Proposed fuel export tax triggers multiple responses in retaliation

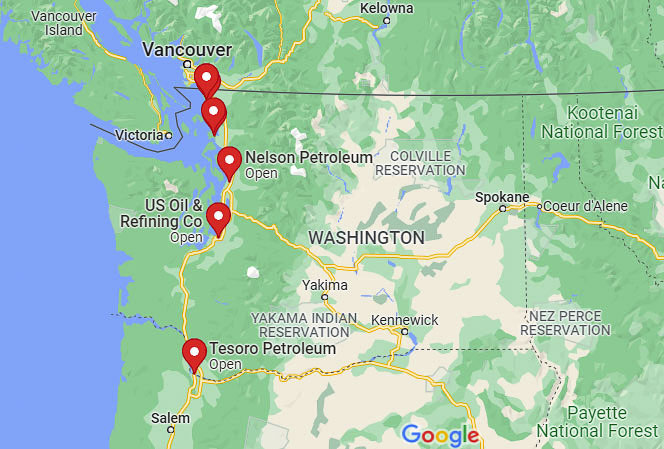

Have Washington Democrats in the legislature started a trade war? Their $16.8 billion transportation package includes raising taxes on Oregon, Idaho, and Alaska citizens via a tax on exported fuels. It is expected to raise $2 billion over 16 years. Washington Democrats want to impose a 6 cent per gallon tax on fuel refined in the Puget Sound but shipped out of state.

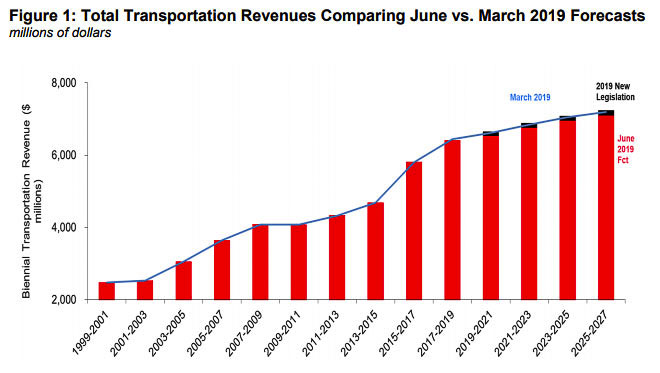

The transportation package is the largest in state history. There have already been three other significant transportation packages enacted in the past 20 years. Those included the “nickel tax” in 2003, a 9 cent increase in 2005, and another 12 cent gas tax increase in 2015.

“House Bill 2119 is just a bad step by the state of Washington,” Randy Pepple of Affordable Fuel Washington told KVI’s John Carlson this morning. “It puts our economy at risk and puts our tax policy at risk of starting a trade war.” The Senate version has already been passed.

Oregon, Idaho, and Alaska legislators have spoken about retribution. The Idaho Gov. Brad Little joined Oregon’s Kate Brown in calling Gov. Jay Inslee and saying the export fuels tax is unfair and unacceptable. Little wrote in a letter to Inslee that the Washington State Legislature “is venturing into new, uncertain territory” and called on Inslee to veto the legislation if it reaches his desk.

Alaska Gov. Mike Dunleavy tweeted the following. “Washington State is currently debating a tax that targets Alaska’s fuel costs. Their view of Alaska as a colony is reflected on a tax on all of us. Take a moment and listen to Rep. Kevin McCabe, calling out the hypocrisy of Washington taxing Alaskans.”

McCabe is proposing retaliatory taxes on fish and oil exported from Alaska to Washington state after Washington lawmakers unveiled a plan to levy a 6-cent-per-gallon tax on fuel refined in Washington and exported to neighboring states.

“Frankly, I’m tired of being thought of as a Washington colony,” McCabe said on the House floor last week. “I’m tired of them depending on us and taxing us for their needs and ignoring ours.”

McCabe has already drafted two bills in response. “One which will be a 6 cent per pound tax over the landing tax on fish that are landed in Alaska,” he described. “The other one would be a 6 cent per foot tax on any boat that moors or anchors in Alaska harbors.” Alaskans could apply for a credit on the boat tax.

That would apply to all Washington fishing vessels with home ports in the Puget Sound but fish in Alaska. If passed, McCabe’s proposals could send the cost of seafood in the state skyrocketing.

Pepple pointed out that the tax could also backfire, costing Washington citizens as well.

