A growing number of families living in the area are spending well over 30 percent of their income just on housing

CLARK COUNTY — Efforts to rebalance the availability of various housing options in unincorporated Clark County continue, with a work session this week to update the results of a stakeholder survey, housing audit, and community feedback.

The Clark County Housing Options Study and Action Plan is a multi-year effort to identify housing-related challenges within the unincorporated Vancouver Urban Growth Area (VUGA). Ultimately, the goal is to implement potential changes to building and zoning regulations that will increase the variety of housing and encourage more affordable options.

It is a challenge that Clark County Councilor Gary Medvigy dubbed “dramatic” during an hour-long presentation on Wednesday.

“Those are challenges that aren’t insurmountable,” Medvigy added. “It’s all about balance and trying to figure this out as to how to get to affordable housing.”

The research is being done as part of a joint effort between the county’s Community Planning department, along with 3J Consulting, ECONorthwest, and JET Planning.

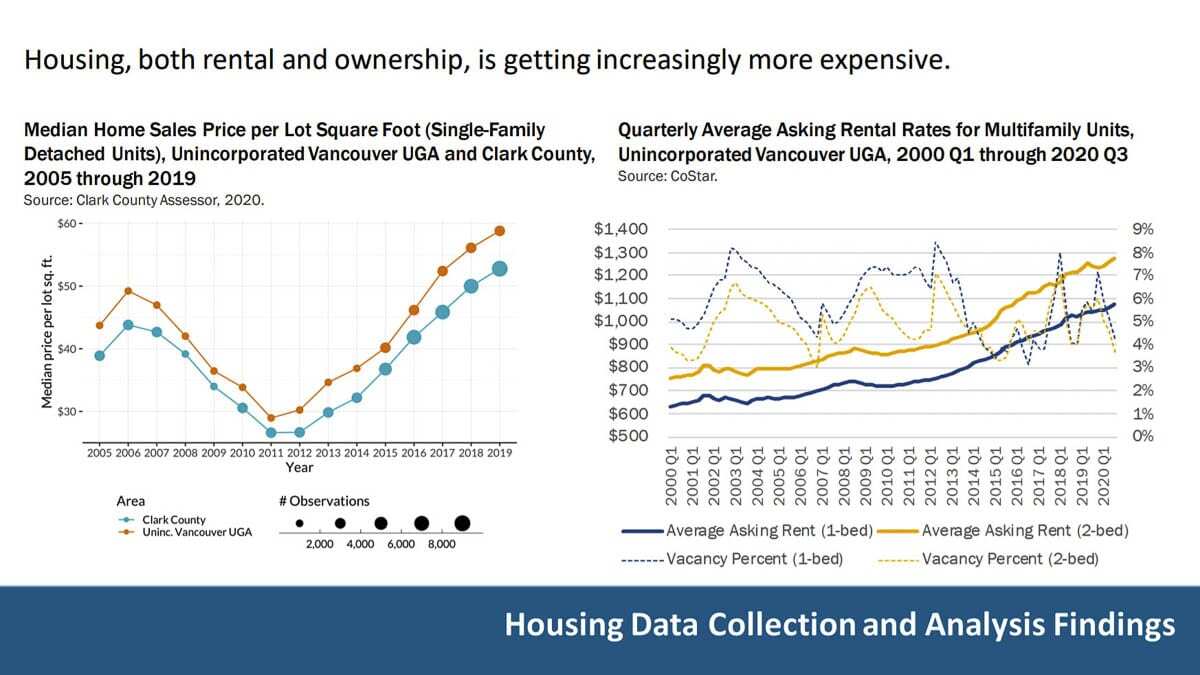

Among the most startling elements of Wednesday’s presentation was the data on income versus housing affordability. Tyler Bump with ECONorthwest noted that average wages in Clark County increased by approximately 12 percent between 2012 and 2019, while rents went up, on average, by 23 percent and the price per square foot for buying a house increased over 95 percent in that same timespan.

“The dynamics that we’re seeing in Clark County are felt throughout the region,” said Bump, “and are starting to happen at a really quicker pace, honestly in Clark County than compared to other parts of the Portland-Vancouver region.”

That dynamic has left approximately 44 percent of renters cost-burdened, meaning more than 30 percent of their income goes to housing costs. Nearly 24 percent of those are severely cost-burdened, meaning over half of their monthly income is spent on housing.

Things are slightly less severe with homeowners, but 23 percent of them are spending between 30 and 50 percent of their monthly income on the mortgage.

Around 47 percent of people in the VUGA earn more than 120 percent of the Area Median Income, but a significant portion, or around 32 percent, earn less than 80 percent of the AMI. That number was even higher in Clark County as a whole.

