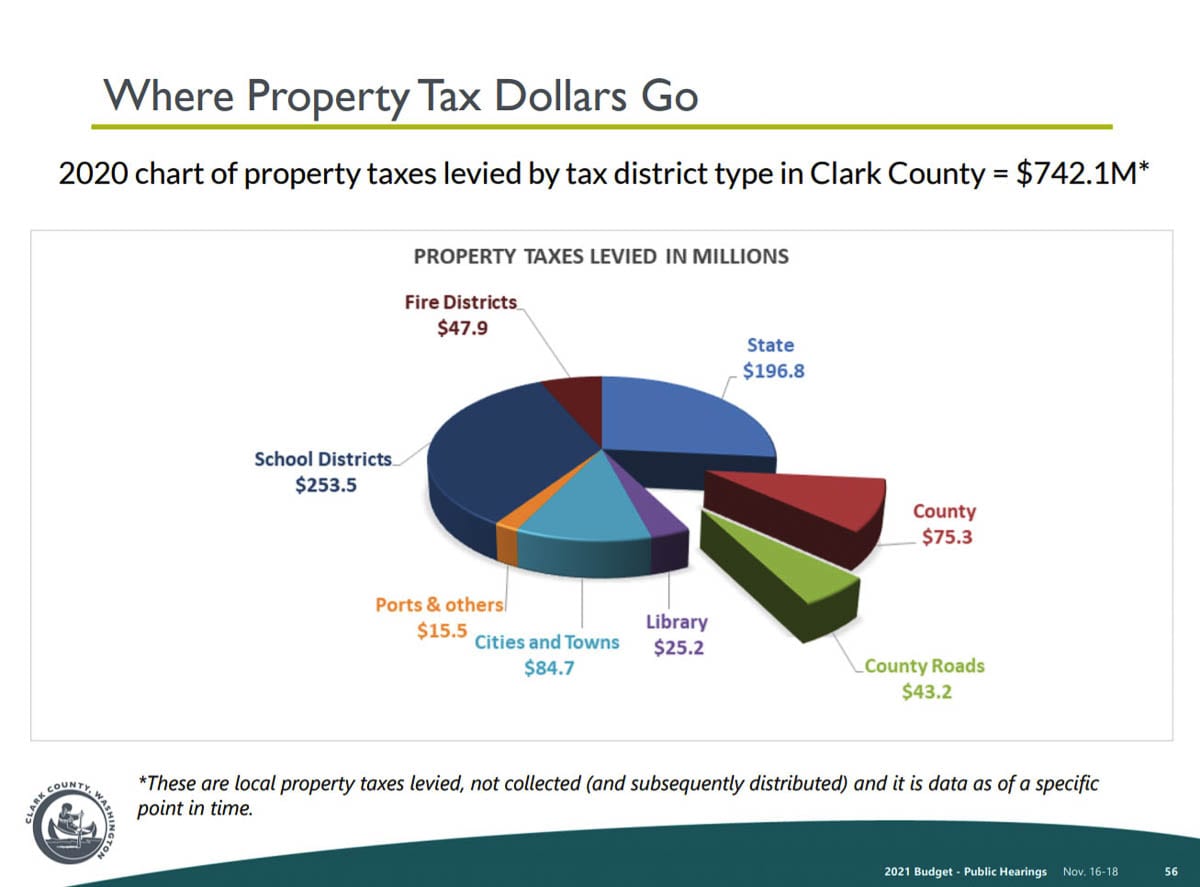

The council also approved property tax and road fund levy increases, with two members voting ‘no’

CLARK COUNTY — The Clark County Council on Tuesday approved a new $557 million budget for 2021.

