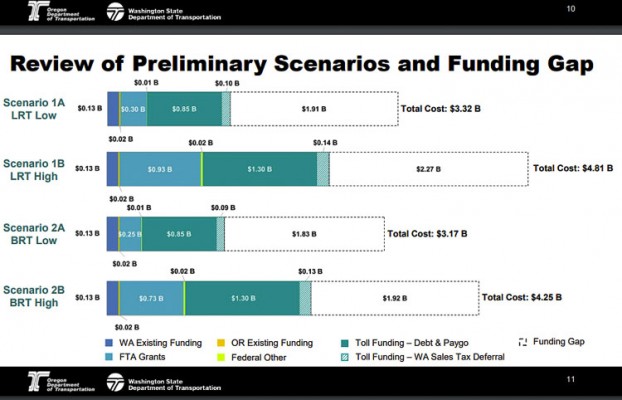

Proposal includes $1 billion for Interstate Bridge and $5 million for C-TRAN Bus Rapid Transit

For the fourth time in the past two decades, the Washington State Legislature is proposing the largest transportation package in history. Unveiled today by Democrat leaders, the $16.8 billion proposal would fund a host of projects around the state, including $1 billion in funds for the I-5 Interstate Bridge Replacement (IBR). It does not include an increase in the gas tax. The “Move Ahead Washington” proposal would run 16 years and includes substantial money for transit and other publicly funded transportation.

Four bills combine to make up the package. Senate and House Transportation Committee Chairs Sen. Marko Liias (Democrat, 21st District) and Rep. Jake Fey (Democrat, 27th District) unveiled Senate Bills 5974 and 5975 and House Bills 2118 and 2119. There are $2.6 billion in new capital projects.

Included is $5 million for C-TRAN’s Mill Plain Bus Rapid Transit in the list of transit projects. They also include $6 million for a SR-500 & NE Stapleton Road/NE 54th Avenue Bicycle & Pedestrian Overcrossing.

The $300,000 proposed to study a third bridge crossing of the Columbia River is not mentioned. According to Rep. Vicki Kraft (Republican, 17th District) those bills were killed late last week by votes of “no action” in both the House and the Senate.

Republican leaders, like minority House Transportation Committee leader Andrew Barkis, say they were never consulted on this package or even asked to contribute.

“Washington is a nationwide leader on so many issues, and we can continue to show our progressive values in the transportation sector,” said Liias. “From letting kids ride free on transit and ferries, to increasing public transit options and investing in pedestrian and road safety projects, this is a win for our entire state.”

To pay for the package of projects, the lawmakers are not proposing to increase the gas tax. Instead they propose $5.4 billion in new taxes, including car registration fees. Many of these taxes and fees were approved by the 2021 Legislature under the Climate Commitment Act. It’s unclear how much of those new taxes and fees will eventually end up being passed down to consumers, which could translate to much higher gas prices at the pump.

“This package is key for an accessible, sustainable future in Washington’s transportation sector,” said Rep. Fey, the chair of the House Transportation Committee. He also sits on the 16-member Bi-state Bridge Replacement Committee of legislators providing oversight of the IBR.

“We’ve worked hard over the last two years to listen to communities all across Washington, and they told us that their top priorities included preserving our infrastructure, finishing projects we’ve started, taking action against climate change, expanding multimodal options, and addressing the harm of past transportation policies,’’ Fey said. “I’m proud that this package reflects all those things to invest in every Washington community.”

Additional details on the taxpayer revenues to be raised include $3.4 billion in federal funds, $2 billion in a one-time transfer from the state operating budget, another $2 billion from a tax on exported fuel, and borrowing $956 million in existing authority. Also are increases on the stolen vehicle check fee, a dealer temporary permit fee, and the enhanced driver’s license fee. Aircraft fuel taxes will go up by 11 cents.

Gov. Jay Insee’s statement praised the package, with emphasis on carbon reduction. He also mentioned the Interstate Bridge.

“The Move Ahead Washington proposal will provide major benefits to communities all across our state. As our state continues to grow, we need to make sure people and businesses have safe, reliable transportation options.

