator Lorri Sibley has launched a campaign for the Battle Ground School Board after 32 years teaching in the district and 36 years as a Yacolt resident.

- Clark County Fire District 3 hiring firefighters and paramedicsClark County Fire District 3 is accepting applications for firefighter and paramedic positions through August 15, with hiring planned by October.

- Red Cross issues advice to stay safe during extreme heatThe Red Cross urges Clark County residents to stay cool, hydrated and connected as extreme heat hits the region, with tips to prevent serious illness.

- Vancouver’s Rental Registration Program to improve quality, safety of rental housingVancouver will require all long-term rental units to register annually starting January 2026, aiming to improve rental safety and housing data.

- Opinion: Taxes and assessed valuesDick Rylander explains how property tax proposals are calculated and urges Clark County residents to understand assessed values before voting on new taxes.

- Junior Market’s entrepreneur of the year recognized by Greater Vancouver Chamber and OnPoint Community Credit UnionWallace Griffin, 11, earned top honors at the Junior Market for his Lemonade Lab, taking home awards and recognition for creativity, profits, and community giving.