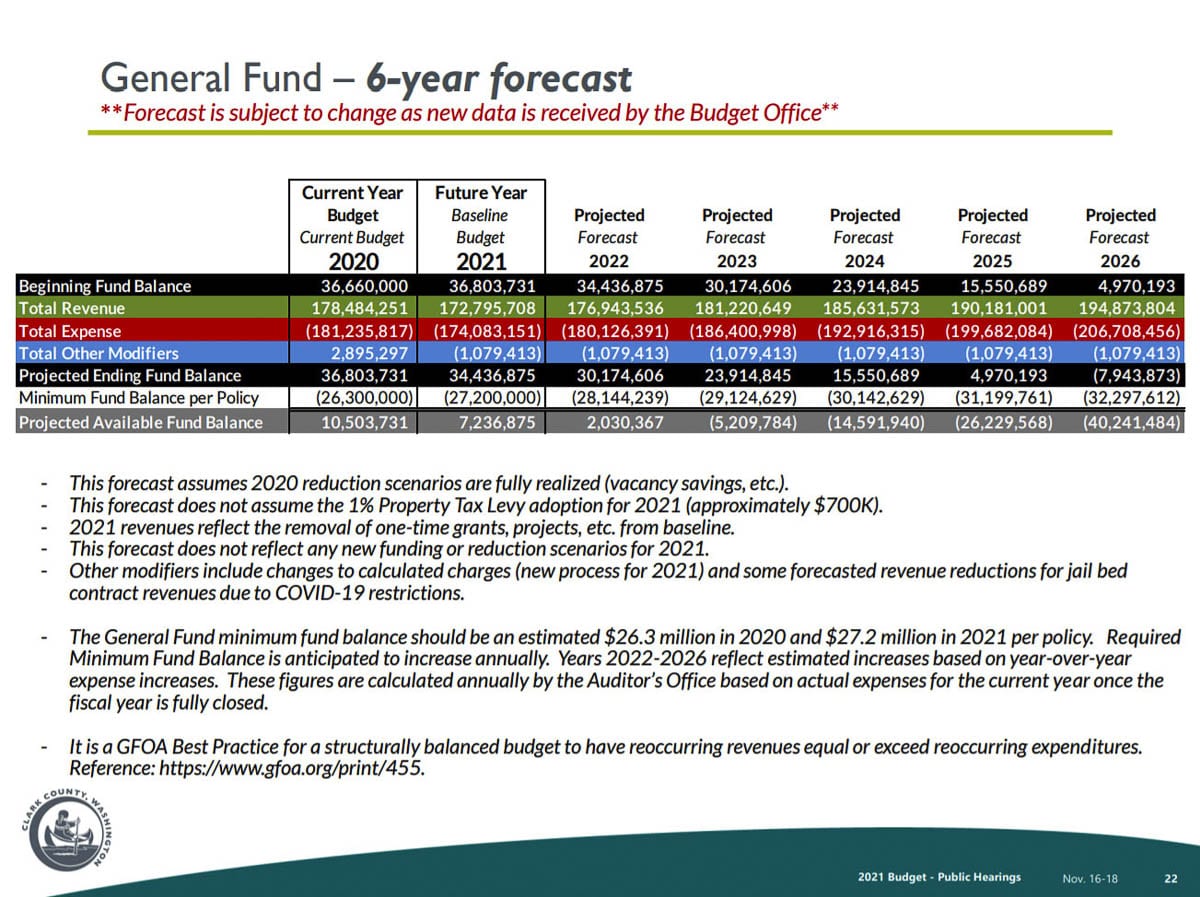

Facing potential budget hits due to the ongoing COVID-19 pandemic, the new budget is $34 million less than 2020, once all supplemental budgets are accounted for.

“The recommended budget is balanced, sustainable and provides flexibility,” said Interim County Manager Kathleen Otto during Tuesday’s council meeting.

While less severe than initially expected, the COVID-19 pandemic is anticipated to cut approximately $6 million in revenue for this year, largely through sales tax reductions and deferred property tax payments.

Otto said her department had received 209 departmental budget requests, of which 124 were recommended.