Larger single-family homes dominate

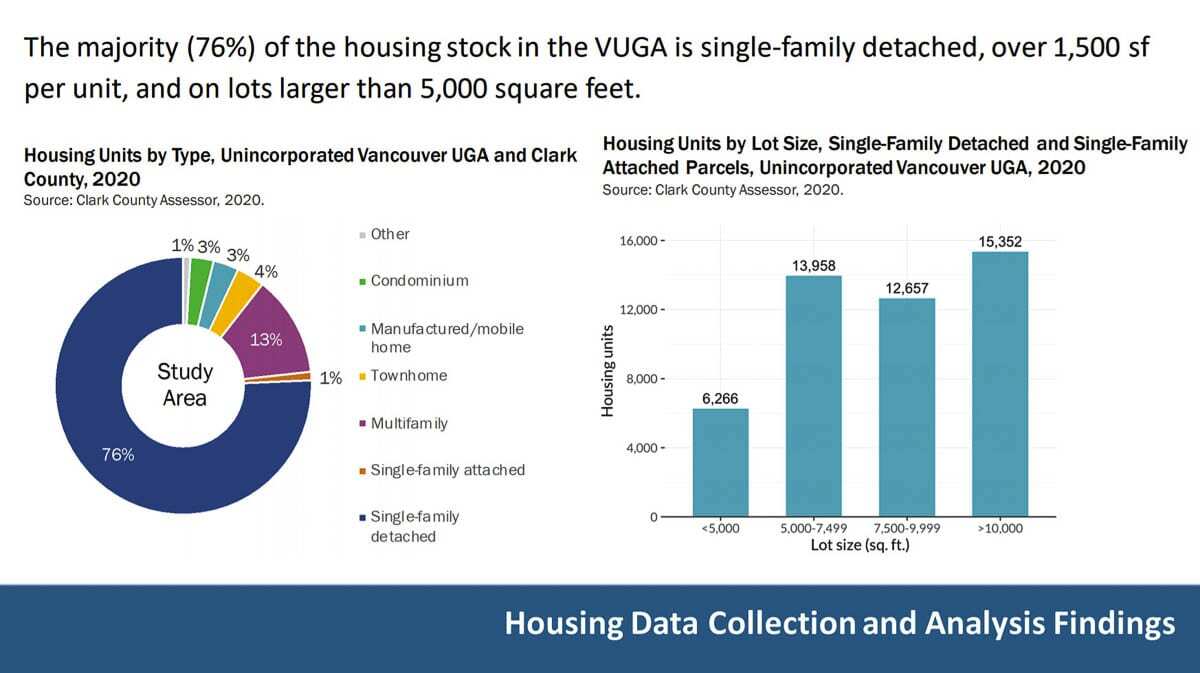

In terms of what kind of new housing is being built throughout the unincorporated urban growth boundary, approximately 76 percent is detached single-family homes, the study found, with 13 percent multifamily homes, such as apartments, duplexes or triplexes. Townhomes made up another four percent, with condominiums and manufactured homes each making up three percent each.

The report also found that nearly 60 percent of families moving into the area are 1-2 person households, while 70 percent of new housing stock is 3 or 4-bedroom homes of 1,200 square feet or larger.

“So you’ve got a lot more bigger units, but a lot more smaller households,” said Bump. “These are trends that are happening across the country as household sizes are shrinking.”

Asked what they should make of the numbers, Bump said it’s up to the council to set future policy decisions regarding housing options through zoning or code amendments, as well as urging the state legislature to examine the issue.

“It does look pretty stark, for sure,” admitted Bump, “but we’re identifying the challenge. And then, as part of this project, we’re helping you all understand what some of the solutions can be.”

Potential solutions

Those solutions could range from adjusting zoning ordinances to allow for more density in certain cases, or lifting some regulations to allow the use of more accessory dwelling units, cottage housing, and housing infill in some parts of the county.

That comes with its own unique set of challenges, admitted Medvigy.

“We don’t want to end up with the County of Vancouver,” Medvigy opined. “I’m hoping to preserve our rural areas as much as we can.”

Several council members said they hope the process can drill down a bit further to identify areas of the county that could sustain added residential growth without putting an unnecessary strain on infrastructure, or intruding on the rural feel in many areas.

Oliver Orjiako, the county’s Community Planning director, said the first step is “recognizing that the need exists,” and then using that knowledge to determine what the next best direction could be.

“We may look at certain transportation corridors and decide that may be where opportunities exist,” he added. “This project is not about increasing density … it’s just about what opportunities and what strategies can we employ to add to the variety of housing types.”

Next steps

Wednesday’s work session represented the end of phase 2 of the Housing Options Study and Action Plan. The group will provide a similar update to the county’s Planning Commission at their next meeting on April 15, and then begin phase 3 with a meeting via Zoom on Tues. April 27 at 3 p.m.

Phase 3 will include more community and stakeholder input, along with further County Council and Planning Commission hearings. Phase 4, which is currently slated for fall of this year, would mark the preparation of an action plan, with the legislative process kicking off at the end of this year, through next Spring.

Whatever emerges from that plan will likely inform the next periodic update of the county’s 50-year Comprehensive Growth Management Plan, currently set for 2025.