Rep. John Ley provides his latest legislative update

Rep. John Ley

for Clark County Today

As the 2025 legislative session heads into its final stretch, taxes and spending take center stage in Olympia. Both the House and Senate have passed spending proposals in budgets that will require the largest tax increase in the state’s history. On Tuesday, Governor Bob Ferguson pushed back. Without mincing words, his message was clear: The governor will not sign either of the budgets in their current form.

Democrats in the House and Senate recently passed comprehensive new tax proposals that will negatively impact everyone in Washington. They are calling for new taxes in both the operating and transportation budgets, which will take more money out of your pocket. Republicans offered a “no new taxes” budget in the Senate that was ignored.

One news source asked Ferguson if he is reviewing Senate Republicans’ no-new-taxes budget proposal.

“I’ve got a meeting in about 30 minutes with Sen. Braun and Rep. Stokesbary after this, so I’m sure I’ll be hearing their perspective…we’ve had multiple meetings just like I’ve had with Democratic leadership, and those conversations will go on,” he said. “We cannot adopt a budget with anywhere near the level of taxes currently proposed by the House and Senate.”

In the House on Monday night, we debated the Senate’s operating budget proposal for six and a half hours. Republicans offered 24 amendments to improve the bill. However, at just after midnight on Tuesday, the majority passed Senate Bill 5167 after accepting just one Republican amendment. Click on the image below to watch me speak on one of the amendments to keep the 1% cap on property tax increases.

As for their tax plans, we will debate and vote on them in the coming days, and we will all feel the impact. Ranging from $15 to $20 billion, if either House or Senate Democratic proposals are enacted, it would be the largest tax increase in Washington state’s history, and that’s just the operating budget. The transportation proposal would add more than $4 billion more in additional taxes and fees, including a significant increase in the gas tax and car tab fees.

I oppose these new taxes. Washingtonians are already struggling, and these taxes will hurt the job market, increase the cost of goods, and make housing more expensive when we can least afford it. Below are several valuable resources to learn more about these proposals.

How Democrats Want to Tax You:Click here to learn about all the new Democrat tax proposals. You can also make your voice heard by visiting the House Republicans Stop Bad Bills page and sharing your input about the new transportation and property tax proposals.

Click on the image below to watch my video about these proposals and learn how they will impact you.

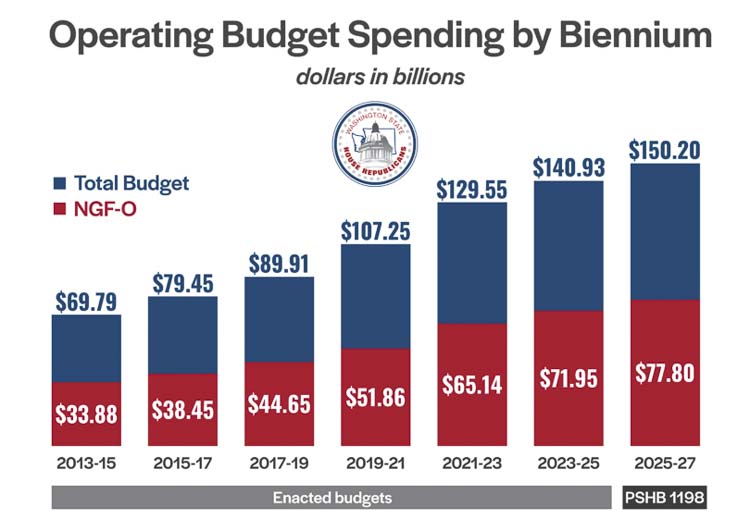

The state will spend more than $150 billion over the two-year biennium, as shown in the chart below.

I also recently appeared on KXL Radio’s Lars Larson show to discuss these budget and tax proposals in further detail. Click on the image below to listen.

I wrote an op-ed about the impact of these taxes for Clark County Today and The Reflector.

Click on the link below to read the article.

Opinion: An assault on affordability – What the new budget proposals mean for you – Clark County Today and The Reflector

House Passes Transportation Budget

Meanwhile, on Wednesday, the House passed Senate Bill 5161 but amended it with the House’s version of the budget (House Bill 2043). There is still a lot of negotiation to be done before this bill reaches the governor’s desk, so I will keep you posted on any updates.

During the debate, I introduced an amendment to the bill that would have ensured Oregon pays for its own Light Rail upgrades and preserved as much as $500 million for Washington’s transportation projects. However, the amendment was not accepted. Click on the image below to watch my speech.

Say “No” to More Taxes and Fees

The majority party treats the people of Washington like an ATM that never runs out of money. However, my constituents keep telling me, “Enough! We can’t afford to have the government take more of our hard-earned money.

State government needs to address the affordability concerns of its citizens and curb its spending. I will be fighting with my republican House colleagues to reduce or eliminate these tax increases. Sadly, given the Democratic majorities in both the House and Senate, most or all these new and increased taxes are likely to become law. Our main hope is that Governor Bob Ferguson will stand firm in his statement that he will not support a budget funded by a wealth tax and use his veto power on these proposals.

Legislation Update

Before I sign off, I wanted to provide a quick update on my legislation. The Senate Environment, Energy and Technology Committee passed House Bill 1857 on Tuesday. This bill would help businesses and labor groups reduce the cost of construction by exempting commercial aggregates or asphalt and concrete materials from restrictions pertaining to labeling and the use of naturally occurring asbestos-containing building materials. Click here for more. Next up would be a vote by the entire Senate.

Make Your Voice Heard

Thanks for your continued support. Please continue to make your voice heard and let state lawmakers in the majority know how you feel.

It’s an honor to serve you.

Also read:

- WA Senate unanimously passes $7.3B capital budget ‘for the entire state’The Washington Senate passed a $7.3 billion capital budget for 2025-27 in a unanimous vote, funding education, housing, and infrastructure across the state.

- Vancouver mayor pro tem acknowledges the mayor ‘set the trap’ for Michelle BelkotAudio reveals Vancouver mayor pro tem described mayor’s plan to provoke Belkot at C-TRAN meeting, sparking removal and lawsuits.

- Opinion: An unacceptable tax burdenNancy Churchill outlines new tax proposals in Washington state, warning of growing burdens on working families amid budget shortfalls and government overspending.

- POLL: Is it time for new leadership at Vancouver City Hall?A new weekly poll asks whether Vancouver voters should prioritize replacing the mayor and city council in the 2025 election.

- Opinion: How will the majority party’s new budget and tax proposals affect you?Rep. John Ley critiques the state’s proposed 2025-27 budgets, warning of record-breaking tax hikes and economic impacts.

Time to DOGE WA state and the otter public entities in WA state – There is fraud, abuse and waste from federal to school districts and all in between that…