I-1436 and HB-1594 designed to halt the long-term care program and tax

In 2019, the Democrat-controlled state legislature pushed through a new state run long-term care (LTC) program. As originally designed, workers would start paying 58 cents for every $100 of income in January, with no income cap. The program offers a maximum benefit of $36,500 but you have to contribute to the program for 10 years to be eligible.

House Bill 1087 had bipartisan support, as Rep. Paul Harris (Republican, 17th District) joined speaker Laurie Jinkins, Monica Stonier (Democrat, 49th District) and Richard DeBolt (Republican, 20th District) in cosponsoring the bill in the House. In the Senate, SB 5331 was introduced and sponsored by Sen. Annette Cleveland (Democrat, 49th District), Curtis King (Republican, 14th District) and others.

In the advisory vote that followed, 63 percent of Washington citizens opposed the tax increase and the long-term care program as enacted.

In response, Rep. Jim Walsh (Republican, 19th District) wrote and filed a citizens initiative in June. He enlisted the help of former state Rep. Cary Condotta on the citizens initiative to give people a choice regarding Washington state’s LTC program and the payroll tax that goes with it. “You’re in a program that you’ll probably never see the benefit of,” Condotta said. I-1436 makes the entire program and tax voluntary.

Condotta listed several examples of flaws in the program. If you’re less than 10 years from retirement, you can’t get vested; yet you’ll still have to pay into it. If you move out of state, you can’t use the benefit as a resident of another state. “Everybody pays the tax,” he said.

“The long-term care tax scheme is a rotten deal for Washington’s working people,” said Walsh, who is also a cosponsor of HB 1594. “It’s insolvent. A measly benefit. Too many strings attached.”

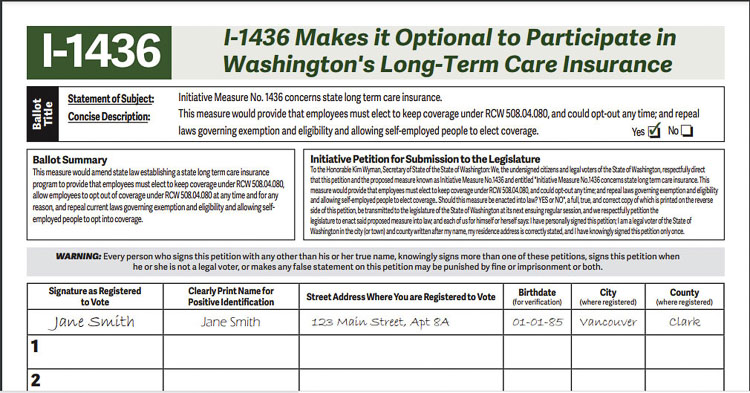

Condotta’s group has submitted I-1436 to the secretary of state. Citizens have through the end of the year to collect and turn in signatures on the petition. A copy of the initiative can be obtained here. I-1436 would make it optional to participate in Washington’s long-term care insurance.

“The governor is frightened,” said John Carlson on his Seattle-based KVI radio show Monday. “Democrats think they’re going to lose their majority if they press this issue and they probably will. So now they’re scrambling and trying to keep the program alive, even if it means putting off the tax for a while.”

On Dec. 1, Democratic leaders in the state senate sent Gov. Jay Inslee a letter asking him to delay implementation of the program. Two days later, Rep. Peter Abbarno, (Republican, 20th District), invited House and Senate Democrats to join him and other Republicans in a bipartisan effort to repeal the state’s mandated “insurance” program. He introduced HB 1594 for the upcoming legislative session.

“House Republican Health Care Leader Representative Joe Schmick and I have been at the table for months, along with our other Republican colleagues, thoroughly examining this issue and the 2020 Long-Term Services and Supports Trust Actuarial Study,” Abbarno said. “We have come to the conclusion the only real solution is to fully repeal the long-term care insurance program and the tax.

