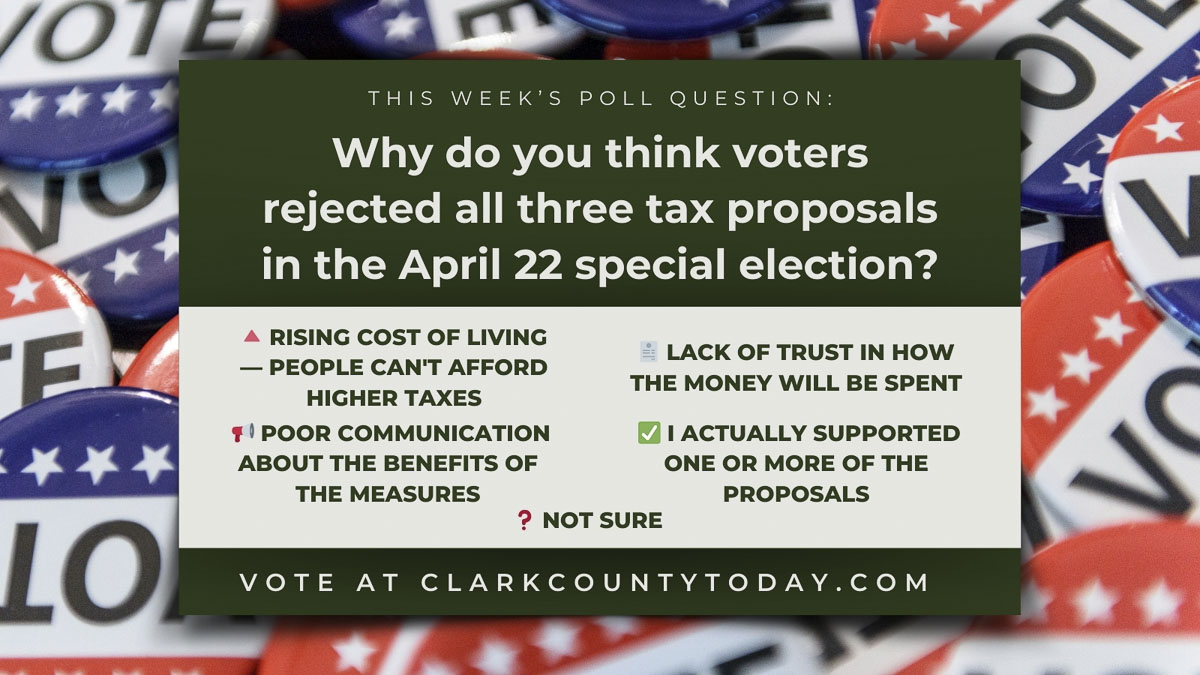

Clark County voters delivered a clear message in the April 22 special election, rejecting all three proposed tax measures. But what drove the outcome? From financial concerns to trust in government, we want to hear your perspective. Take this week’s poll and let us know what you believe was the biggest factor behind the no votes.

More info:

Voters reject tax proposals in April 22 special election

Clark County voters rejected all three tax measures on the April 22 special election ballot, including proposals in Camas, Washougal, Battle Ground, and Hockinson.

Read more

Also read:

- Letter: ‘Something is wrong when our vote means nothing’Bob Zak challenges the political handling of the I-5 Bridge project and urges voters to demand accountability.

- Letter: ‘This is a time for bold leadership, clear advocacy, and strong representation’Justin Forsman of Vancouver announces his candidacy for mayor and outlines a bold new platform focused on rights, infrastructure, and local governance.

- Opinion: Schools notifying parents about the kinds of care kids can decide on their own didn’t make itElizabeth New criticizes the removal of Amendment 1164 from current legislation, arguing it leaves parents uninformed about health care services accessed by their children through schools.

- Opinion: Off-road vehicles in the neighborhoodDoug Dahl responds to a resident’s concern about off-road vehicles on neighborhood streets, outlining the legal violations and safety risks involved.

- POLL: Is America more united or more divided than it was a decade ago?Clark County Today’s weekly poll asks: Is America more united or more divided today? The question comes after Stephen Davis brought a powerful message to Vancouver.

Government never, ever has enough money. They always want more and will make any excuse to get it. Voters have to understand this and vote appropriately….

The schools keep doubling down on things people don’t want for their kids (DEI teachings, certain health & LGBTQ curriculum, boys in girls sports, etc..) so this is a way to finally say no more money. Keep it up, and we will keep voting no. And keep wondering why enrollment is down along with test scores. One day is might click

I see every single day how much waste is in our schools. Money is not helping our schools. Teachers need to teach not do all these extra paperwork. so, so much waste!!!!

I am tired of higher taxes…make a plan make it work.

http://www.meritstreetmedia.com › show › dr-phil-primetimeF Is For Failure – meritstreetmedia.com

State government raising taxes to unaffordable levels without voter approval. Can’t afford more local tax increases.

I agree.Locals may have rejected the levy but my property tax assessment still includes

the two state assessments for “Sate Schools 1” plus “State Schools 2”.

Since we cannot vote for or against the State school property taxes will they simply

impose their will on the property owners and voters?

State Schools 1 and State Schools 2 are both for K-12 education, the state funds basic education.Voters input on State school taxes is thru elected representatives and Senators.

Local levies for K-12 schools go to voters for Extra curricular activities and other spending. I think the Treasurer and Assessor should add the description K-12 for State schools part 1 &2 and also for local levies. Our property tax bill can and should include as much detail as possible.