That included an amount of $700,000 set aside for potentially hiring an outside consulting firm to look into options for the long-overdue renovation and expansion of the county jail, as well as other improvements to the law and justice campus space.

The fund also sets aside nearly $1.6 million for one-time capital facility improvements, and $1.7 million to replace the leaking courthouse roof.

Still, Otto noted that departmental belt-tightening had resulted in an anticipated $8 million in cost reductions for the general fund budget through departmental efficiencies, reducing overtime expenses, curtailing non-essential spending, and having a hiring freeze in place.

“The hard work of county departments and offices to establish these reductions means we are able to adopt a 2021 budget without having to sacrifice services our residents deserve,” said Otto. “I appreciate and am proud of county staff efforts during this tumultuous year.”

Outside of the pandemic, the financial challenges facing Clark County are familiar ones.

Despite being the fifth most populous county in Washington state, Clark County ranks 18th when it comes to sales tax revenue per capita, thanks largely to proximity to Oregon, which does not charge sales tax.

Otto said the county likely loses between 10 and 30 percent of its potential sales tax revenue through “leakage” from residents crossing the Columbia River, usually for big ticket items.

All of that adds up to a per capita revenue of $191.34 per county resident, Otto said, compared to the statewide average of $248.24 (the data excluded King County as an outlier due to its size).

The projected 2021 budget assumes no change to that situation, and expects revenue from both sales taxes and property taxes will likely remain relatively stagnant. Otto said the assumption was based on continuing uncertainty around the economic recovery from the pandemic.