Abbarno said he’d heard nothing from his Democratic counterparts in the house and senate, even though the Senate Democrats’ letter acknowledges they have “heard loud and clear’’ from their constituents about the unfairness of this program.

Newspapers from around the state weighed in condemning the program. Stories in The Spokesman Review, NW News Network and The Seattle Times weighed in saying the long-term-care plan (the WA Cares Fund) was in trouble.

On Friday, Gov. Inslee weighed in with a press release, putting the collection of the income based tax on hold for next year. He hoped the legislature would find a way to fix the many problems.

“I am taking measures within my authority and ordering the state Employment Security Department not to collect the premiums from this program from employers before they come due in April,” Inslee said. “My actions mean that the state will not collect those funds until the Legislature sorts through these issues. While legislation is under consideration to pause the withholding of LTC fees, employers will not be subject to penalties and interest for not withholding fees from employees’ wages during this transition.”

Rep. Walsh responded. “It’s so bad that the governor and his minions have admitted they made a mess. The fact people are supporting I-1436 is forcing the issue.”

According to Walsh, the governor’s “fix” to his mess is unconstitutional. “He’s pretending the rotten law he signed doesn’t exist,” Walsh said.

“We’re in a constitutional crisis in Washington,” he said. “This governor ignores our constitution. And his minions enable his unlawful actions. Thankfully, Initiative 1436 is acting as a check on their bad behavior.”

Condotta told Carlson that Democrats are terrified. “The design of this program is a train wreck. It makes no sense. Nobody wants to be involved with it.”

“The Democrats now know that if this thing is on the ballot . . . they’re gonna take a beating,” Carlson responded. “They stand to lose almost every competitive race in every swing district. And the long term care tax will be part of the reason.”

He shared that the governor said he’s going to pause collecting the tax even though just two weeks previous he said he wasn’t legally allowed to do so. Inslee said he’s not going to collect the tax for the first three months. The Democratic leaders in the House and Senate said that the tax would not be collected until the end of the legislative session in 2023 according to Carlson.

Elizabeth Hovde of the Washington Policy Center has been tracking the legislation and it’s flaws for the better part of a year. She shared the following on Friday.

“While one-man rule might appear to be coming to the rescue, saving us from a payroll tax that the Democrats wanted to fund a program they bragged about, it’s only a temporary halt. While Inslee and Democratic leaders are acknowledging the law they passed was a mistake, be clear: They aren’t saying they won’t take your money for this fund, they are saying they won’t be taking it yet.’’

I-1436 sponsor Condotta shared the following response with his supporters on Saturday. “Olympia knows we are closing in on the required signatures and they are in panic mode,” he said. “They are trying to slow our progress by saying they will improve the program and DELAY the tax. Two things here. The delay is only to get them through the next election and any improvements will cost more and raise the already insidious tax rate. It won’t work any other way.”

Condotta said he needs 400,000 signatures on full-size petitions to qualify. “It would be a shame and a very costly mistake to fall just short,” he said.

He predicted that in spite of any legislative tweaks, it will remain mandatory. “I-1436 will not let them get away with this,” he said. “Having this option on the ballot in November will make the point that it’s voluntary or not at all. It will also give better candidates a chance to expose these people for what they are. Tax and spend bureaucrats.”

Sen. Andy Billig (Democrat, 3rd District) and Speaker Laurie Jinkins (Democrat, 27th District) added their support to the governor’s action. “In addition to delaying the premium assessment, we also support employers pausing premium collections from employees in Washington so lawmakers can take necessary action. While we cannot direct employers not to collect, we strongly encourage them to pause on collecting premiums from employees, giving us time to pass legislation extending implementation dates until next year.

“We know that this extra time will allow us to find solutions and craft updates to the Fund that allows Washingtonians to age with dignity in their own homes,” Billig and Jinkins said.

Abbarno shared a link to HB 1594 for the upcoming session of the legislature, encouraging voters to share their views of the program. “Let the Legislature know you want to repeal the regressive payroll tax and unpopular, unfair, and unstable WA Cares Act. Support HB 1594,” he said in a social media statement. You can comment here.

