National Association of Home Builders’ Chief Economist Robert Dietz said it may take two years for the economy but the news ‘should be improving’

National Association of Home Builders’ (NAHB) Chief Economist Robert Dietz said he is approaching economic forecasting “with a certain amount of humility’’ these days. Nevertheless, Dietz offered a revised housing forecast to members of the Building Industry Association of Clark County Thursday morning.

Dietz, speaking in a Zoom meeting format, said it was a “difficult time to be in the forecasting game’’ due to the abrupt recession created by the coronavirus pandemic. He said previous forecasts of how the pandemic would impact the economy missed the mark. However, Dietz offered area building industry professionals a great deal of data in his updated forecast.

“The forecast that we are laying is not what we were projecting three months ago,’’ Dietz said. “As early as mid-February, I would have said there was no way we were going to have a recession in 2020 or ‘21. We definitely missed how much of an affect the virus would have on the economy and the degree of the government’s response’’

Dietz offered advice on how he believes professionals in the housing industry should approach information on the current economic information being presented.

“Consume the data with a two-month, two-quarter, two-year perspective,’’ Dietz said. “We are at the end of the first two-month period, which is a period marked by particular bad economic data.

“We are now transitioning to the two-quarter period,’’ he said. “The two-quarter period is going to be about stabilization and planting the seeds of an eventual rebound.

“While there has been a lot of discussion about how quickly the economy is going to snap back, it’s going to take about two years for the economy to heal,’’ Dietz said. “This isn’t going to be something where we get back by November or December of this year and say, ‘Wow, we got through that.’ We are still going to be dealing with lingering issues, but the news should be improving.’’

Dietz is confident the housing industry will be at the forefront of the economic recovery.

“One of the things we’re focused on is, unlike the great recession, in this downturn, housing will lead the recovery,’’ Dietz said. “We are 15 percent of the GDP (Gross Domestic Product) when you consider homebuilding, remodeling, home sales and other activities related to housing activity. “We’ve gotten a lot of good news.’’

Dietz said examples of that good news include nine consecutive weeks of increases in mortgage applications.

“Housing demand is up,’’ he said. “It’s certainly being promoted by lower rates, but supply is down. We’re seeing a 20 percent decline in listings in most markets. That’s keeping the prices up. That’s another difference from the great recession, when we had a significant price decline causing foreclosures, which then increased the inventory. We don’t have anything like that now. We entered this downturn under built rather than over built.’’

“A good example of some of the good economic news, we saw new home sales in the April data came in, actually, almost up 1 percent year over year,’’ Dietz said. “There’s some indications the May data will be even stronger.’’

Dietz added that there was still caution in his optimism.

“There are definitely risks to the forecast, the most important is the second wave of the virus,’’ he said. “I think the chance of that, by the way, is kind of one chance in three. I’m not saying the virus isn’t going to spread in the fall. But, I mean a real economically damaging uptick in the virus that causes renewed lockdowns at the local level … I think the country as a whole is in better shape to deal with the second wave.’’

Builder confidence surges in June

Even before Thursday’s webinar, Dietz wrote of his belief that housing is well-positioned to lead the economy forward according to Dietz. “Inventory is tight, mortgage applications are increasing, interest rates are low and confidence is rising,’’ Dietz reported. “And buyer traffic more than doubled in one month even as builders report growing online and phone inquiries stemming from the outbreak.

“Housing clearly shows signs of momentum as challenges and opportunities exist in the single-family market,’’ Dietz reported. “Builders report increasing demand for families seeking single-family homes in inner and outer suburbs that feature lower density neighborhoods. At the same time, elevated unemployment and the risk of new, local virus outbreaks remain a risk to the housing market.’’

Taken from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All the HMI indices posted gains in June Dietz reported. The HMI index gauging current sales conditions jumped 21 points to 63, the component measuring sales expectations in the next six months surged 22 points to 68 and the measure charting traffic of prospective buyers vaulted 22 points to 43.