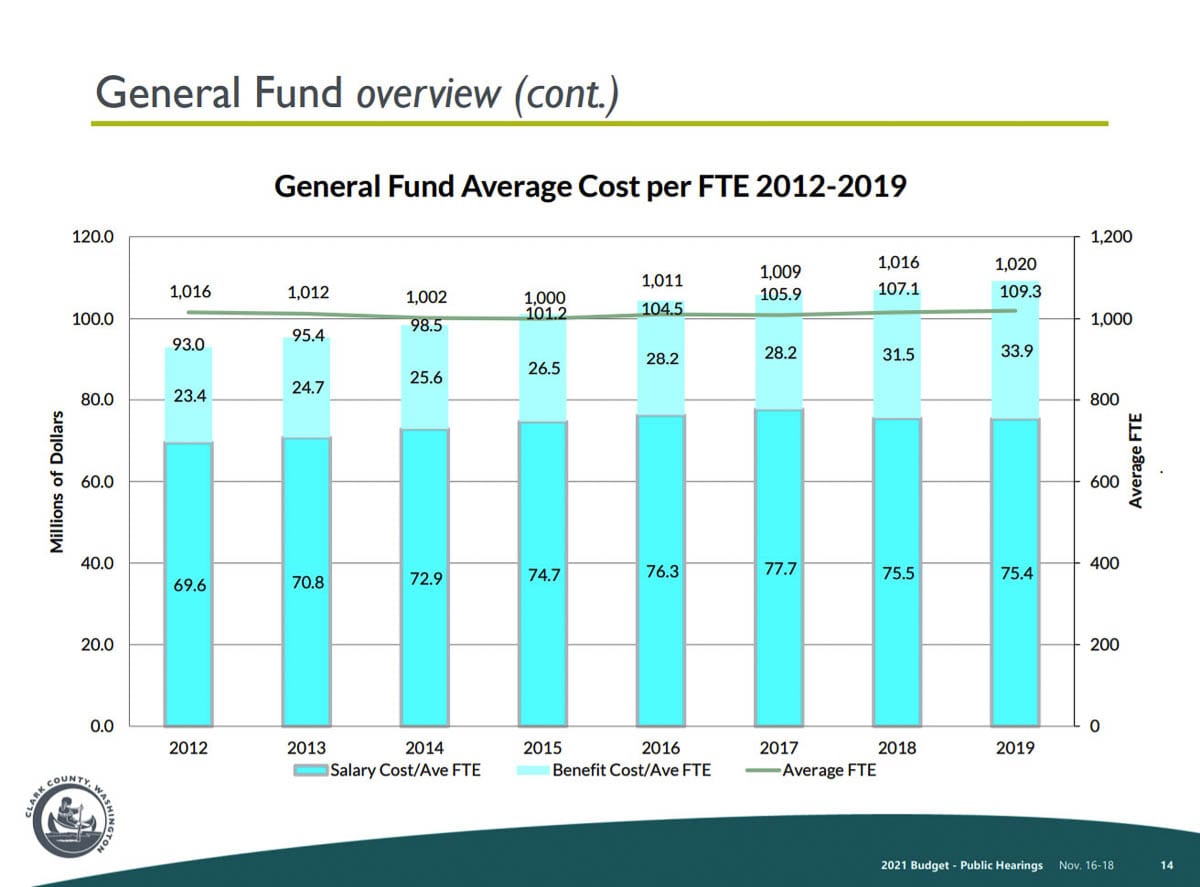

Even as revenue is presumed to flatline, the county is also facing upward pressure on the cost per employee.

Clark County’s 2019 budget included 1,621 full-time equivalent employees, an increase of just three percent since 2010. Otto noted that means the number of county employees per resident has dropped by 10.4 percent, to 3.32 full-time employees per 1,000 residents.

(The county had budgeted for 1,723 full-time employees in 2019, but 110 of those remained unfilled).

Even so, the cost per employee has risen from approximately $93,000 in 2012, to more than $109,000 last year, once salary and benefits are combined.

Otto noted that most of those cost increases have been in benefits and the state’s Public Employee Retirement System (PERS). Average base salaries have actually declined from $77,700 in 2017, to $75,400 last year, largely as non-union employees saw wage growth stagnate.