“Every time you modify this thing, it’s going to cost more,” Condotta said. “If you change portability, if you raise the benefit, if you reduce the time paying into the system to be eligible for a benefit, it will add to the costs. That in turn means the legislature will have to raise the tax even higher.

“The key word to all of it is, it’s still going to be mandatory, unless I-1436 gets on the ballot,” Condotta concluded. Supporters need to collect the last few signatures and then get their I-1436 initiative petitions in the mail to Condotta by the end of the week.

Rep. Harris was contacted by Clark County Today. You were an original sponsor of HB 1087 in 2019, but ended up voting against the bill. What are your feelings about the Governor’s use of executive authority, and what changes would you like to see made to the LTC program?

Harris responded with the following:

“As legislation often changes from when it starts to the finish. I was originally on the bill but the bill changed a lot during the process and I voted no on the final proposed bill.’’

His Concerns:

1: Do my constituents want this?

2: Near Retirees will pay into the system and not receive benefits.

3: Border State residents commuting or classified as Washington employees can not receive benefits unless they move into the state.

4: People who leave the state after paying in for years cannot receive benefits. You must reside in the state to receive benefits.

5: Non immigrant visa holders who have to return to their respective countries when their work visa expires will be required to pay in but cannot receive benefits because they cannot stay in Washington long term.

It is so unclear what employers should do regarding payroll deductions. What if the ESD decides to collect the first quarter premiums in April 2022 and employers did not deduct them from employees checks. Does the employer have to pay it on the employees behalf when they file their first quarter 2022 tax returns? The ESD has got to come out with directions for employers now, since some are running payrolls for 2022 soon.

Ugh… they should have not had an opt-out deadline.

This is a poorly designed approach. $100/day is half the cost of home care and assisted living and 1/3 the cost of nursing home care… so people are going to be paying $100-$200+ per day ($3000-$6000+/month) out-of-pocket.

That means many are going to go broke and end up on Medicaid anyway.

The only ways to protect assets from Medicaid: 1. irrevokable trust (set up 60mo. before applying for Medicaid or 2. a traditional long term care insurance policy that is Partnership approved

– from partnershipforlongtermcare

According to Medicare/Medicaid 70% of Americans will need some long term care. Insurance is always cheaper than paying out-of-pocket. Would you buy car or house insurance if you didn’t have to?

The reality is most of us will need care and since we’re not in EU where some countries take care of citizens cradle to grave while taking a large part of income for tax to pay for it. In America people don’t like taxes but the long term care risk is the same… so one way or another we pay.

This is a poorly designed approach. $100/day is half the cost of home care and assisted living and 1/3 the cost of nursing home care… so people are going to be paying $100-$200+ per day ($3000-$6000+/month) out-of-pocket.

That means many are going to go broke and end up on Medicaid anyway.

The only ways to protect assets from Medicaid: 1. irrevokable trust (set up 60mo. before applying for Medicaid or 2. a traditional long term care insurance policy that is Partnership approved

– from partnershipforlongtermcare

According to Medicare/Medicaid 70% of Americans will need some long term care. Insurance is always cheaper than paying out-of-pocket. Would you buy car or house insurance if you didn’t have to?

The reality is most of us will need care and since we’re not in EU where some countries take care of citizens cradle to grave while taking a large part of income for tax to pay for it. In America people don’t like taxes but the long term care risk is the same… so one way or another we pay.

Just another “tax and spend” boondoggle that does nothing it intends to do… Even if you were to pay into the LTC tax for a decade, and you then qualify, does the cost paying into boondoggle tax match the value taken out of it? How will the 36.5k cover the time spent in a managed care facility? a couple months? or how about in home health care costs? 6 months maybe at best? even in the best case scenarios, you still are paying the tax until you die, even when the money is fully utilized and spent… I guess the hold adage still holds true – the only thing you can depend on is death and taxes… Why does Washington State keep electing these “tax and spend” moronic monkeys into office?