Looking at the monthly average regional HMI scores, the Western quarter of the country increased 22 points to 66.

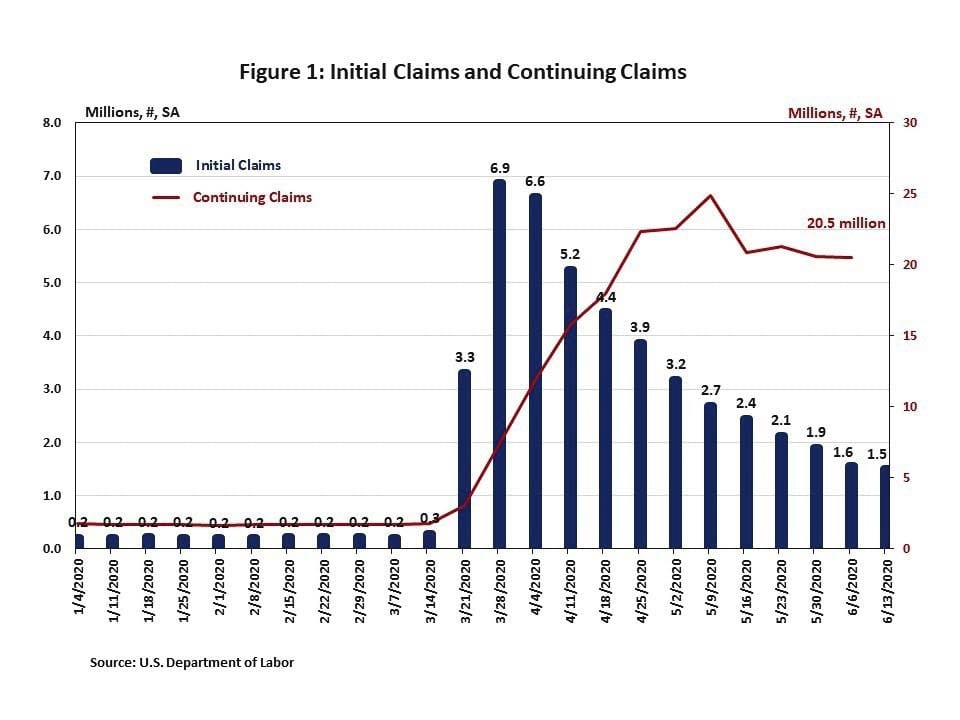

Labor market data

Dietz found a positive perspective in the recent jobs data reported by the Bureau of Labor Statistics, which indicated the unemployment rate in May declined to 13.3 percent. Dietz said the true unemployment rate is likely closer to 16 percent due to many who reported being “employed but absent from work” but who were most likely unemployed. Even with the technical adjustment, the jobless rate came in well below the 20 percent rate (or higher) some analysts had forecasted. NAHB’s forecast called for a 17.8 percent rate for the second quarter.) This forecasting miss by those predicting a much higher level of unemployment appears to have been based on somewhat unreliable state-level jobless claims data. The unemployment rate for construction workers is currently 15.2 percent.

Moreover, a job gain of 2.5 million was reported for May; a striking contrast to what many analysts had predicted of a job loss of up to 8 million. Residential construction was among the top sectors in terms of the May turnaround. After posting a job loss of 422,000 in April, home builders and remodelers added 226,000 jobs in May, as housing demand improved.

Dietz indicated “the reopening of the economy in most states has led to a rapid reversal for the jobs outlook and the prospects for the beginning of a recovery in the third quarter.

Dietz added “challenges remain ahead for housing, but as the labor market improves, so too has the outlook for the housing market. And while a decline in listings of existing homes is holding back the resale market, home builders have benefitted in the short-run due to the corresponding decline in competition. However, on the whole, historically low interest rates and a more rapid than expected improvement in the labor market should set the stage for a V-shaped recovery for housing, which in turn will provide support for the overall economy as a rebound takes shape in the second half of the year.’’