Property tax levy divides Council

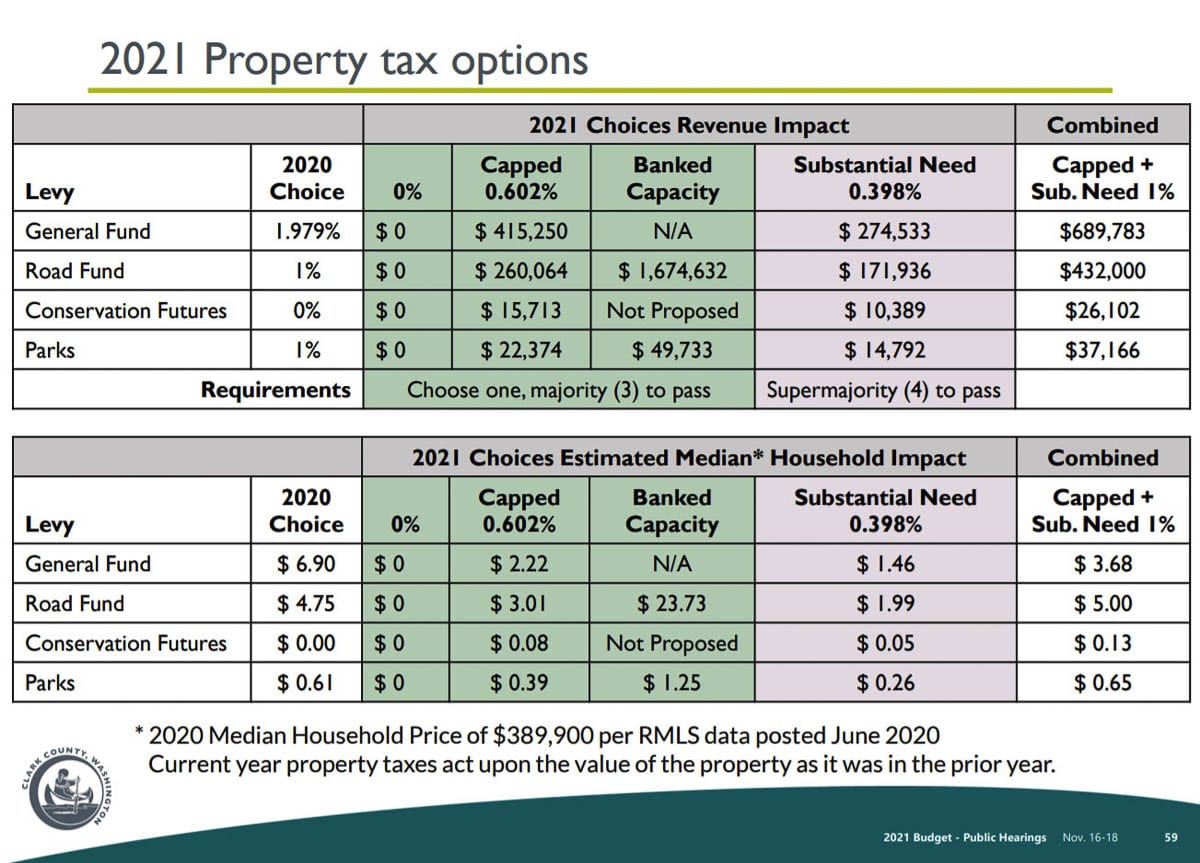

The two areas the council members largely diverged on were whether or not to take a state-approved increase in the property tax levy, and the road fund levy.

Council Chair Eileen Quiring O’Brien and District 4 Councilor Gary Medvigy opposed the increases, noting that the upcoming budget could be balanced without it.

“Right now, it’s very uncertain, and now is not a time to raise taxes,” said Medvigy, who favored banking the levy increase to potentially use at a later date when people weren’t feeling so much economic uncertainty.

The .602 percent increase in the road fund and the property tax levy were estimated to add $5.23 per year onto the tax bill of a median priced home worth $389,900.

“It doesn’t sound like that much, but it does accumulate,” said O’Brien, noting that many area businesses have already gone under, and others are facing an uncertain future during the pandemic.

Councilor Julie Olson responded with a brief history lesson, noting that voters statewide approved I-747 in 2001, limiting local municipalities to a levy increase of no more than 1 percent each budget cycle. The state Supreme Court later overturned the initiative in November of 2007, after which then-Governor Christine Gregoire convened a special session of the legislature to address the issue.

“The voters have said local governments can take up to one percent to fund county government,” said Olson, “and that’s what we’re trying to do here.”

For the road fund levy, Otto noted in her presentation that the council had declined to use the allowed increase eight times since 2010, leaving an estimated $24 million out of the road fund.

“Our roads are in great shape, we’re doing a good job,” said Medvigy in arguing against the road fund levy increase. “And we have a healthy road fund without adding additional taxes to it.”

“If our public works department is doing a good job, and if we’re happy with the work, then it doesn’t seem to make sense to cut off avenues to the funding that allow them to do that job,” countered Councilor Temple Lentz, noting that previous presentations by Public Works have shown the road fund dwindling quickly without additional sources of revenue.

Ultimately, the council voted 3-2 in favor of the .602 percent property tax and road fund levy increase, and 5-0 in favor of a small increase to both the parks fund, as well as conservation futures.

The council declined to use banked tax capacity for the road and general fund levies, though they did use banked capacity for the parks fund.

Without those increases, Otto noted, the county would likely see its ending fund balance disappear by 2026.

“Even with taking the one percent this year, if there were no requests and no increases for next year, we are not balanced,” Otto told the council. “We have $1.6 million without any new requests that we’re going to have to reduce … probably with staff, because that’s 75 percent of our general fund.”

To see the budget presentation go to the council website at https://clark.wa.gov/councilors/clark-county-council-meetings.

To watch a video of Tuesday’s budget hearing go to the CVTV website at https://www.cvtv.org/vid_link/31776?start=0&stop=9473.