This increase is smaller than the four previous 75 basis point increases but is still a notable increase, putting the range at 4.25-4.5 percent

Casey Harper

The Center Square

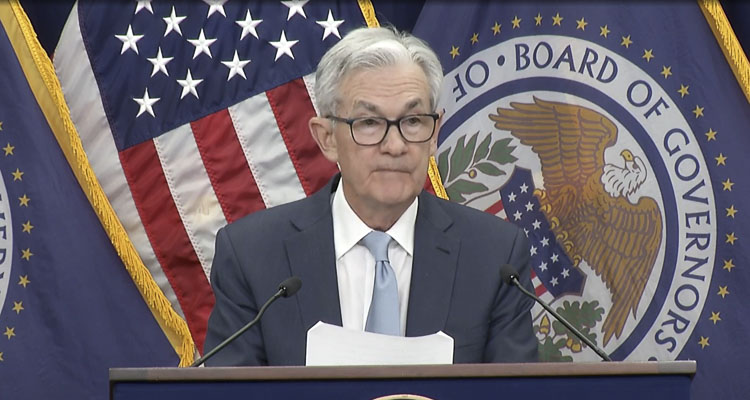

The U.S. Federal Reserve announced a new rate increase of half a percentage point Wednesday in its ongoing effort to curb inflation.

The Fed raised the rate by 50 basis points, as expected, the seventh rate hike this year. This increase is smaller than the four previous 75 basis point increases but is still a notable increase, putting the range at 4.25%-4.5%.

“Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low,” the Fed said. “Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.”

The Fed blamed the Russian war in Ukraine for the price hikes. That war delayed the supply chain and increased costs, but the price increases began long before that war, due in part to trillions of dollars in federal debt spending since the pandemic began.

“The war and related events are contributing to upward pressure on inflation and are weighing on global economic activity,” the group said. “The Committee is highly attentive to inflation risks. The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.”

The increase comes in response to inflation, which has soared during President Joe Biden’s term. The latest federal inflation data shows that those price increases have slowed but not stopped entirely.

Economists say these rate hikes help curb inflation but have negative economic consequences. Raising rates too much too fast can send the economy into a recession.

“We expect that as the Fed moves closer to its terminal rate the market will shift more directly towards growth, especially if valuations become compelling if the market sells off as the economy slows,” said Quincy Krosby, chief global strategist for LPL Financial.

Analysts say the U.S. economy and the possibility of a recession are still in flux.

“Though yesterday’s CPI report was encouraging, we believe the market has overreacted to an easing of inflationary pressures,” said John Lynch, Chief Investment Officer for Comerica Wealth Management. “A drop from 9.0% to 7.0% is likely the easiest of the 200 basis point moves lower that investors hope for … we suspect the next 200 basis point reduction will be much more difficult to achieve as wages, housing and energy prove stickier than consensus believes. Moreover, while the move lower in market interest rates has been received warmly by investors, balance sheet reduction remains a wildcard and may provide further upward pressure on market interest rates in 2023.”

This report was first published by The Center Square.

Also read:

- POLL: Why did voters reject all three tax proposals in the April 22 special election?Clark County voters rejected all three tax measures on the April 22 special election ballot, prompting questions about trust, affordability, and communication.

- Love of theater inspires owners of Love Street Playhouse in WoodlandLove Street Playhouse in Woodland, run by Melinda and Lou Pallotta, is bringing community together through live theater and love for the arts.

- Former Vancouver sports administrator, now working in Nevada, predicts big things for girls flag footballAlbert Alcantar, now in Las Vegas, says Washington’s new WIAA-sanctioned girls flag football program could mirror the success Nevada has already seen.

- Southwest Washington is becoming quite the attraction for fast food hamburger aficionadosSouthwest Washington is experiencing a burger boom, with Shake Shack open in Vancouver, Habit Burger opening soon, and In-N-Out under construction in Ridgefield

- GoFundMe spotlight: Victim of car crash to be bedridden for monthsJessica White was critically injured in a crash in east Vancouver and is now the focus of a GoFundMe campaign to help with living expenses.

- Clark County Fire District 3 chief to host community coffee hour May 1Fire Chief Chris Drone will host a community coffee hour May 1 in Battle Ground to answer questions and share updates about Clark County Fire District 3.

- 2025 Home & Garden Idea Fair to be held April 26-27Clark Public Utilities will host the 2025 Home & Garden Idea Fair April 26–27 at the Clark County Event Center in Ridgefield, featuring vendors, family fun, and one of the largest plant sales in the region.