With less than a month before stepping down from office, Inslee is proposing a $78.8 billion operating budget that comes with $4 billion in new taxes to fund it, including a wealth tax

TJ Martinell

The Center Square Washington

When Gov. Jay Inslee took office in 2013 after stating in the 2012 election race that new taxes weren’t “the right direction”, the state Legislature approved a $38.4 billion for the biennium. With less than a month before stepping down from office, Inslee is proposing a $78.8 billion operating budget that comes with $4 billion in new taxes to fund it, including a wealth tax.

The approach is contrast with how the Legislature responded to a massive budget deficit during the Great Recession, when lawmakers reduced spending by $11 billion in response to a significant loss of revenue.

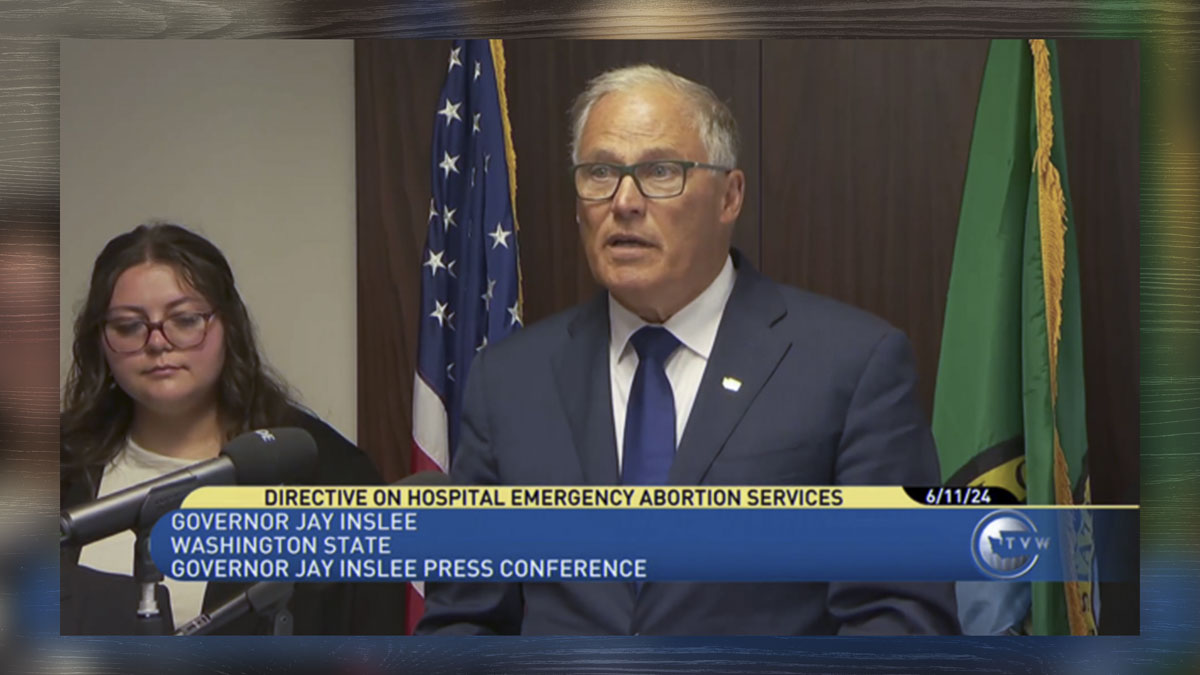

At Tuesday morning’s budget news conference, Inslee said that “they did things that leaders sometimes would do in difficult times, particularly during the recession,” and though his budget involves $2 billion in delayed spending, he said the Great Recession-era cuts to services such as mental health has created “a problem we’ve been trying to dig ourselves out of for 12 years now.”

Despite record revenue coming in, the state operating budget faces a shortfall in the billions over a four-year period, though the exact figure has repeatedly changed from $10-12 billion to $14 billion, Inslee said it could be “as much as $16 billion” over the next four years.

With revenue at record highs, Inslee remarked that “fortunately, our circumstances are different than they were the last time we faced a budget shortfall. We’ve got a booming economy rather than a recession.” However, he said the state tax system “is still a bit below average on the revenue that it generates, and it needs to continue to become fair,” describing it as “one of the most regressive tax codes in the nation.”

Per capita, Washington taxes its residents more than all but 12 other states, according to 2022 information from the Tax Foundation.

Under his “fairly modest proposal” for a wealth tax, it would generate an estimated $10.3 billion over four years by taxing 1% of the wealth of residents who exceed $100 million, which the governor said would apply to approximately 3,000 state residents.

“I am fairly confident that their wealth will continue to grow after this tax,” he said.

Inslee is also proposing as part of his budget a change to the state business and occupation tax, in which businesses making over $1 million annually in “service and other activities” category would have their rate increased by 20% through 2026.

When asked by the press how this might impact low-profit margin businesses subject to the B&O tax, Inslee said it would have less of an impact than President-elect Donald Trump’s proposed tariffs on Canadian and Mexican imports.

“Taxes are not considered happy news for anybody, anytime, anywhere,” he said. “I can tell you, as the discussion goes on, the legislation, in the Legislature, people will announce a very strong principle, which is, ‘don’t tax you, don’t tax me, don’t tax the feller behind the tree.’ So yes, there’s some impact somewhere on some businesses, but as I said, I think it’s quite modest and is consistent with the booming economy.”

Senate Ways & Means Committee Chair June Robinson, D-Seattle, described Inslee’s budget proposal in a statement as “thoughtful and future-focused” and a “strong starting point for our work in the Senate. His plan recognizes the growing costs of inflation, increasing caseloads for safety net programs, and the need to maintain critical investments in areas like housing, education, behavioral health, and public safety.”

Ways & Means Ranking Minority Member Chris Gildon, R-Puyallup, wrote in a statement that “Governor Inslee proposed a double-digit spending increase in the very first budget he submitted to the Legislature – breaking his no-tax pledge in the process – and he’s going out the same way. Tax-and-spend to the end.”

He added that “there is a deficit ahead, but it’s caused by overspending, not by a recession or a drop in revenue. The governor could have come up with a budget that lives within the additional $5 billion in revenue that is anticipated. Instead, he wants to spend even more and impose additional taxes on Washington employers to help make up the difference. When the cost of doing business goes up, consumers feel it too. His budget would make living in Washington even less affordable.”

This report was first published by The Center Square Washington.

Also read:

- Opinion: ‘Today’s Democratic Party is not our father’s Democratic Party’Editor Ken Vance reflects on how today’s Democratic Party diverges from the values he associates with his father’s generation, citing issues like taxation, gender policies, and shifting ideology in Washington state politics.

- Trump signs ‘big, beautiful bill’ during White House July 4 celebrationPresident Trump signed the “big, beautiful bill” on July 4 during a White House event featuring a military flyover and Republican leaders.

- Opinion: Your cost of living is about to go up as the majority party’s new taxes and fees kick inRep. John Ley shares a legislative update on rising costs across Washington, including gas taxes, childcare, housing, and business impacts. He highlights concerns about state spending and new transportation policies.

- US Senate narrowly passes GOP megabill after overnight session, sending it to HouseVice President JD Vance cast the deciding vote on a sweeping GOP tax and spending package that now heads back to the House, sparking reactions across the aisle.

- Opinion: Trump Administration rolls out program to help verify that only U.S. citizens can cast ballotsBill Bruch outlines the Trump administration’s new citizenship verification system aimed at ensuring only U.S. citizens are eligible to vote.