I-2124 would allow W-2 workers to choose not to be part of the program

Carleen Johnson

The Center Square Washington

More than nine months since Washington state workers started paying into the state-mandated long-term care insurance program, most working Washingtonians have contributed at least a few hundred dollars to the program.

But if voters approve Initiative 2124 this November to repeal the program known as WA Cares, workers can opt out of having 58 cents out of every $100 earned deducted from their paychecks.

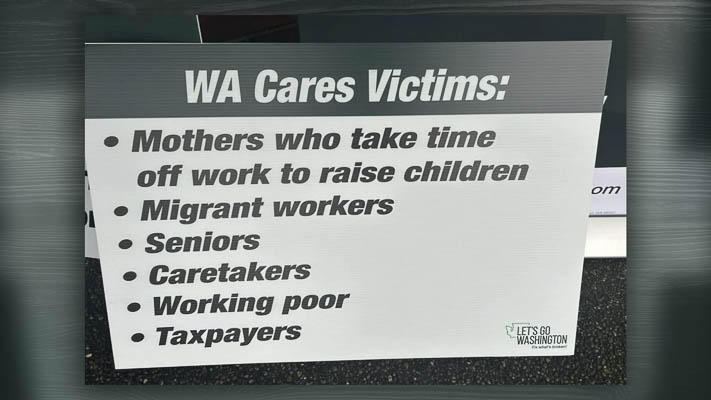

WA Cares opponents argue the maximum $36,500 benefit, not available until July 2026, is not adequate and may give someone a false sense of security about future long-term care needs.

Others have complained about the benefit not being transferable in cases where a Washingtonian who has paid into the program moves out of state.

The “frequently asked questions” section addresses the portability issue: “Washington is the first state in the nation to develop a way to make long-term care affordable for all workers as we age. The benefit is only usable within Washington because all providers have to be contracted with the state and each state has different laws on what makes someone qualified to provide long-term care.”

Rep. Peter Abbarno, R-Centralia, offered legislation during the 2024 legislative session to address some of the concerns, but he contends multiple bills weren’t given a public hearing by the Democrats who control the Legislature.

“I had a bill to repeal the long-term care program, and I had a number of different bills to change the program in other ways, but none of them got hearings,” he said.

He then pivoted to I-2124.

“The initiative would just allow W-2 workers to choose not to be part of the program, and I think that’s something individuals should have the right to do, to choose if they want to participate or not,” Abbarno said.

He urged people to explore long-term care planning but said the state’s mandatory program is not a good version of long-term care insurance.

“It’s not a good deal for workers and doesn’t provide a good benefit, and you can do a lot better on the open market than the state’s program,” Abbarno explained.

He characterized it as a cost-benefit problem.

“It’s kind of like you’re paying for long-term care, but you’ll be getting short-term care,” Abbarno summarized. “I’ve met with a number of long-term care planners and facilities in my community, and they’ve all said the same thing: $36,500, when you’re talking about in-home care or memory-care, it’s like six months at most in terms of what that benefit is really worth.”

Young people will be more affected, he pointed out.

“My kids are still young, and that means they’ll pay a lot more money into that program than they’ll ever see out of it, and that’s a shame,” Abbarno said.

He said he hasn’t been hearing people talk about the fact Washington is a community property state.

“My income during marriage is a community property for me and my spouse, so what if I invest all this money through a payroll tax into this program, and I never need long-term care, but my spouse does?” he asked. “If she needs long-term care, she never can access any of that money.”

If I-2124 passes this November and Washington workers take advantage of opting out, then what happens to all the money already paid into WA Cares?

“I think the state will say it’s a state asset now,” Abbarno predicted. “You can opt out but you can’t get a refund for the money you’ve paid into the program.”

He went on to say, “Those who contributed may have a claim otherwise, and I think the courts will have to decide whether or not that money should have to be refunded or if that just belongs to the state and going forward you can opt out.”

This report was first published by The Center Square Washington.

Also read:

- Opinion: What is liberty worth?Nancy Churchill explores how the lure of federal funding erodes local control, using real examples from Washington and rural America.

- Industry leaders hope to convince Clark County to not ban fireworksFireworks vendors and nonprofit partners plan to speak out against a proposed Clark County ban that would take effect in 2026.

- CCRP issues ‘Call to Action’ to oppose proposed fireworks banThe Clark County Republican Party is urging residents to attend Wednesday’s Council meeting to oppose a proposed countywide fireworks ban.

- TriMet seeks $190M-$290M for Interstate Bridge light rail vehicles; charging taxpayers up to $15M per vehicle — triple the $4.5M costRep. John Ley is raising concerns over TriMet’s escalating light rail vehicle costs for the IBR project, calling for fiscal transparency and alternatives.

- Conservatives on U.S. House Budget Committee switch votes, advance GOP packageA GOP budget reconciliation bill advanced by a single vote after several House conservatives changed positions during a rare Sunday night session.

- Opinion: Prescription price controls and rationing would undermine the innovation that has saved so manyTodd Myers argues that U.S. adoption of prescription price controls would endanger future medical innovation and limit patient access to life-changing treatments.

- The Annual Big Paddle Waterfront Festival returns on Saturday, June 7Ridgefield’s Big Paddle Festival returns June 7 with paddling events, hikes, music, games, and downtown fun from early morning through the evening.