Transportation package would impact Clark County residents in multiple ways

The Portland Metro $7 billion transportation measure appears to be at risk of failing, according to a new poll released Tuesday by the business groups fighting the proposed payroll tax in Oregon. If passed, the measure could impact Clark County citizens who travel across the border as the largest item in the plan is funding a 12-mile light rail extension with an estimated price of $2.9 billion.

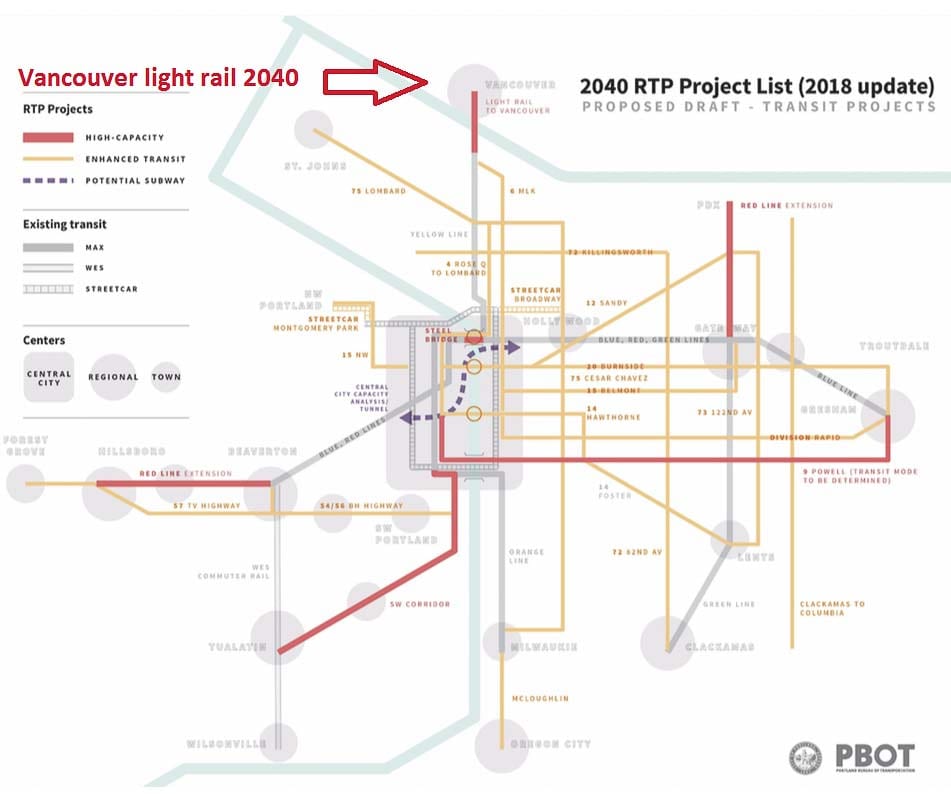

Recent discussions to replace the Interstate Bridge include a “high capacity transit” element in the project and both Metro and the Southwest Washington Regional Transportation Council (RTC) have a light rail expansion in their 20-year plans. In 2013, the Columbia River Crossing project, which would have replaced the I-5 Bridge, was defeated in the Washington State Senate largely because light rail was a component of that project. On multiple occasions, Clark County residents rejected advisory votes asking their opinion about the concept of light rail projects between the two states.

The Metro package would fund $7 billion in transportation programs and projects over a 20-year period, funded by the payroll tax on Oregon employers. Metro expects to receive roughly $1 billion in federal matching funds, mainly for the 12-mile light rail extension proposed to end at Bridgeport Village in Tigard.

The survey of 600 likely voters across the tri-county Portland Metropolitan area found the measure has questionable support in all counties, which offers some evidence that many voters in Oregon may join Washington residents in opposing light rail projects. Twenty percent of respondents said they were undecided after hearing the short description of the measure that will appear on the Nov. 3 ballot. Support reportedly drops to just 32 percent after voters hear the best arguments from both sides about the measure, according to the Stop the Metro Wage Tax campaign.

In Clackamas County, a majority of voters polled said they will vote no. Clackamas County residents are also facing the prospect of the first tolls in the region, as the Oregon Department of Transportation (ODOT) proposes tolling I-205 between Stafford Road and Hwy 213.

Multnomah County voters told pollsters they favor the measure 46 percent to 32 percent. Washington County voters are split, 40 percent in favor and 39 percent against. Twenty percent of respondents said they were undecided.

Another possible consideration for Clark County residents is the impact on employers and jobs. Over 70,000 Clark County residents work in Oregon. This tax is on employers payroll.

John Charles of the Cascade Policy Institute reports there are at least three problems with the proposal.

“The first is that we already pay two transit taxes: the TriMet payroll tax assessed on employers, and the statewide transit tax collected from employees’ paychecks that was adopted by the Legislature in 2017. Most people don’t benefit from either one, because they don’t use transit. Adding a third tax to pay for light rail to Tigard – called the Southwest Corridor project – makes no sense.

“Second, light rail ridership peaked in 2012 and has been dropping ever since. Now, amid the coronavirus pandemic, it is down about 70% from last July, according to TriMet ridership numbers. With many worried about the inability to physically distance on public transit and the prospect that some may work from home permanently, more rail is the wrong project at the wrong time.

“Third, if the Metro tax is approved, TriMet could bulldoze nearly 300 homes and up to 156 businesses for the right-of-way, according to its environmental impact statement. Roughly as many as 1,990 employees will be forced to leave the area, the analysis states.”

Earlier this summer, the Metro Council approved the measure, but raised eyebrows with a last-minute exemption. The regional government exempted state and local government employees from the proposed payroll tax. That raised the ire of the local business community.

Willamette Week characterized the proposal as “perhaps the largest local government financing request in Oregon history.” The $7 billion Metro proposal is 32 percent larger than the state’s $5.3 billion transportation package in HB 2017.

Multiple news reports, including a report last month by the Cascade Policy Institute (report), an Oregon free market think tank, indicated that Metro President Lynn Peterson, a former Washington State Department of Transportation (WSDOT) secretary, attempted to broker deals with the business community. She offered a reduction of the payroll tax, on the condition that the Portland Business Alliance doesn’t campaign against the measure and also lobbies the Oregon legislature to recover the losses. This was quickly rejected.

Instead, Metro carved out local governments from the tax, right before the referral vote. Because this 11-percent loss in revenue further burdens businesses and residents, the business community then filed a ballot title challenge. They argued Metro’s wording was unfair in using the phrase “business tax” rather than a “wage-based payroll tax.”

Willamette Week reported “while Metro employees use the term ‘payroll tax,’ it was recharacterized as a business tax after realizing how unpopular the phrase sounds during a time when many firms can’t make payroll and so many families aren’t getting paid.”

The Cascade Policy Institute has tracked this measure since its inception. “Metro’s payroll tax will reduce take-home pay and kill jobs. Research shows that workers pay the price of a payroll tax, with low-skilled workers suffering the most.” The nonprofit organization reported the transportation measure only offers 3 percent to ease traffic congestion.

Kevin Looper and Dan Lavey are political consultants leading the Stop the Metro Wage Tax campaign. They say the more voters learn about the measure the less likely they are to support it.

“The numbers are so bad that there’s not a lot of credit that Dan and I are going to get as geniuses for defeating this measure,” Looper told the Oregonian Newspaper.