Program already has $15 Billion actuarial long term deficit

The seven-member leadership of the Senate Democratic Caucus today requested Gov. Jay Inslee delay the implementation of the WA Cares Fund premium assessment by one year. This is the “income tax” Democrats passed in the state legislature in 2019, which created a long-term care insurance plan.

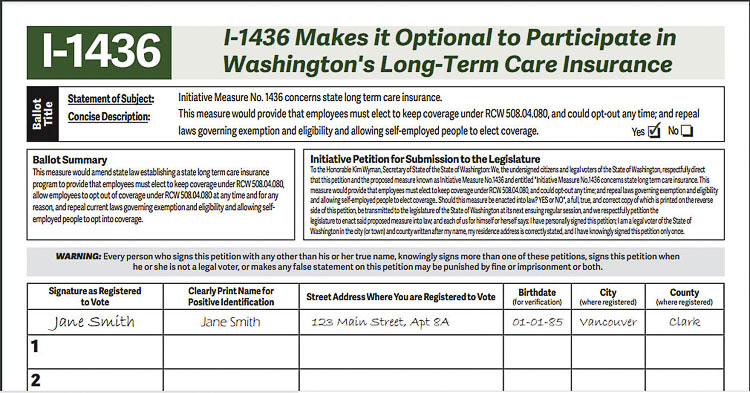

Earlier this year, former state Rep. Cary Condotta introduced a citizens initiative to give people a choice regarding Washington state’s long-term care (LTC) program and the payroll tax that goes with it. The legislature passed the law in 2019 and it is scheduled to go into effect in January 2022.

The state’s mandatory LTC program provides a maximum benefit of $36,500, or $100 per day. “It’s not good for workers,” says Elizabeth Hovde of the Washington Policy Center.

Employers will be forced to collect a tax of 58 cents per $100 of earnings and remit it to the state, unless employees have already obtained their own LTC insurance plan and already submitted proof of this to the state in October. The state would then provide the employee an exemption form, that could be given to the employer, to avoid the withholding of the tax.

The Democrats asked for the delay to allow the legislature time during the 2022 legislative session “to engage the public in a transparent, deliberative process to address concerns that have been raised with the WA Cares Fund without being limited by a premium assessment that is already in progress. The additional year will also allow the relevant agencies time to fully implement any changes with appropriate time to communicate with the public about the program.”

It would appear they have received significant pushback from constituents and fear the consequences at the ballot box in 2022. Furthermore, a class-action lawsuit was filed against the law that created the mandatory program. Opponents of the law filed in federal court and seek to stop the January start of the payroll tax.

“You’re in a program that you’ll probably never see the benefit of,” Condotta said to KVI’s John Carlson, when he announced the initiative petition.

Condotta listed several examples of flaws in the program. If you’re less than 10 years from retirement, you can’t get vested; yet you’ll still have to pay into it. If you move out of state, you can’t use the benefit as a resident of another state. “Everybody pays the tax,” he said.

Additionally, Idaho’s attorney general filed a cease-and-desist order concerning the collection of taxes from Idaho residents for the WA Cares Fund. The law is written in such a way that even Washington workers who live in other states will be forced to pay the state payroll tax but are not eligible for the program’s benefits.

The order rightly reads, “The Program is discriminatory and unconstitutional as to Idaho residents who work in Washington. To avoid legal action, please ensure that Washington refrains from implementing or enforcing the program against Idaho residents ….”

Members of a commission tasked with running the program were told last month the cost of implementing this law might be going up. State agencies sought money for more actuarial work, more outreach and more customer care, among other things.

When offering to answer questions commission members might have about the money request for more actuarial services, WA Cares Fund Director Ben Veghte said that the program’s needs have far exceeded expectations. “Just through the first four months of the current biennium, the cost for actual services have been approximately $210,000.” He added that’s “42 percent of the total cost that’s been allocated for actual services, just through the first four months of this biennium.”

Veghte said he expects that there could be high levels of actuarial support needed during the upcoming legislative session.

The seven Democrat senators who signed the letter to Inslee say they continue to be in full support of the goals of the WA Cares Fund. “The high cost of care as people age has potentially devastating financial consequences on every Washingtonian without long-term care insurance.”

The senators cited concerns that many constituents were unable to buy private insurance by the Nov. 1 deadline. They blamed the failure on the private insurance market. “This market has been unstable and unpredictable for many years and is a risk to many consumers who purchase policies that never pay out benefits,” their letter said.

Many employees who wished to opt out will nonetheless get assessed the 0.58 percent on their wages on January 1st. The Legislature should be given ample time to evaluate our options before employees get money taken out of their paychecks.

The legislators want “ample time” to evaluate options, ignoring the fact that citizens were only given one month to navigate a new state bureaucracy to obtain an exemption.

Sen. Lynda Wilson shared the following perspective with Clark County Today.

“Back on September 22 there were several Republican senators that sent him a letter requesting the same thing. Yes, at the very least it should be put on hold.

There are far too many problematic issues with this law. It has a $15 Billion actuarial long term deficit already projected. The payroll rate would have to immediately be increased to $.66 to cover that deficit. So, the cost is likely going up before it’s even implemented.

It’s not portable, meaning if you have paid into the system for years and you move out of state, you lose all benefits. As well, there have been over 400,000 people applying for exemptions, which are much higher than the state anticipated. This could affect the viability of the program where the choice would be either the state raises the tax or you reduce benefits. Neither one is acceptable.

Then consider the increasing costs of healthcare that hasn’t been considered. And most importantly, there is no way to opt out….ever.

These are just a few of the many reasons it should be delayed. I’d suggest it should be repealed and continue to let the private sector meet the needs of the people.”

In the meantime, Condotta continues collecting signatures on I-1436 petitions. The initiative, if enacted into law, would require people to “opt in,” to actually choose to be in the program. That is a stark contrast to the current law that only allows people a one-time opportunity to opt out.

The program can’t pay for itself according to Condotta. “It’s 58 cents. It’ll turn it into $1.58 and then $2.50,” he said.

“Explain why it is that my Social Security is portable; wherever I go my Social Security comes with me,” Carlson said. “My 401k comes with me, my medical insurance comes with me. Why wouldn’t this brand new long-term care program come with me if I paid the taxes into it?”

“Because that’s the way they wrote it,” Condotta responded. “It’s got a lot of problems like that.”

The legislators closed the letter with the following.

“In order for the Legislature to have time to listen to the public, examine all the necessary data, and engage in a robust debate of what modifications must be made, we believe that the program must be delayed until January 1, 2023.”