The FTC has argued that the merger would reduce industry competition and as a result lead to higher prices for consumers and lower wages for grocery employees

TJ Martinell

The Center Square Washington

A federal judge has blocked the $24.6 billion proposed merger between Albertsons and Kroger in response to a lawsuit filed against it by the Federal Trade Commission and several states.

In the ruling, Oregon-based U.S. District Judge Adrienne Nelson argued that the merger “is a plausible, relevant market for antitrust purposes,” adding that the plaintiffs “are likely to succeed on the merits and the equities weigh in favor of an injunction.”

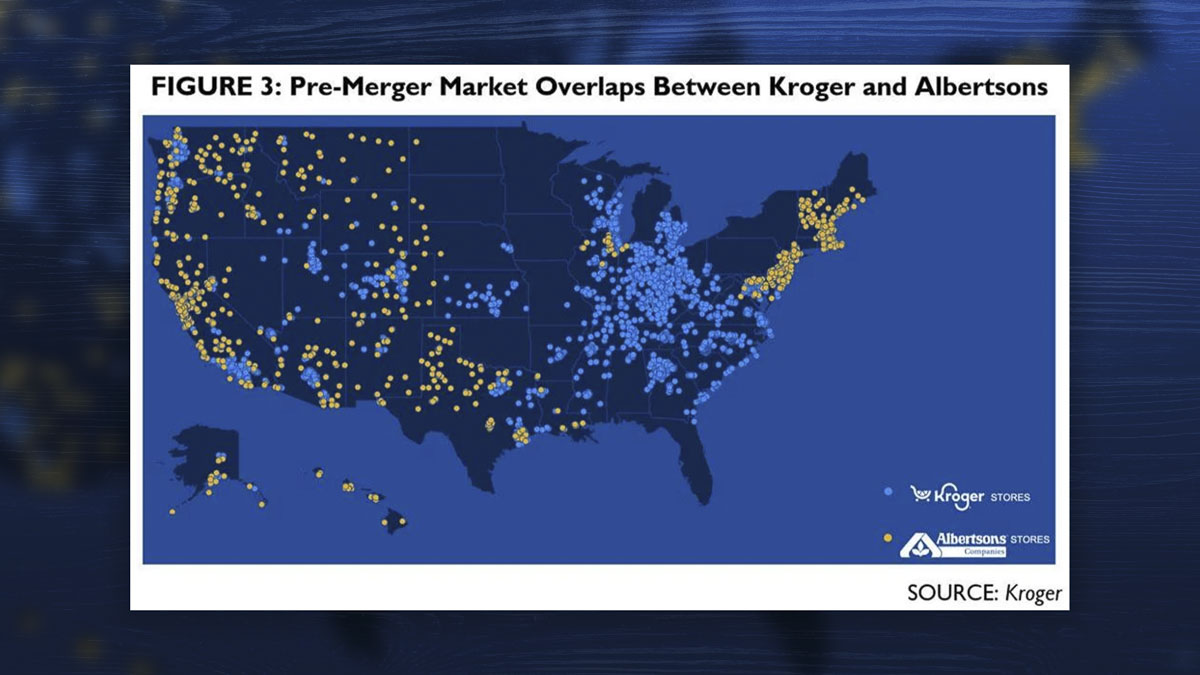

Kroger owns Quality Food Center and Fred Meyer, while Albertsons owns Safeway and Haggen. The proposed merger was announced in October 2022. As part of the agreement, it would have sold hundreds of stores to privately-owned C&S Wholesale Grocer to avoid accusations of creating a monopoly.

The FTC sued to block the merger. The federal agency was joined in the lawsuit by Arizona, California, Illinois, Maryland, Nevada, New Mexico, Oregon, and Wyoming. Although not a party to the federal case, Washington state filed a separate lawsuit. Ohio’s State Attorney General has spoken in favor of it.

The FTC has argued that the merger would reduce industry competition and as a result lead to higher prices for consumers and lower wages for grocery employees.

Advocates for the merger claim that it is necessary for the two grocers to compete with a changing market landscape, with much of retail sales shifting over to companies like Costco, Walmart and Amazon.

Among those in favor of the merger is the Mountain States Policy Center, based out of Idaho. President Chris Cargill told The Center Square in an interview prior to the court ruling that “this is not just about having an Albertsons store or a Kroger store. This is about competition with the giants.”

He added that the two companies make up 9% of nationwide industry sales. “It’s not as if we’re looking at 40-40-60%. This is the last best chance to try to level the playing field. But if you’re only looking at it with tunnel vision, I guess I could understand why they would be opposed to it.”

Nelson argued in her ruling that “supermarkets are distinct from other grocery retailers. Professionals understand supermarkets to be a distinct category of stores that compete with each other, and that supermarkets monitor each other’s pricing and are sensitive to changes bolsters the conclusion that supermarkets are a submarket within grocery retailers. For the reasons discussed above…the supermarkets market, consisting of traditional supermarkets and supercenters, is a relevant product market for antitrust purposes.”

This report was first published by The Center Square Washington.

Also read:

- POLL: Why did voters reject all three tax proposals in the April 22 special election?Clark County voters rejected all three tax measures on the April 22 special election ballot, prompting questions about trust, affordability, and communication.

- Love of theater inspires owners of Love Street Playhouse in WoodlandLove Street Playhouse in Woodland, run by Melinda and Lou Pallotta, is bringing community together through live theater and love for the arts.

- Former Vancouver sports administrator, now working in Nevada, predicts big things for girls flag footballAlbert Alcantar, now in Las Vegas, says Washington’s new WIAA-sanctioned girls flag football program could mirror the success Nevada has already seen.

- Southwest Washington is becoming quite the attraction for fast food hamburger aficionadosSouthwest Washington is experiencing a burger boom, with Shake Shack open in Vancouver, Habit Burger opening soon, and In-N-Out under construction in Ridgefield

- GoFundMe spotlight: Victim of car crash to be bedridden for monthsJessica White was critically injured in a crash in east Vancouver and is now the focus of a GoFundMe campaign to help with living expenses.

- Clark County Fire District 3 chief to host community coffee hour May 1Fire Chief Chris Drone will host a community coffee hour May 1 in Battle Ground to answer questions and share updates about Clark County Fire District 3.

- 2025 Home & Garden Idea Fair to be held April 26-27Clark Public Utilities will host the 2025 Home & Garden Idea Fair April 26–27 at the Clark County Event Center in Ridgefield, featuring vendors, family fun, and one of the largest plant sales in the region.