“Importantly, this package recognizes the need to reduce emissions in our transportation sector by prioritizing billions of dollars to clean transportation initiatives including funding for four new hybrid-electric vessels, support for new state and local decarbonization projects, and historic investments in transit, bicycle and pedestrian infrastructure.

“I am especially appreciative this package includes funding to replace the I-5 bridge over the Columbia River; keeps our legal commitment to remove fish passage barriers on our state highways; and continues work on ultra-high-speed rail.”

Roger Millar, Secretary of Transportation highlighted the following amounts of dedicated funds.

• $1.3 billion towards Washington State Ferries’ vital work to build four new hybrid electric ferries and electrify two existing ships

• $1.2 billion in active transportation models like Safe Routes to School, bike and pedestrian safety programs and school-based bike programs.

• $3.1 billion in transit programs and investments, including funds to allow those 18 and under to ride free on all public transportation services

• $3 billion towards highway preservation and maintenance to help us make progress toward reducing our preservation and maintenance backlog

• $2.4 billion to fulfill the state’s obligation to replace fish passage culverts

• $150 million toward Ultra-High-Speed Rail

• $50 million for Connecting Communities to fund projects in communities that have had historic underinvestment in walking and biking infrastructure.

• Some notable project funding including:

o $1 billion to fund Washington’s portion of the I-5 Interstate Bridge Replacement program

o $640 million to widen SR 18

o $210 million for the US 2 Trestle

o $380 million for I-405 Corridor Construction

o $406 million for the SR 520 project

o $434 million for SR 167/SR 509 Puget Sound Gateway project

Both houses of the legislature must pass the bills, and then they must be signed by Gov. Inslee. This is highly unusual for such a significant transportation proposal to occur during a short, 60-day session of the legislature. The last day of the current session is March 10.

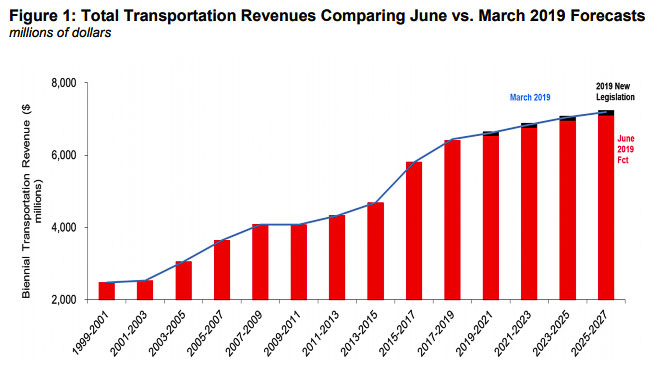

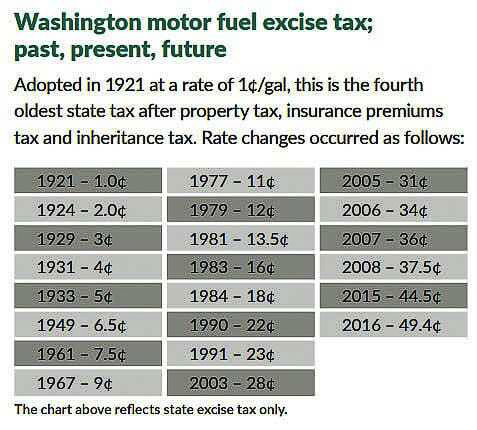

The “nickel tax” approved by Washington’s legislature in 2003 bumped the gas tax up to 28 cents after a 12-year period of no increase. It raised $4.2 billion. In 2005, the legislature enacted a 9 cent gas tax increase, in three steps. The Transportation Partnership Act was scheduled to raise $8.5 billion over 16 years. The 2015 Connecting Washington $16 billion package raised gas taxes another 11.9 cents over 16 years. Six years later it had produced $245 million more revenue than originally forecast.

The 12-year 2003 nickel tax package expired in 2015, and the 16-year 2005 TPA package expired in 2021. Therefore those bonds should be paid off, leaving that 14 cents of gas tax available for other transportation purposes.