Most residents will see taxes increase, especially in Battle Ground

BATTLE GROUND — When the people in charge of collecting property taxes in Clark County spend several minutes of a public forum explaining who you really should complain to about property taxes, it’s easy to guess which way the wind is blowing.

Clark County Assessor Peter Van Nortwick and Treasurer Alishia Topper held a public forum at the Battle Ground Community Center on Tuesday evening to break down changes for the new year, and answer questions.

They were there largely because people in the Battle Ground School District will see the most extreme change in property taxes this year.

The change is due in large part to an increase in the local school enrichment levy (previously known as maintenance and operations levies) from $1.50 per $1,000 of assessed property value to $2.50 per $1,000.

Add in the expiration of a one-year 30 cent property tax relief bill, and the owner of a $400,000 home in Battle Ground will see their 2020 tax bill increase by an estimated $539.60, said Van Nortwick.

While many school districts approved new levies while under the original $1.50 cap, several districts were in the midst of existing levies, including Battle Ground, Washougal, and Camas. Only Battle Ground, via a vote of the school board, approved taking the full $2.50 per thousand. The local levy in Camas is increasing to $2.15 per thousand, with Washougal increasing to $1.98 per thousand.

Van Nortwick called the situation a property tax “roller coaster” created by the state legislature.

“Do you want to ask me what property taxes are gonna look like next year?” Van Nortwick said, “I don’t know. The legislature is in session. There are lots of discussions on the way in terms of what’s going on with property taxes.”

One of the issues Van Nortwick sees is the flat rate for state school levies.

“Our tax system was never designed to have a fixed rate in it,” he told the crowd, “and so what the state legislature did was they went and they passed this bill that imposed a tax rate of $2.70 starting with the year 2018.”

Generally, property taxes are collected to meet a set dollar amount. That means, as home values increase and new construction comes online, rates can decline as the tax pool spreads further.

Instead, the state schools levy will bring in more money as property values increase.

In 2019, the state collected $162.6 million as part of the McCleary-based State Schools Levy Part 2. This year they expect to collect $196.8 million, a 21-percent increase. That means even in districts where local school levies are staying stagnate, the owner of a home worth $400,000 can expect to pay nearly $140 more in property taxes towards schools this year.

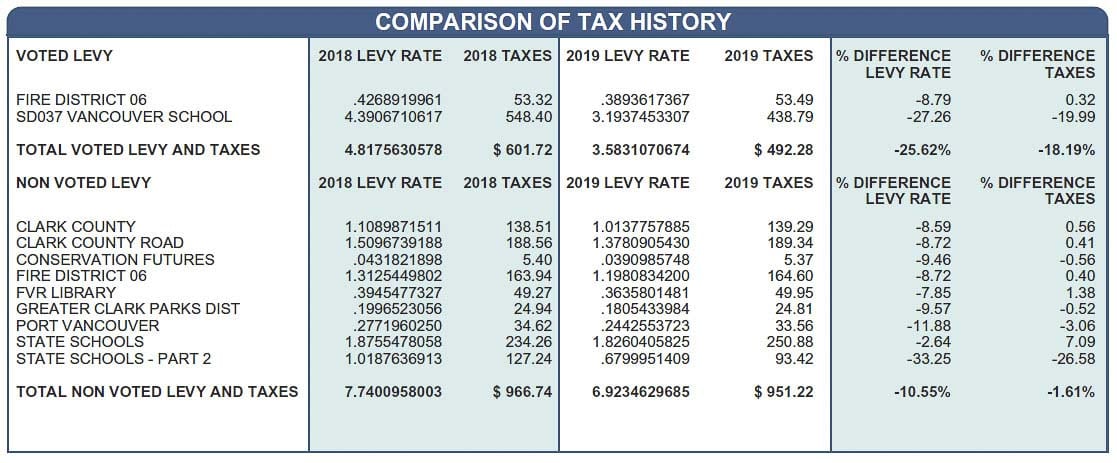

If you see a tax increase on your bill, which most people will, Topper pointed out that you can view a line-by-line breakdown of what you’re paying, with a comparison to last year’s taxes, by visiting the treasurer’s website.

Senior exemption changes

The other major change this year applies to the senior property tax exemption program. The state legislature approved a bill last year linking the income level to qualify for the program to the median income level in the county.

That change bumped the qualifying income level in Clark County from $40,000 annually to $50,348. That’s expected to increase the number of individuals in the county who qualify from around 7,500 currently, to around 15,000 households.

“Typically we have about 1,000 people every year that come in to apply for the senior exemption program,” Van Nortwick said. “This year, we’re expecting to have about 5,000 people show up.”

To deal with the increased workload, the Clark County Council approved two year’s worth of funding for a full-time employee. The assessor’s office is also hiring one more assessor to help with new construction.

Other requirements that have changed include length of residency. To qualify, you must now live in your primary residence for nine months out of the year, up from six months previously.

More information on the program is available here.

Van Nortwick did stress, in response to one question, that the penalty for not reporting income that might disqualify you from the program is steep. The county can come after you for any back property taxes, plus a 100 percent penalty.

“You’re on the senior exemption program and your taxes go from, let’s say $3,000 to $1,000, that extra $2,000 I have to collect from all your neighbors,” said Van Nortwick. “And people don’t want to pay taxes for other people that shouldn’t be on the program.”

Real estate excise tax changes

The other big change this year is coming for many who decide to sell their homes. The state has changed the way it charges excise tax on real estate transactions (REET), creating a tiered system based on the value of the property and the type of sale.

Under the new system, homes sold for less than $500,000 will pay a 1.10 percent REET, up to 3 percent for homes over $3 million. Local REET rates remain unchanged.

Topper said property tax bills should go out around mid-February, but people can see their adjusted tax bill and the details already by looking up their address on the county’s open data portal.

One final tip Topper gave was to make sure that, if you have a mortgage company with an escrow account set up to pay your property taxes, that they’re following through with the payment. You can check that online as well under tax documents, by checking to see if an escrow company is assigned to pay your property taxes.

Topper said one of the most common calls they get come October, when property tax payments are overdue for the first half of the year, comes from people who paid off their mortgage and then forgot that they didn’t have someone paying their taxes.

Worse yet, she said, the law doesn’t allow penalties and interest accrued on a late property tax bill to be wiped away.

“So really, if you pay off a mortgage, or if you know your friends are celebrating because they just paid off their mortgage, make sure they know they’ve got to pay their property taxes,” Topper said. “Nothing I can do.”