Jared Walczak, of the Tax Foundation, stated in a Thursday blog post that Bezos would have been on the hook for about $1.44 billion a year under the proposed wealth tax.

Spencer Pauley

The Center Square Washington

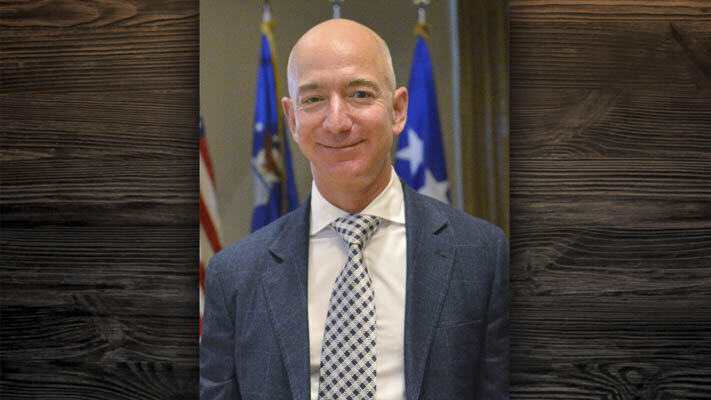

Billionaire Amazon founder Jeff Bezos announced on Thursday that he is leaving Washington state for sunny Miami, Florida, which means the Evergreen State is likely to see a significant loss in tax revenue from its wealthiest resident.

The planned move would benefit Bezos financially if he sells Amazon shares, since Florida, unlike Washington, does not have a capital gains tax. In January 2022, Washington enacted the 7% tax on the sale of financial assets despite a legal challenge. Earlier this year, the state Supreme Court upheld the constitutionality of the capital gains tax.

That translates into Bezos being subjected to owing the state $70 million for every $1 billion of Amazon stock he sells.

Prior to the capital gains income tax being implemented in 2022, Bezos sold over $8.8 billion worth of Amazon stock in 2021, according to Forbes. That would have raked in $616 million in capital gains tax revenue.

Bezos, who started Amazon out of his garage in Bellevue, Washington, back in 1994, made his announcement on social media. He did not mention taxes as a reason for the planned move.

“[His parents] recently moved back to Miami, the place we lived when I was younger – I want to be close to my parents, and [his fiancée, Lauren Sanchez] and I love Miami,” Bezos said in a social media post. “Also, Blue Origin’s operations are increasingly shifting to Cape Canaveral. For all that, I’m planning to return to Miami, leaving the Pacific Northwest.”

Back in 2021, the state held a public hearing on House Bill 1406, which concerns a proposed Washington state wealth tax, Sen. Noel Frame, D-Seattle, remarked at that hearing that there is a “really pessimistic view of the world to just assume someone would leave [Washington state].”

“These are folks who have been deeply invested in our community,” Frame added.

Chris Corry, director of the Center for Government Reform at the free market Washington Policy Center think tank, notes that Bezos’ departure will have a huge impact on the capital gains income tax, as well as other proposed taxes like the wealth tax.

“This move is a predictable response to Washington’s recent string of tax increases – Jeff Bezos’ move may be making headlines, but for every Bezos there are many other individuals and businesses who quietly leave the state,” Corry, who is also a representative in the state Legislature, told The Center Square in an email. “Washingtonians should worry about what other future economic opportunities will pass us by given recent tax increases.”

The Center Square previously reported on Senate Bill 5426 in 2022, which would have imposed a 1% tax on intangible financial property such as stocks, bonds, futures contracts and publicly traded options. The first $1 billion of assessed wealth would be exempt from the tax, which “equals one percent multiplied by a resident’s taxable worldwide wealth.”

Jared Walczak, vice president of state projects at the Tax Foundation, stated in a Thursday blog post that Bezos would have been on the hook for about $1.44 billion a year under the proposed wealth tax. That would have made up about 45% of the projected $3.2 billion a year the tax was projected to bring in.

This report was first published by The Center Square Washington.

Also read:

- Hundreds rally in Olympia against proposed tax increasesHundreds gathered in Olympia on Tax Day to protest a wide range of proposed tax hikes put forward by Democratic lawmakers in Washington state.

- Vancouver City Council urged to adopt seven changes to limit public campingClark County Matters is calling on Vancouver leaders to adopt seven ordinance changes that would limit public camping and address growing concerns about safety and livability.

- On ‘Tax Day,’ Senate Democrats propose billions more in tax increasesOn Tax Day, Washington Senate Democrats introduced new tax proposals totaling $12 billion, contrasting sharply with Senate Republicans’ no-new-taxes ‘$ave Washington’ budget proposal.

- Letter: ‘There will be consequences’Hazel Dell resident Bob Zak criticizes Democratic lawmakers for advancing ESSB 5181, arguing it undermines parental rights and defies biblical principles.

- Clark County Fire District 10 selects local firm to begin planning for replacement of the Amboy Fire StationClark County Fire District 10 has selected Aetta Architecture to begin planning a replacement for the Amboy Fire Station, first built in 1963 and no longer equipped to meet modern emergency response demands.

- Kitten finders, kitten keepers?Nomi Berger shares practical steps for what to do if you find a litter of kittens this spring, including how to assess their needs and connect with Furry Friends in Vancouver.

- PeaceHealth Southwest Medical Center seeks new members for Patient & Family Advisory CouncilPeaceHealth Southwest Medical Center is seeking new members for its Patient & Family Advisory Council to help improve patient care through direct community feedback.

If I were Jeff Bezos, I’d leave Washington State too. Our state government has developed a reputation of being addicted to spending money…