“It will lead to Washington residents potentially being double taxed on gas because they’ll pay the nation’s second highest gas tax if they buy their gas in Washington,” he said. “But if that gas started in Washington, and took the pipeline down to Portland, it’s often trucked back across the river into Southwest Washington because that’s more efficient.”

The State Senate acted with the haste of someone that knows they’re doing the wrong thing, Pepple pointed out. They introduced it on a Tuesday, heard it on a Wednesday, voted on it on a Friday in committee. They brought it to the full Senate on Monday for the next vote and passed it on Tuesday; all in one week.

The complete tax package could increase taxes and prices on natural gas, electricity and other utilities in Washington as well.. “They either don’t understand, or they don’t care,” Pepple said.

House Bill 2119 is just a bad step by the state of Washington. It puts our economy at risk and puts our tax policy at risk of starting a trade war.”

“I suppose, if enacted, Oregon will look at ways to retaliate,” said Oregon Sen. Lee Beyer. He chairs the state’s transportation committee and also sits on the Bi-state Bridge Committee of 16 legislators from Oregon and Washington that provide oversight to the Interstate Bridge Replacement (IBR) program.

Asked whether the tax proposal could sour the ongoing discussion about replacing the Interstate Bridge, Beyer said: “I don’t want to jump to any conclusions on that.”

Last week, Sen. Annette Cleveland (Democrat, 49th District) voted against an amendment offered by Sen. Curtis King (Republican, 14th District) to kill the fuel export tax. Twenty minutes after the Senate Transportation Committee killed the King amendment, Cleveland introduced her own which delayed the tax by five months. She told her fellow senators that the tax was a “grave concern” to Oregon, yet refused to eliminate the tax.

One legislator argued turnabout is fair play when it comes to the export fuel tax. Rep. Sharon Wylie (Democrat, 49th District) represents tens of thousands of commuters who live in Washington, but have Oregon taxes withheld from their paychecks because they work at jobs in the Portland area.

“My people pay 10 percent Oregon income tax if they don’t have a job on my side of the river,” Wylie said. She is one of the sponsors of HB 2119.

Another response being discussed would impose a $15-per-barrel surcharge on Alaska crude oil going to refineries in Washington.

McCabe expressed his belief that Washington’s proposed export tax would be a clear violation of the federal commerce clause, which prevents states from taxing items exported between them.

“I mean, anybody that has read a little bit of the Constitution understands that, but apparently the Washington lawmakers don’t,” he said.

Washington Senate Transportation Committee Chair Marco Liias (Democrat, 21st District), said there is precedent for a state to charge an exported fuel tax that targets a neighboring state’s drivers.

“Florida, Texas and Tennessee … have taxes that they apply to exported fuel from their in-state refineries,” Liias said during a Feb. 8 virtual press conference. “Washington will not be the first to consider this as a revenue tool.”

Texas does have an export tax, but it’s not written the same way according to one news report. This leaves Washington’s proposal in uncharted territory. Tennessee also levies a tax on all petroleum products it exports to other states, but at a much lower rate of one-twentieth of one cent per gallon.

The Washington bill has already passed the state Senate. There will be an executive session of the House Transportation Committee later today (Tuesday). If the bill is signed into law, the tax measure will take effect in February 2023 in the House version, or June 30 in the Senate version.

Much of Alaska’s oil is refined outside of the state and transported back to Alaska by barge. Many rural Alaskan communities rely on diesel electric generators for power. Alaska ranks second only to Hawaii in the share of its electricity — 16 percent in 2020 — generated from petroleum, according to the U.S. Energy Information Administration.

As for how potential retaliation from other states might affect Washington’s proposed transportation package, KIRO Newsradio reporter Hanna Scott says Democrats in the legislature don’t appear to be backing down on the export tax for the time being.

This is not the first time Alaska lawmakers have proposed a retaliatory tax in response to a Washington tax proposal.

In 2009, Alaska lawmakers proposed imposing a $16 a barrel surcharge on North Slope crude destined for Washington state in response to a Washington bill that would tax fuel that’s refined in Washington and exported to other states, including Alaska. After Alaska lawmakers proposed the retaliatory tax in 2009, the Washington proposal failed to pass.

“Washington State tried this before and we had the same exact response,” McCabe said. But he added that it’s hard to say if the measures he is proposing will have the same effect this year.